SMFX Solidary Markets is a New Zealand-based Forex broker offering Over 70 Forex Pairs, Metals, CFDs, and Cryptos for trading. In the review that follows, we’ll provide information on the account types, trading platforms, trading conditions, and other specifics related to this Forex brokerage.

SMFX has three types of commercial accounts, calls, Standard, Top, and Elite. All three accounts offer access to a relatively complete portfolio of assets. It also provides the possibility to trade binary options in 26 currency pairs, gold, and silver. SMFX Solidary Markets offers its customers a free demo account, so they can practice with the platform before investing their real money.

This broker also offers a VPS (private virtual server) service for its clients. For this service, there are three types of monthly rates, ranging from €12 to €22, to which a single installation fee of €5 must be added. This service is efficient for traders who do automatic trading, as they can shut down their computers with the peace of mind that the virtual server will continue to trade. In what currency can you open your account at SMFX Solidary Markets? You can open it in Euros Australian Dollars, or American Dollars.

SMFX Solidary Markets is an STP broker. The STP brokers (Straight Through Processing) are those who send the orders of the clients directly to the liquidity provider, and these liquidity providers trade in the interbank market. The result is that traders have access to the real market, and their orders will be executed very quickly.

Another characteristic of SMFX Solidary Markets is that it calls itself solidarity because it claims to donate part of its benefits to charitable and social causes. An initiative we’ve never seen in any broker.

The broker’s website is available in English and Chinese.

