Securcap, oriented towards the Asian markets, is an offshore agency offering to trade on its Metatrader5 platform. Their customers can choose from the 2 account types available, both with high levels of leverage. Securcap broker has more than 40 currency pairs and various CFDs to trade, such as 15 commodities, 23 stock indexes, and 3 bonds. This diversification of underlying assets is always appreciated by traders.

ACCOUNT TYPES

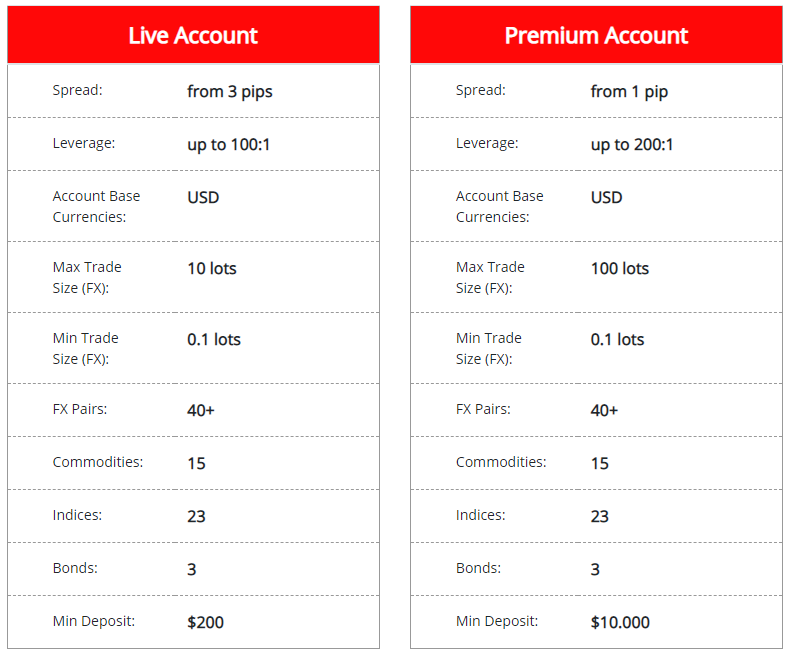

Securcap broker has 2 types of accounts, called Live account and Premium account.

Let’s look at the characteristics of each of them:

Live Account:

- Spreads from 3 pips

- Leverage: up to 1:500

- Account Base Currencies: USD

- Max Trade Size (FX): 10 lots

- Min Trade Size (FX): 0.1 lots

- FX Pairs: 40+, Commodities: 15, Indices: 23, Bonds: 3

- Min Deposit: $200 USD

Premium Account:

- Spreads from 1 pip

- Leverage: up to 1:1000

- Account Base Currencies: USD

- Max Trade Size (FX) 100 lots

- Min Trade Size (FX): 0.1 lots

- FX Pairs: 40+, Commodities: 15, Indices: 23, Bonds: 3

- Min Deposit: $10.000 USD

PLATFORMS

Securcap makes the Metatrader5 (MT5) platform available to its customers. Although it is not the MT4, a platform to which most traders are accustomed, the presence of any of the Metaquotes platforms by a broker is always positive.

MT5 was born in 2010 and is actually very similar to its predecessor, the Metatrader 4. For example, advanced graphics, the multitude of indicators, the Expert Advisors (EA), and simplicity in use, are common on both platforms. MT5 was originally designed to operate in Forex, stocks, and commodities.

LEVERAGE

The maximum leverage available on both accounts is 1:500 and 1:1000 respectively. It is difficult to find brokers that offer such high levels of leverage. The leverage of up to 1:1000 offered by this broker can serve as the most aggressive trading strategy. But traders need to know that such high leverage is associated with a much greater risk of losing their funds with a small market fluctuation. That is why the leverage available to retail traders is limited in several countries, such as Europe 1:30, the US 1:50, and Japan 1:25.

The maximum leverage available on both accounts is 1:500 and 1:1000 respectively. It is difficult to find brokers that offer such high levels of leverage. The leverage of up to 1:1000 offered by this broker can serve as the most aggressive trading strategy. But traders need to know that such high leverage is associated with a much greater risk of losing their funds with a small market fluctuation. That is why the leverage available to retail traders is limited in several countries, such as Europe 1:30, the US 1:50, and Japan 1:25.

