Have you ever exited a trade too early for a small win or loss and wished you could go back and change it shortly afterward? Many traders have struggled with the problem of exiting trades too early at some point. Here are a few examples of this problem:

- A trader fears taking a loss and decides to close out their trade at break even, even though the trade is a winner.

- A trader exits the market after making a small profit, but well before their planned profit target due to a fear that the market will reverse. This causes them to make less profit.

- The trader sets a stop loss but decides to exit the trade well before the stop loss is reached because they have incurred a small loss. The trade then goes on to be a winner.

Of course, there are many different reasons why a trader might choose to exit their trades too early. If you want to be a successful forex trader, you’ll need to work to overcome this problem and make sure it isn’t happening to you. Below, we will talk about some of the underlying factors that contribute to the issue of closing trades out too soon.

- Lack of Proper Education

An ideal trader is well-educated and has a good trading strategy that accounts for risk-management. Others jump in too soon and open a trading account simply because they have money to invest or they’re inspired. If you don’t really know what you’re doing, then you’re going to have an issue with figuring out when to exit trades. Knowing when to enter trades would also be an issue. The best way to overcome this is to make sure you have a good understanding of all concepts related to forex trading. If you’re constantly watching your trades, you could also remember to “set and forget”. Some other common problems that stem from lack of education include overleveraging trades or risking too much money on any one trade. It is important to look at the bigger picture to see if you are making any of these mistakes.

- You’ve Incurred Previous Losses

Those that have had recent bad luck with a trade or a string of losing trades are more likely to be fearful and anxious when trading. This affects one’s view of the market and makes it seem riskier to enter a standard trade. The best way to overcome this problem is to realize that there’s no way to know for sure whether a trade will be a winner or a loser and that your bad luck will come to pass. It isn’t logical to make decisions out of anxiety or fear, as this usually leads one to make the wrong choices.

- Trading Psychology

Trading psychology focuses on the ways that different emotions affect our trading habits. For example, if a trader experiences a number of bad trades, their anxiety might cause them to exit too quickly. Fear can do this too. We briefly mentioned anxiety and fear above, but we want to point out that these emotions can occur for many different reasons. Some traders are naturally anxious or scared of losing money because that is their personality, or they aren’t entirely confident in their abilities. Whatever the reason, someone might let these emotions convince them to exit a trade too soon. Emotions like greed or excitement might have the opposite effect and cause traders to exit too late.

- Negative Thinking

Even though they have decided to become traders, some people still think negative thoughts about their abilities. One might tell themselves that they have always been poor and always will be if they have some losses. Another might consider themselves stupid and be too hard on themselves over losing trades they couldn’t have expected. It’s important to remember that the way you think will affect your performance. Don’t beat yourself up over losses, simply try to learn from them and move on.

In Conclusion

Above, we highlighted some of the personal factors that contribute to exiting trades too early. Emotion, previous losses, negative thinking, and the lack of a proper trading education seem to cause this problem for many traders. Now that you might have an idea of what is causing you to exit your trades too early, we will provide some tips that will help to avoid it:

- Remember that everyone loses. You aren’t going to have a 100%-win record when trading and that’s normal, so move on if you take a small loss.

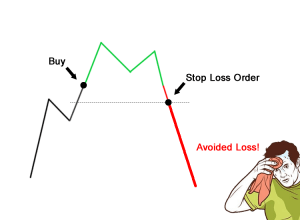

- Have an entry and exit strategy with take profit targets and a set stop loss. Don’t exit before your planned take profit level or stop loss is reached. Try to “set and forget” your trades.

- Learn to take a break if your emotions become too difficult to manage.

- Keep a trading journal to log your progress so that you’ll see if there is a pattern of exiting trades too early.

- Try not to allow any recent losing streaks to alter your decisions when trading.

- If you feel confused when trading, then consider taking measures to educate yourself more thoroughly so that you can base your entry and exit points off more solid data.

Realizing that you’ve been exiting trades too early is the first step to solving the problem. Next, you just need to figure out the reasons why you’re doing this and how to overcome it. Hopefully, this article will help many traders to pinpoint some of the personal causes for this issue. If you’re an intermediate or skilled trader, however, you may be having this problem because of more technical concerns.