Hedging Your Cryptocurrency Portfolio Part 4 – The Best Methods Explained

Perpetual Swaps

Perpetual swaps (or just perpetuals) have recently grown in popularity. More and more cryptocurrency exchanges are starting to offer them. Their use is quite similar to that of inverse futures. However, it does have some differences, mainly:

The periodic funding rate (usually 8 hours)

No expiration date

Why Would You Use This Method

The key reasons for using this method are the same as with using futures. The main difference would be that the short funding rate means that perpetual swaps closely track the underlying prices (much closer than the futures). On the other hand, this also means that your hedging cost may vary (as funding rates are re-adjusted every 8 hours).

Not having to deal with rollovers reduces your trading costs as well.

How You Construct This

The portfolio construction is exactly the same as inverse futures. Check out part 2 of our series to see how to construct this hedging method. The only difference is that you will need to have an account on an exchange that offers perpetual swaps.

Summary

Just like hedging with futures, hedging with swaps is best suited for cryptocurrency investors that carry the standard coins rather than ones that are well diversified. It is also for the investors that want to hedge their exposures efficiently. A good understanding of perpetual swaps is highly recommended, as you will need to assess the risk of using financial derivatives fully.

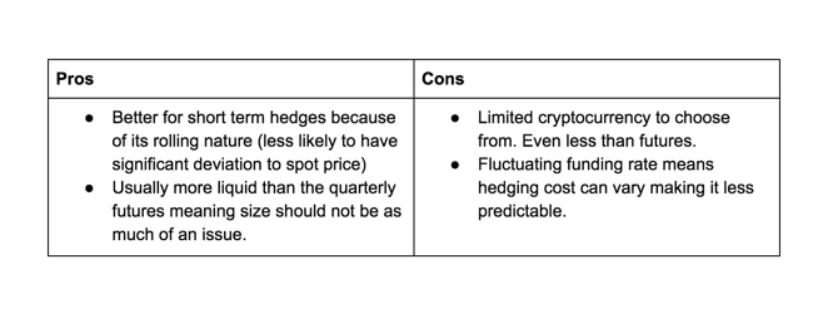

Pros and Cons are mostly the same as for futures, so this table will list the differences between the two:

Bonus: Why Do People Hedge?

Most investors in the cryptocurrency industry probably want the exposure as they expect their favorite crypto to “go to the moon.” However, in some cases, they might want to stay safe for certain reasons. Those reasons are dependent on what position they have in the industry:

Miners

Miners need to pay their electricity bills as well as other costs in USD or their native currency. For this reason, they might want to have more predictability on their capital returns. They could sell their cryptocurrencies directly, but it may be more beneficial for them to stock up their cryptocurrencies and sell them in one larger batch periodically. This way of selling cryptos is better as they can negotiate better fees and reduce certain transfer costs. Therefore, miners will hedge to reduce their risk while they are piling up cryptocurrencies to sell them in a bigger batch.

ICO Projects

ICO projects often incur various costs in USD. They often have a need for a more predictable cash flow, which is why they might want to sell some cryptocurrencies they hold. However, they do not want to be seen selling their own tokens or funds, as that could be interpreted as a weakness and send off a bad vibe to the investors. Therefore, ICO projects hedge to keep their cash flow more predictable while maintaining the trust of their investors.

Funds

Certain funds employ strategies that are based on a return that is relative to Bitcoin. In this case, they would have to overlay their portfolio with a BTC equivalent hedge so the returns they get become relative to BTC’s performance.

Whales

Selling a significant amount of cryptocurrencies is not as easy as it can cause market fear. Whales need to make sure not to cause big market drops when wanting to cash out. Therefore, their alternative would be to put hedges in place. This reduces their overall exposure as they slowly sell their holdings over a longer period of time.