TRADE SIZES

In the 2 accounts that the broker offers, the minimum size to trade is 0.1 lot (mini lot).

TRADING COSTS

The broker does not clearly specify the costs associated with the transactions. What we understand is that in the Live account, due to its high spreads, it is possible that it is exempt from commissions, while in the Premium account there may be some sort of commission.

However, like any broker, traders will pay a swap for transactions that remain open overnight. Swaps are interests based on the economic conditions and policies of the central bank of the country of origin of the currency.

ASSETS

More than 40 currency pairs and various CFDs to trade, such as 15 commodities, 23 stock indexes, and 3 bonds. The broker does not specify which currency pairs are the commodities and indices. We only know that the available bonuses are: BUND (5 years Germany Bond), SCHATZ (2 years Germany Bond), and TNOTE (10 years US Bond).

SPREADS

We see from the information on the Securcap website that the reference spread in EUR/USD is above 3 pips in the Live account type. These spreads are not attractive for traders. Because they are much higher than most traders offer 0.7 – 1.3 pips in the case of EUR/USD.

MINIMUM DEPOSIT

The minimum deposit for the Live Account is 200 USD, while for the Premium account, the minimum deposit is 10,000 USD. We consider the minimum deposit requirement for the Premium account to be very high. In the market, we find many brokers with better commercial conditions and a minimum deposit of 100 USD.

DEPOSIT METHODS & COSTS

It’s very curious that throughout the broker’s website, we don’t find deposit methods. We understand that once the account has been requested, the broker will inform us of the methods available for depositing. The most common deposit methods, and that virtually every broker offers, are bank transfer and payment by debit or credit card.

WITHDRAWAL METHODS & COSTS

Not knowing the deposit methods, we don’t know the withdrawal methods, let alone the costs. Normally to make a withdrawal, it is normal to do it in the same deposit method that has been used previously.

WITHDRAWAL PROCESSING & WAIT TIME

We haven’t been able to figure out withdrawal processing or wait time. That information is not provided by the broker on his website.

BONUSES & PROMOTIONS

Securcap does not have any bonuses or promotions currently available. Also, the broker has the possibility that the customer will become an Introductory Broker (IB). A program that several brokers offer and that consists of the collection of commissions for the clients that you take to the broker and that they trade with real money.

EDUCATIONAL & TRADING TOOLS

There is an educational area with 12 video tutorials where you deal with basic aspects of trading, as well as the operation of the website. It also has a very long glossary of trading-related terms and an updated economic calendar.

CUSTOMER SERVICE

CUSTOMER SERVICE

Securcap has several options for contacting their customer service. It has a chat room that we think is very interesting to deal with all those questions that require a quick answer. It also has a telephone, 2 emails, a contact form, and a physical address.

ADDRESS: SECURCAP SECURITIES LTD. Office 4, Suite C2, Orion Mall, Palm Street Avenue, Victoria, Seychelles.

CONTACTS. Tel: +248 4323 763

EMAIL [email protected] , [email protected]

DEMO ACCOUNT

Securcap offers a free DEMO account with which you can trade in fictional money emulating a real-money operation. It is also important to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account.

COUNTRIES ACCEPTED

The broker does not inform about the objection of certain citizens or jurisdictions to trade with their accounts, so we assume that any citizen of the world can be a customer of Securcap Broker.

CONCLUSION

This broker claims to be authorized and regulated by the Financial Services Authority, but this agency is based in the Seychelles Islands. With the regulation of Forex brokers in Seychelles, they have no obligation to comply with any requirements and have little regulatory oversight.

Indeed, clients of such brokers are exposed to substantial risk, as their funds are not protected. Brokers registered in this type of offshore jurisdiction are not required to have a certain minimum capital, nor to keep clients’ money in segregated accounts, or to set up a clearing system in the event of insolvency.

Advantages: MT5 platform, a wide variety of CFDs, wide leverage possibility.

Disadvantages: No adequate financial regulation, high spreads, no information on deposit and deposit methods, costs, and waiting times in the process.