I’m sure you’ve heard of financial leverage, but knowing how important this concept is in trading and what it implies. Let’s get on with it!

What is Leverage?

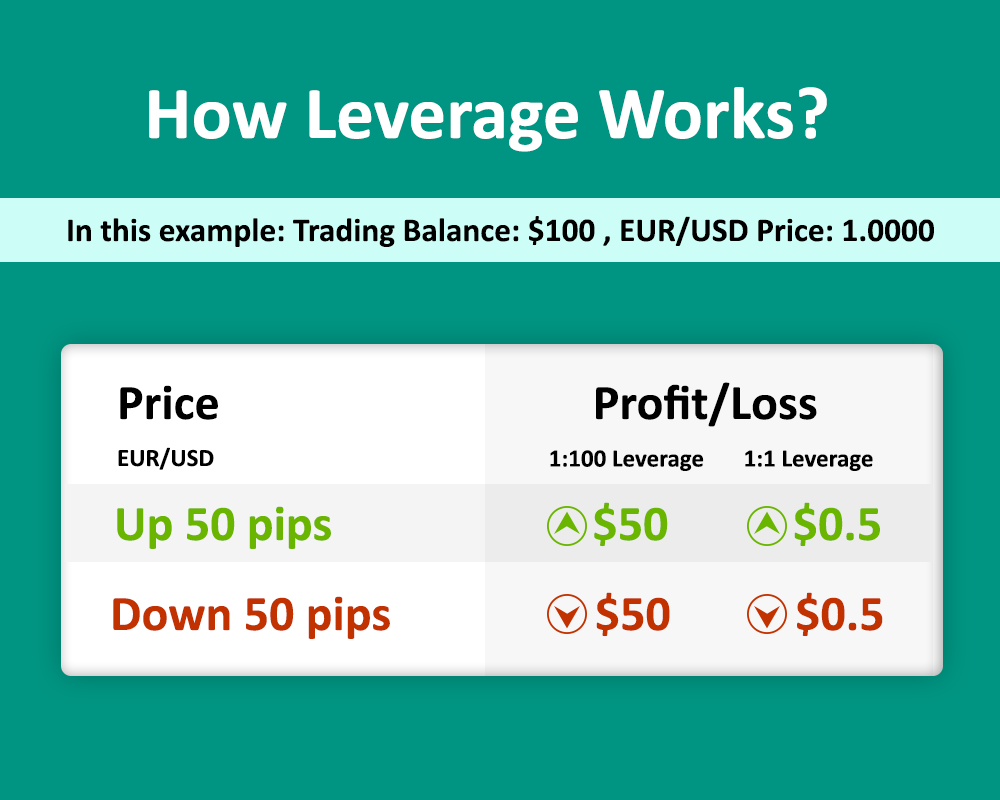

When trading on Forex, the broker lends you money so you can trade for more than you have in your account. It’s like an accelerator, it makes the profits and losses in applying it can be greater. The greater the leverage you use will be your exposure in the market.

How does trading work?

If you trade $5,000 in your broker account to trade with a leverage level of 1:10, the margin required is $500. If you have a balance of $3,000 for this, you have $2,500 of available or free margin ($3,000 – $500) to do more trading.

Why is Forex leverage important?

Knowing the leverage you’re using will help you know what potential gains or losses you may have, what margin the broker requires for smooth trading, and how your money fluctuates in your account with each price variation.

New ESMA Regulation

Due to misuse and losses resulting from excessive leverage with CFDs, in 2018 ESMA (European Securities and Markets Authority) decided to limit it to a maximum of 1:30 per account for European customers. In a practical way this means that, if your account balance is $5,000, you will not be able to do operations worth more than $150,000.

A paragraph, if you do not know what CFDs are, are contracts for differences that is their translation of the acronym in English (Contract for Difference). When you trade in currencies and click on the broker tab to buy or sell you do it through CFDs, which is the instrument that allows us to access and exit the market and settle the position easily.