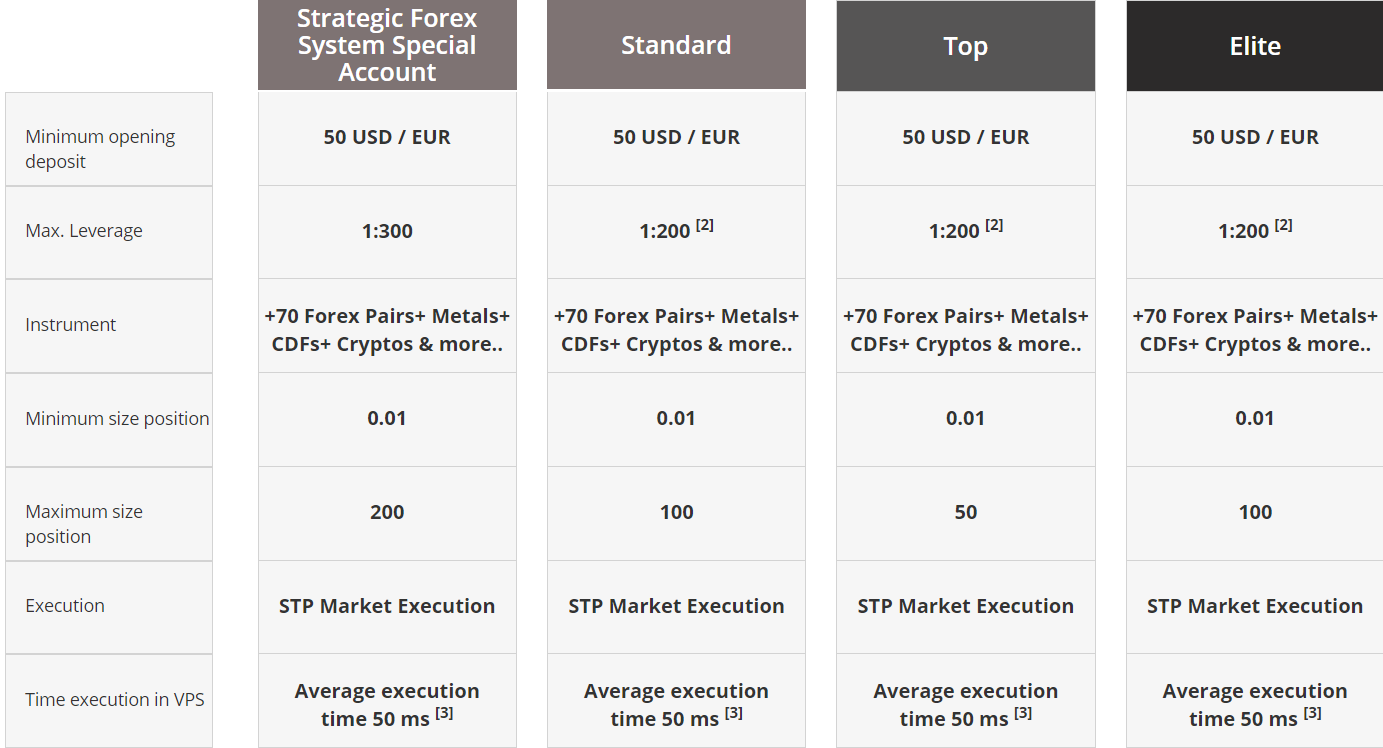

ACCOUNT TYPES

As already mentioned in the intro, SMFX Solidary Markets offers three types of accounts. Below is a summary of the characteristics of each of them.

Standard Account:

Minimum opening deposit 50 USD / EUR. Maximum opening deposit, Unlimited. Maximum balance, Unlimited. Max. Leverage, 1:200. Instruments, Over 70 Forex Pairs + Metals+ CDFs + Cryptos. Minimum size position, 0.01. Maximum size position, 100. Execution, STP Market Execution. Time execution in VPS, Average execution time 50 ms. Spread, Variable Raw Concept from 1.3. Commission 0 USD. Margin Call 200%. Stop Out 100%. Account Currency USD, EUR.

Top Account:

Minimum opening deposit 50 USD / EUR. Maximum opening deposit, Unlimited. Maximum balance, Unlimited. Max. Leverage, 1:200. Instruments, Over 70 Forex Pairs + Metals+ CDFs + Cryptos. Minimum size position, 0.01. Maximum size position, 50. Execution, STP Market Execution. Time execution in VPS, Average execution time 50 ms. Spread, Variable Raw Concept from 0. Commission 2.9 USD per lot (0.0029% notational)/side. Margin Call 200%. Stop Out 100%. Account Currency USD, EUR.

Elite Account:

Minimum opening deposit 50 USD / EUR. Maximum opening deposit, Unlimited. Maximum balance, Unlimited. Max. Leverage, 1:200. Instruments, Over 70 Forex Pairs + Metals+ CDFs + Cryptos. Minimum size position, 0.01. Maximum size position, 100. Execution, STP Market Execution. Time execution in VPS, Average execution time 50 ms. Spread, Variable Raw Concept from 0.2. Commission 3.9 USD per lot (0.0039% notational)/side. Margin Call 200%. Stop Out 100%. Account Currency USD, EUR.

We have analyzed that the fundamental differences between them are in the spread and the commissions. For a novice trader, the standard account is sufficient, has a spread of 1.3 pips, according to the market, and will not pay commissions.

For more advanced traders, and more experienced, Top and Elite accounts, offer lower spreads for a fee ranging from 2.9 USD to 3.9 USD. If the volume of transactions is high, then it is more convenient to pay a commission, which will always be less than the savings you get for the lowest spread.

