Gold surged as the greenback came under load following the U.S. Federal Reserve decreased interest rates while risk surrounding a U.S.-China trade agreement supported the metal’s demand as a safe-haven investment.

Prices also took additional help after U.S. weekly jobless claims increased more than anticipated last week. Spot gold rose 0.9% to $1,507.98, having briefly soared to an almost one-week high of $1509.80.

On Wednesday, the U.S. central bank lowered interest rates for the third time in 2019 to accommodate the U.S. growth despite retardation in other regions of the world.

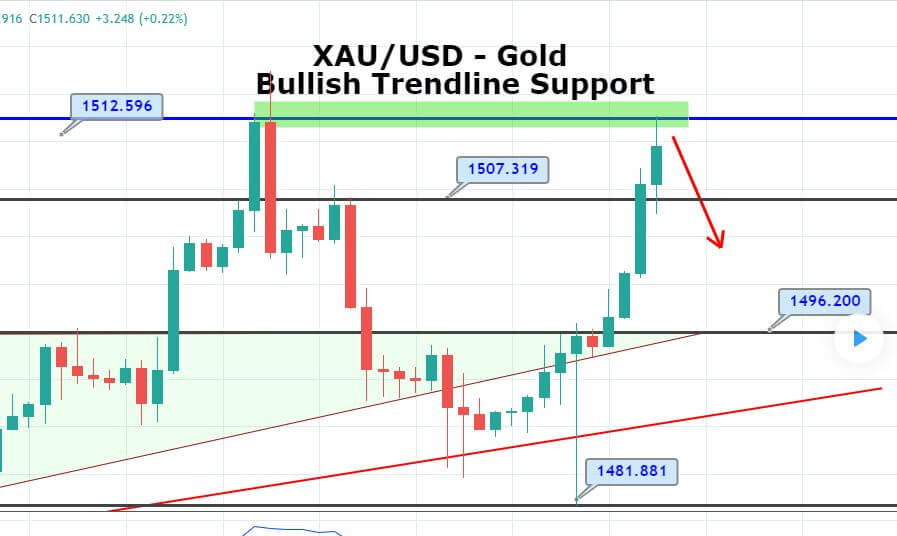

At the moment, gold is trading below the healthy resistance level of 1,514 area, which is pretty much likely to drive the bearish trend in the market.

Gold – Daily Technical Levels

Support Resistance

1485.63 1501.21

1475.6 1506.77

1460.02 1522.36

The leading indicators, such as MACD and Stochastics, are staying in the overbought zone, signaling chances of a bearish reversal in the gold.

Consider taking a sell trade below 1,514 area to target 1,507 today. All the Best!