One of the great attractions of CFDs is leverage, especially in currencies where some brokers offer very high levels that have caused some people who are starting to lose a lot of money. Faced with this situation, ESMA decided to act and limit leverage to 1:30 for one year, although it has recently been extended and already seems an unlimited measure. This has generated quite a number of opinions against and in favour of this measure.

Anyway, I have to tell you that the many brokers have looked the other way and offer customers high leverage despite this measure. This is done by changing its headquarters outside Europe, creating another tax residence. The fact is that if you take a look on the Internet you will find intermediaries that offer up to levels of 1:500.

What is the best leverage in Forex?

The best leverage for trading is the minimum that allows you to achieve your goals. If it’s not necessary for you to leverage yourself, don’t, because that will make your risk less. Do you really think that most losing traders are because they don’t have a higher level of leverage?

You may think that since you have a small account, the trick is to leverage as much as possible, but in these years I have seen how many traders open small accounts that later go bankrupt, then open another. and thus entering a vicious circle.

1:30 leverage is more than acceptable. From here, if you have more, you can use it or not. Having leverage of 1:500 does not mean that you will be overexposed in the market or with an excessive level of risk, simply the broker will require you less margin and ready. The key is that you always have the maximum loss of each trade in money controlled and is manageable.

Margin call

At this point, you’ll think leverage is a bargain. You can make use of it in small accounts and if the operation goes well make a good part of the capital and if you leave bad lose what you have in the account. You know, lose a little, earn a lot. Right? No, because you should be very clear that the broker will normally close your operations when you run out of margin in the account (margin call) since it does not interest you to end up owing money to him. But be careful because if not, you can ask for the amount you lost if your account is negative because you do not have the obligation to do so. In other words, you are ultimately responsible. The margin call is the ‘over game’ of trading.

We go with an example, we have a balance in our account of 1,000 dollars and leverage of 1:30. We opened a purchase operation of 0.30 lots in EUR/USD (30,000 dollars in face value). Our margin required to make the trade is 900 dollars. We only have 100 dollars in our account and if the EUR/USD quotation drops the margin will decrease.

That is to say, of the 30,000 dollars of exposure that we have in the market, with only a little more than 0.3% we would be left without margin to face the losses and the broker (is not obliged) would close the operation to us. This is what we called margin call before. In this case, we would assume the loss, but if you take this to the extreme and you do not close the positions or an event occurs that makes the quotes move much in a short time (news, black swan, Brexit type events) the consequences can be worse.

Is leverage bad?

Let’s think a little bit in perspective, is salt really bad? No, as long as you don’t have a disease related to it and take a reasonable amount.

Is leverage bad? No, if you have it and it’s not too high. If you engage in excessive leverage to trade Forex, sooner or later you will end up with big losses. Even if you win at first, you’ll end up losing. Use leverage to get more with less and diversify for better results.

The broker industry sells it as a panacea for beginners, where they announce that you can make a lot of money with very little. As we have already seen this may be true, but what you are not usually told is the B side of the coin.

How to calculate the size of a Forex trade

If you’re starting out on Forex, don’t worry about pips and lots, it’s a lot easier than it looks. An example to look at, with starting data that we need to calculate how much we are going to trade for a reasonable level of risk.

- Risk per operation: 1%

- Stop loss: 50 pips

- Account balance: $1000

- Currency pair: EUR/USD

We first calculate our risk assumed in dollars: 1% of 1000 dollars, 10 dollars.

Since our stop loss is 50 pips, we will calculate the value of the pip.

$10/50 pips = $0.2/pip.

Now we only have to know how much we’re going to trade so that each pip is worth 0.2 dollars.

Size of our operation = 0.2 dollars/pip / 0.0001

(Pip size) = 2,000 dollars.

Now we know that to take a risk of 10 dollars with that level of stop at EUR/USD we have to open an operation of 2000 dollars, 0.02 lots, or 2 micro-lots.

I know you’re thinking this is all bullshit and that doing it every time you open an operation is impractical. And that’s why I do it, algorithmic trading and I recommend you do it too. No more excuses for not knowing what leverage you’re using and calculating the risk properly. On to success!