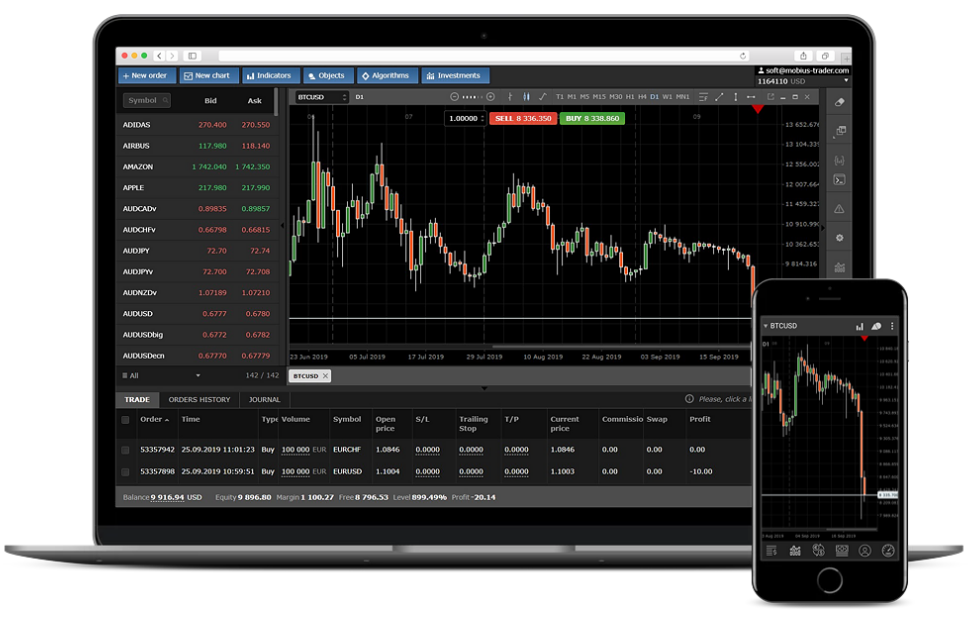

PLATFORMS

SMFX provides access to its own web platform, called SMFX Web Trader. The SMFX Webtrader platform, which uses Solidary Markets FX has been developed with the latest technologies and offers essential tools such as, Technical indicators, trend lines, oscillators, volatility data…but we still prefer the popular MT4 platform of Metaquotes. SMFX also offers the FX Lite Bo mobile application for its binary options trading service; this software is developed by the company Tradetools FX.

The broker also makes available to its customers the Myfxbook Autotrade application, which serves for automated trading. Autotrade was created in 2013 by Myfxbook, a UK-based forex analytics tool company, and a famous portal for the trader community. As an automated social trading copy service, Myfxbook’s Autotrade offers traders to search, compare, analyze, and share their business strategies. Myfxbook is not a broker in itself, and traders must register with one of its associated brokers to get permission to use the platform.

The broker also makes available to its customers the Myfxbook Autotrade application, which serves for automated trading. Autotrade was created in 2013 by Myfxbook, a UK-based forex analytics tool company, and a famous portal for the trader community. As an automated social trading copy service, Myfxbook’s Autotrade offers traders to search, compare, analyze, and share their business strategies. Myfxbook is not a broker in itself, and traders must register with one of its associated brokers to get permission to use the platform.

LEVERAGE

The broker has a leverage of up to 1:200. This level of leverage can only be maintained on trading accounts with a balance sheet of up to EUR 50,000/USD. You can change the leverage of your trading account at any time, simply request it by email at [email protected], and in less than 24 hours, you will have the change made.

TRADE SIZES

The minimum size position is 0.01 lots (micro lot), and the maximum size position is 100 lots. Traders, with the broker’s permission and with sufficient liquidity in the markets, may request the opening of positions of up to 500 lots. The exception is the TOP account, where the áximum trade size allowed is 50 lots.

TRADING COSTS

Traders can have two trading costs apart from the spread. Commissions for trading in 2 of the accounts offered by the broker (Top and Elite) are 2.9 USD and 3.9 USD per lot operated, respectively.

At this cost, you have to add the swap, that is, any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

ASSETS

The assets available to trade with this broker are varied and include over 70 Forex Pairs, Metals, CFDs, and Cryptos.

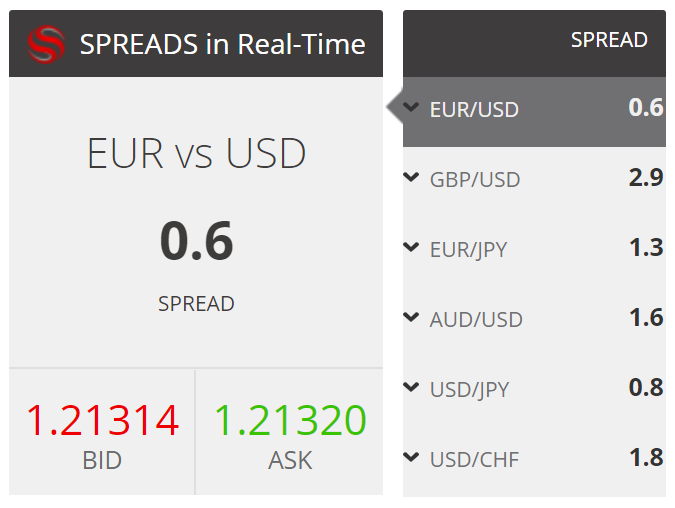

SPREADS

The spreads that Solidary Markets FX applies to its accounts are as follows:

The spreads that Solidary Markets FX applies to its accounts are as follows:

Standard Account – Variable Raw Concept from 1.3 – Commission 0 USD

Top Account – Variable Raw Concept from 0. 2.9 per lot, (0.0029% notational)/side.

Elite Account – Variable Raw Concept from 0.2. 3.9 per lot, (0.0039% notational)/side.

MINIMUM DEPOSIT

The minimum deposit required by SMFX Solidary Markets to open any of the 3 accounts available is USD 50 / EUR. This is a very affordable amount to start trading, and the standard account conditions are optimal for a novice trader.

DEPOSIT METHODS & COSTS

How to deposit money into an SMFX Solidary Markets account? There are currently four options available:

1) Bank transfer

2) Credit or debit card

3) Skrill

4) Neteller

What fees will you have to pay for making a bank transfer to SMFX Solidary Markets? For SMFX Solidary Markets there are no commissions. For transfers from European Union (EU) countries the SMFX bank does not charge a commission. For countries outside the European Union, there is a cost of 15 USD / EUR /AUD.

What is the commission for entering money with my credit card? The cost for coming with card is 3.8% of the total. Is there any limit to entering by credit card? Yes, up to a maximum of 25,000 USD / EUR.

Neteller or Skrill, summary:

- Neteller. Currency: USD/EUR. Minimum Deposit: 10 USD/EUR. Maximum Deposit: 5.000 USD/EUR. Fee: 4.09%. Wait Time: 1-12 hours.

- Skrill. Currency: USD/EUR .Minimum Deposit: 10 USD/EUR. Maximum Deposit: 5.000 USD/EUR. Fee: 3.5%. Wait Time: 1-12 hours.

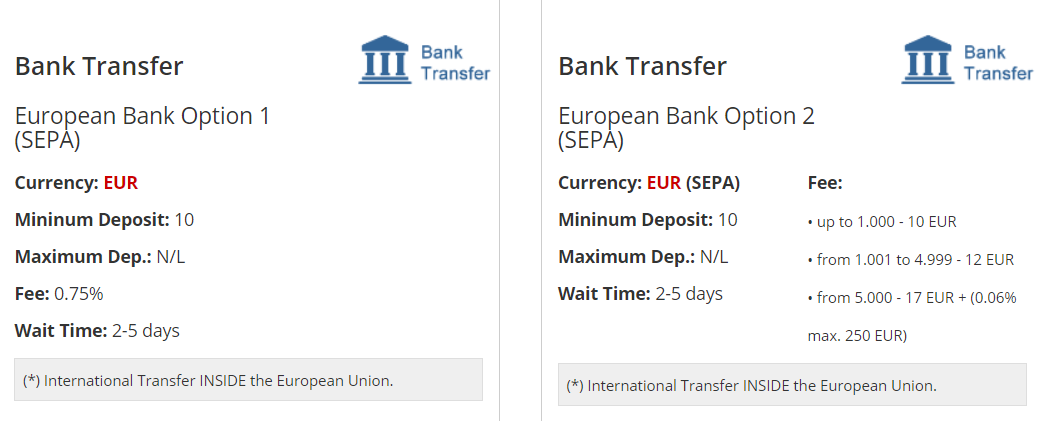

There are three options available to enter by bank transfer, and these are the options:

Bank Transfer. Option 1. European Bank. (SEPA). Currency: EUR. Minimum Deposit: 10 USD/EUR. Maximum Dep.: N/L. Fee: 0.75%. Wait Time: 2-5 days.

