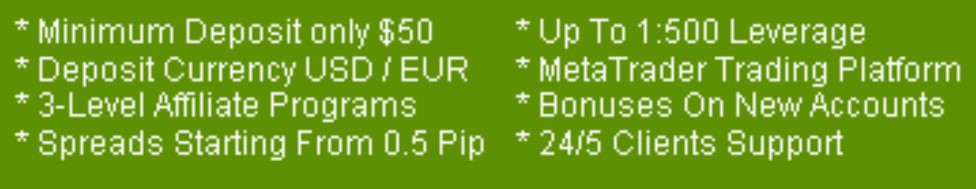

Lucror Capital Markets LP is a brokerage firm which is headquartered in Auckland New Zealand (registration number 2539816). This broker offers the popular MT4 platform which can be used when trading on their four available accounts and they also have quite an affordable minimum deposit requirement. Lucror FX offers a number of currency pairs and precious metals as available instruments and they also offer quite a high leverage. Take a look at this review to see what this broker has to offer.

Account Types

Customers of Lucror FX have a choice of four account types to choose from, namely: The Mini Account, The Micro Account, the Muslim Account, and the Standard Account. The accounts vary in their leverage ratios and minimum volume per trade, however, all accounts seem to offer quite similar conditions. The standard account has the largest number of available forex pairs, 29 whereas the other accounts all have a choice of 17 pairs, which when comparing it to what other brokers offer, seems to be quite limited. On their terms and conditions page, we found that this broker requires a minimum of $1000 to maintain an open account.

Here is a breakdown of the four accounts’ main characteristics:

Mini Account

Leverage – 100:1

Minimum Account size – 1000

Minimum Volume – 0.1

Swap-Free – No

Hedging – Yes

Available pairs – 17

Micro Account

Leverage – 200:1

Minimum Account size – 500

Minimum Volume – 1

Swap-Free – No

Hedging – Yes

Available pairs – 17

Muslin Account

Leverage – 100:1

Minimum Account size – 1000

Minimum Volume – 0.01

Swap-Free – Yes

Hedging – Yes

Available pairs – 17/20

Standard Account

Leverage – 100:1

Minimum Account size – 1000

Minimum Volume – 0.01

Swap-Free – No

Hedging – Yes

Available pairs – 29

Platforms

Lucror FX uses the Meta Trader 4 as their platform. The MT4 is the world’s most popular and most trusted trading platform and for good reason. This platform is compatible with several different operating systems including MAC and Windows-based, as well as iOS and Android. The MT4 is ideal for beginner traders looking to discover more about the industry and also for advanced traders who are looking for a data-rich experience and multiple tools to make the most of their trading.

Leverage

The leverage offered by this broker depends on the account type customers decide to open. The highest leverage customers can use is 200:1 which is available for those who have a Micro account. The other three accounts, Mini, Muslim, and Standard, all have a leverage of 100:1.

Trade Sizes

Trade sizes are also dependent on the account type, the Micro account has a minimum volume of 1 lot, the mini 0.1 lots and both the Muslin and Standard account have the minimum volume of 0.01 Lots.

Trading Costs

Regarding this topic, the information on Lucror FX’s website is quite lacking. There is no mention of commission fees applicable to trades on their account, however, in their Terms and Conditions documents, we did find commissions and fees mentioned quite often, however without any specific details about what type of commissions customers will be expected to pay. We did get in touch via Live chat, however, we did not receive any information about this.

Assets

From what we could see on their website, this broker does not have a very extensive list of assets available for trading. The only information given is that the Mini, Micro, and Muslim account have 17 FX Pairs available, whilst the Standard account has 29 available pairs, however, the broker does not specify which pairs these are. Apart from this, all available accounts can also trade precious metals, Spot Gold and Silver specifically.

Spreads

On their homepage, this broker claims that they offer highly competitive spreads, however, we could not locate any more information about the specific spreads customers should expect when trading with Lucror Fx.

Minimum Deposit

Although this information is not found on their Accounts page on their website, we did manage to find a section in their Terms and Conditions that states that a minimum deposit of $1000 is required to commence trading. We are not sure if this is applicable to all available accounts, however taking into consideration the lack of choice when it comes to trading assets, we feel this deposit requirement is quite steep.

Deposit Methods & Costs

Deposit Methods & Costs

Customers wanting to deposit funds to their Lucror FX accounts can do so via two payment methods, Bank Transfer or via Credit card. The broker does not state whether there are any charges that customers are expected to pay.

Withdrawal Methods & Costs

To withdraw money out of an account, customers must send a signed withdrawal request via fax, email, or post. On the request, customers must include their account details, the amount they wish to withdraw, and the account that the money will be withdrawn to. Unfortunately, we could not find any information regarding commission or fees associated with withdrawing funds. We suggest that interested customers should speak to the broker beforehand to have a clear idea of what deductions might be made before deciding to open up an account and withdrawing money.

Withdrawal Processing & Wait Time

We found no information regarding processing and wait time for withdrawals so we cannot comment any further on this for the time being.

Bonuses & Promotions

At the moment there does not seem to be any available welcome bonuses, however, they are offering a completely free $15 account for new clients. Profits on that account can be withdrawn at any time, but there is a $15 charge for withdrawal. So this means that only profits can be withdrawn.

Educational & Trading Tools

When clicking onto the Education page on Lucror Fx’s website, we did not find any information however when we searched the term Forex a number of articles came up. These articles covered topics such as the best type of forex platform, exchange money rate, how to guide to Forex hedging, and a few more articles. Customers can also find a glossary outlining commonly used terms and phrases within the trading industry.

The website also has an Industry News page; however, the last article was posted back in 2011 which makes the information completely out of date.

Customer Service

For those wanting to get in touch with this broker, they can do so via telephone or through their live chat option. We did try and contact them through live chat however after filling in the short form to start the conversation, nothing really happened and we were left with unanswered questions. We also tried to reach the broker through their Facebook page, however it seems like this page no longer exists.

Here is their contact information:

Address – 1008-1009, Level 10,

300 Queen Street, Auckland 1010,

New Zealand

Telephone – +64.9.2813160

Demo Account

Lucror FX offer their Demo account for customers to test their trading strategies risk free and in a real-time environment. Once customers apply to open up a demo account, they will be given virtual cash (no details about the amount) and they will also be able to use a fully-functional version of the Lucror ProTrader. Customers can use the demo for 30 days before it expires.

Countries Accepted

This broker does not specify if they have any restrictions on any particular countries so we suggest that customers get in touch with them to find out whether their own residence it accepted.

Conclusion

Lucror FX is a New Zealand based broker that offers four similar account types with a limited number of available assets for trading. We did find that the information on their website is either not explained fully or not present at all, which is inconvenient for potential customers. We also noticed that they are quite limited when it comes to funding accounts as they only accept two payment methods. On the plus side, they do offer a demo account that can help customers determine whether the trading conditions offered by the broker are good or not.

Their customer service is quite lacking, and we were left with unanswered questions after 48 hours and although they do have quite a lot of articles on their education page, their news segment is very outdated with the latest news article having been put up more than eight years ago.

If you’re interested and would like to know more about what this broker has to offer, head on to their website and determine whether investing with this broker would be a good move for you.