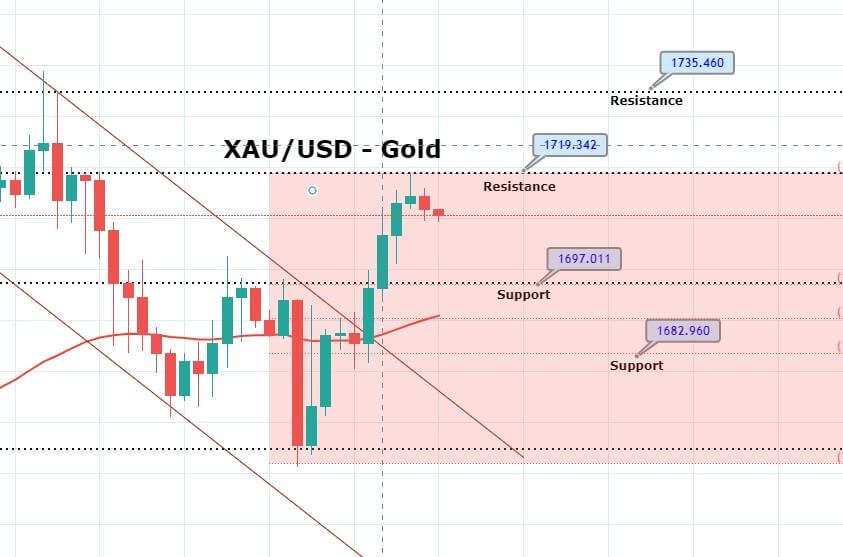

During the Asian session, the precious metal gold was trading at 1,713 area. Technically, gold has entered the overbought zone, and it may help show us a slight bearish retracement below 1,718 area until 23.8% Fibonacci retracement level of 1,705 before showing further bullish trends in the market.

Overall, the fundamental side of the market is suggesting a bullish bias for gold as it’s price soared as much as 1.9% a day before. Most of the bullish bias was seen in the wake of sentiments of additional fiscal and monetary stimulus measures amid massive economic collapse due to stay-at-home and business abandonment orders around the world to restrict the spread of the novel coronavirus.

On the 4 hour timeframe, the precious metal gold has formed a bearish engulfing candle, which is suggesting odds of selling trend in the market below the 1,718 area. Since the overall trend seems bullish, we will try to capture quick sell in gold. Let’s open a sell trade at 1712.52 with a stop loss around 1720.02 and take a profit at 1705.02.

Entry Price: Sell at 1712.52

Take Profit 1705.02

Stop Loss 1720.02

Risk/Reward 1.00

Profit & Loss Per Standard Lot = -$750/ +$750

Profit & Loss Per Micro Lot = -$75/ +$75