Bank Transfer. Option 2. European Bank. (SEPA). Currency: EUR. Minimum Deposit: 10 USD/EUR. Maximum Dep.: N/L. Wait Time: 2-5 days. Fee:

- Up to 1.000 – 10 EUR

- from 1.001 to 5.000 – 12 EUR

- from 5.001 – 17 EUR + (0.06% max. 250 EUR)

Bank Transfer. Option 3. European Bank. (SWIFT). Currency: EUR (SWIFT). Minimum Deposit: 10 USD/EUR. Maximum Dep.: N/L. Wait Time: 2-5 days. Fee:

- Up to 1.000 – 35 EUR

- from 1.001 to 5.000 EUR – 35 EUR + 0.28%

- from 5.001 – 40 EUR + (0.28% max. 3000 EUR)

WITHDRAWAL METHODS & COSTS

What is the limit you can withdraw with a card? Up to 25,000 USD / EUR.

What is the minimum amount I can withdraw from my account?

– By card 100 USD / EUR.

– Through bank transfer, there are no limits.

– By Skrill or Neteller from 10 USD / EUR.

- Neteller. Currency: USD/EUR. Min. Withdrawal: 10 USD/EUR. Max. Withdrawal: 5.000 USD/EUR. Fee: 2%. Wait Time: 1-12 hours.

- Skrill. Currency: USD/EUR. Min. Withdrawal: 10 USD/EUR. Max. Withdrawal: 5.000 USD/EUR. Fee: 1%. Wait Time: 1-12 hours

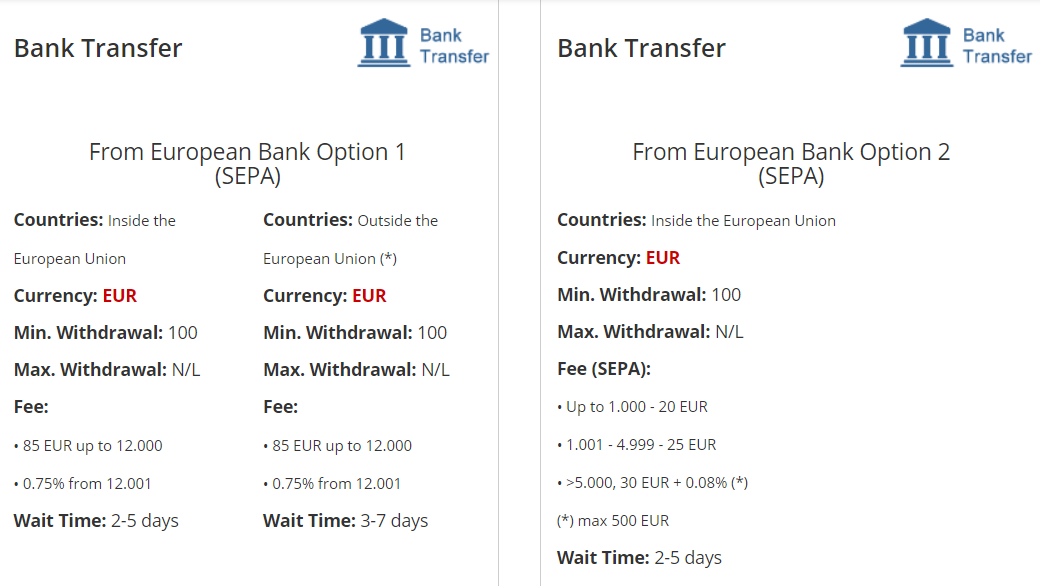

Bank Transfer:

Bank Transfer. From European Bank Option 1. (SEPA).

- Countries: Inside the European Union

- Currency: EUR. Min. Withdrawal: 100. Max. Withdrawal: N/L.

- Fee: 85 EUR up to 12.000 USD/EUR, 0.75% from 12.001

- Wait Time: 2-5 days

- Countries: Outside the European Union

- Fee: 85 EUR up to 12.000 USD/EUR. 0.75% from 12.001

- Wait Time: 3-7 days

Bank Transfer. From European Bank Option 2. (SEPA).

