Introduction

Inflation is one of the most tracked economic indicators by policymakers, economists, consumers, businesses and analysts. The effects of inflation are felt throughout the economy – no exceptions. Inflation expectations can help every player in the economy better to prepare themselves in anticipation of future inflation levels. Therefore, we must understand the how the anticipation of the inflation rate impacts the economy.

Understanding Inflation Expectations

Inflation is the increase in the general prices of goods and services that are produced within an economy, over a specific period. This increase in the prices of goods and services tends to erode the purchasing power of a currency. Therefore, assuming there is no increase in wages, consumers can only be able to purchase a lesser quantity of goods and services. There are several causes of inflation, but the primary cause occurs when more money is supplied in the economy relative to the wealth.

Inflation rate: is the percentage increase in the prices for a basket of goods and services over a specific period. It is used to compare inflation over different periods.

Inflation expectation is the opinion about the future rate of inflation. This opinion is derived from different players in different sectors of the economy to guarantee the validity and ensure it the data is comprehensively representative. These players include investors, central bankers, and consumers. Their inflation expectation is based on a variety of economic activities they intend to undertake.

How to Calculate Inflation Expectations

These are the two main methods of calculating inflation expectations.

Market Survey

The central banks conduct surveys to determine inflation expectations. Households, businesses and economic experts are polled to ascertain if their welfare has improved and what they anticipate. The questioned asked mostly includes household finances, inflation, investment activities, changes in the ease of doing business and inflation. The polled panel is nationally representative

Market-based Method

In this method, the expected inflation can be determined by the understanding of the price differential between government bonds and the Treasury Inflated Protected Securities (TIPS). The Treasury Inflated Protected Securities tends to increase the amount of the bonds in tandem with inflation.

In this case, the pricing difference = yield of a government bond – Yield of the TIPS

Let’s look at an example;

Suppose the yield of a 10-year bond is 5%, and the yield of a 10-year TIPS is 3%, the market pricing is 5% – 3% = 2%

The 2% can be said to be average annual expected inflation over the next ten years.

How can inflation Expectations be used for analysis?

The data on inflation expectations can be used by a variety of players in the economy. The inflation expectations data is the primary leading indicator of the rate of inflation in an economy.

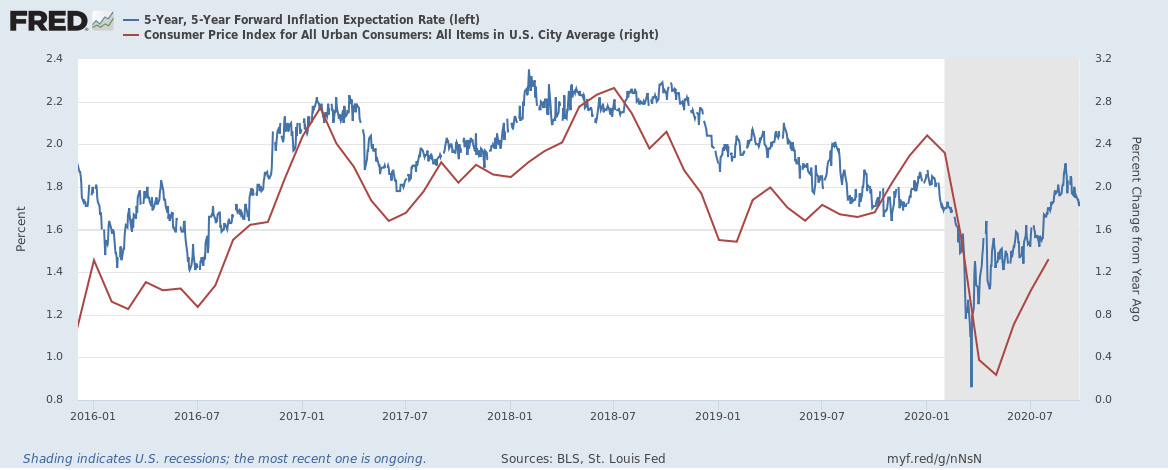

Source: St. Louis FRED

Here are some of the ways different market participants can use the inflation expectations data.

Investment decision making: Businesses use the expected inflation data to make business decisions about future productions. They can choose to make changes on their product quality or quantity depending on the inflation outlook.

With expected inflations data, businesses can also make adjustments regarding factors of production. If the higher inflation rate is expected, businesses could opt into paying upfront for production inputs of their businesses. This upfront payment enables them to hedge against a future increase in the cost of businesses, thus protecting their bottom line. Furthermore, businesses can use this data during negotiating for employee contracts and wages.

Household decision making: Inflation expectations plays a vital role in households’ budgeting process. The data enables them to make rational decisions regarding expenditure, savings and investments. If they anticipate higher inflation, households can decide to put more funds into the purchase of essential products and cut back on savings and investments, since higher inflation erodes the value of money.

With lower inflation expectations, households might elect to increase their savings and investment activities since the potential increase in purchasing power will leave them with more disposable income.

Central banks and governments: One of the core mandates of the central banks is to ensure that the rate of inflations is kept below the targeted rate. Using the inflation expectations data, the central banks and governments can make informed policy decisions. These decisions are whether to implement expansionary or contractionary policies.

When the rate of inflation is expected to drop and result in deflation, central banks and the government will adopt expansionary monetary and fiscal policies. These policies include lowering interest rates to pump more money into the economy. Dramatically falling in the rates of inflation can be bad for the economy, as the reduced prices encourage complacency in the economy and could result in stagnation.

Conversely, expectations of higher rates of inflation will compel central banks and governments to adopt contractionary monetary and fiscal policies to avoid an overheating economy. Such policies will include increasing interest rates to make the cost of money more expensive and encourage investments and savings.

Impact on Currency

Since inflation expectations inform the decision of the central banks, it plays a vital role in the forex market.

When inflation expectations hint to lower rates of inflation, the outlook is negative for a country’s currency. The expansionary policies that ensue results in depreciation of the currency since the rate of return of investments will be less lucrative. The low-interest rates also make foreign bonds and treasury bills more attractive compared to local bonds; which results in a net outflow of investments.

Conversely, expectations of higher rates of inflation are positive for a country’s currency. The central banks will adopt contractionary policies like raising the interest rates, which makes an investment into the country more lucrative; increasing the demand for local currency hence appreciation.

Sources of Data

In the US, the inflation expectations data are released monthly on the last Friday of the month. The University of Michigan collates the data.

A comprehensive and historical breakdown of the US inflation expectations data can be accessed at St. Louis FRED here and here.

Statistics on global inflation expectations can be accessed at Trading Economics.