- Countries: Inside the European Union.

- Currency: EUR. Min. Withdrawal: 100 USD/EUR. Max. Withdrawal: N/L.

- Fee: Up to 1.000 – 20 EUR, 1.001 – 5.000 – 25 EUR, >5.001, 30 EUR + 0.08%

- Wait Time: 2-5 days

- Countries: Outside the European Union (*)

- Fee: Up to 1.000 – 35 EUR, 1.001-5.000, 35 EUR + 0.28%, 5.001, 40 EUR + 0.28%. (max 3.000 EUR)

- Wait Time: 3-7 days

WITHDRAWAL PROCESSING & WAIT TIME

How to withdraw your funds?

In the menu “Enter or Withdraw” you select “Withdraw Funds,” there you will find an option to request your refund by “Bank Transfer.” Following the instructions, you will arrive at a form, you must fill it out with your bank details. When the broker receives your request, they will send you a confirmation, informing you that the refund process has been done correctly. The broker agrees to process your withdrawal request no later than 2 hours after receipt (provided it is on business hours). The time limit within which the money must be in your account will be 2 to 5 working days.

How long does it take for my deposit to be available in my trading account? If the deposit has been made by bank transfer, the standard term is 2 to 5 working days. In the case of a deposit by credit or debit card, the balance will be available within 1 to 12 hours. Deposits made using Skrill or Neteller, the balance will be available within 1 to 12 hours.

BONUSES & PROMOTIONS

They currently have a promotion where they give away a mobile phone of the Xiaomi brand. They offer 3 models: Xiaomi Note 8T, Xiaomi MI 9T, and Xiaomi Note 10. The requirements for you to choose one of these mobile phones are: Open a trading account with SMFX. Deposit in the account a minimum of 2000 EUR or 2300 USD. Stay in the trading account for 24 months. The value of the mobile phone will be retained in your account. You also have the option to finance it and pay it in 6, 12, 18, or 24 months.

EDUCATIONAL & TRADING TOOLS

In this section, we have found an economic calendar, which is always important to consult to know the most important events of the day, and which can influence the movements of assets. SMFX Solidary Markets also provides a complete forex course free of charge, which we have seen and enjoyed the content. Add that this is provided by an external agent, https://www.whitetigertools.com.

CUSTOMER SERVICE

There are several ways to contact the SMFX Solidary Markets customer service, as follows:

- Phone: +64 (0) 36694803

- Customer Service: [email protected]

- General Information: [email protected]

- Technical Support: [email protected]

- Opening Accounts and Withdrawals: [email protected]

- Skype: service_smfx ; smfx_info

They also have an online chat available 24 hours from Monday to Friday.

DEMO ACCOUNT

The broker provides us with a Demo account based on your SMFX Webtrader version. The demo account will become inactive if you do not use it for a period of 30 days. After that period, you can activate a new Demo account if you wish.

COUNTRIES ACCEPTED

We have not been able to find a list of restricted countries on the website. We have gone to the registration page to check the countries accepted, and we have detected that at least 4 countries are not on the list, and therefore will not be able to open an account with this broker. The excluded countries are the United States of America, Canada, Libya, and Syria.

CONCLUSION

Solidary Markets NZ Ltd owns SMFX Solidary Markets. This company is registered and based in New Zealand, but is not regulated by the Financial Markets Authority (FMA). The company claims to be a Financial Services Manager but is outside the policies of the 2008 Financial Law; therefore it does not require it to belong to the FSP Registry for companies providing services within New Zealand.

The broker claims that he keeps the client’s funds in segregated accounts, which is good practice and is one of the requirements of the strictest regulations. It seems that the broker is serious despite not being regulated. It is based in New Zealand, a country that maintains an excellent regulatory reputation. We can say that their trading conditions are quite good and they are within the average of the industry sector.

Advantages: Very acceptable minimum deposit requirement. It has several commercial platforms. It offers VPS at a reasonable cost. Tasty variety of accounts. Wide range of assets to trade. Attractive welcome promotion.

Disadvantages: Not regulated but appears to be a serious broker.