Recently in the cryptocurrency world, there’s been a lot of discussion of CeFi vs. DeFi. Many hardcore crypto enthusiasts are pushing for DeFi, while a number of others are pushing for CeFi. So, which one is better? Well, that depends on what you are looking for when it comes to crypto and how you are planning to invest.

The main difference between DeFi and CeFi is that the former involves decentralized infrastructures, where the financial services are governed by communities rather than single entities. In CeFi, all operations are managed by a business or a consortium of companies and organizations. Consequently, the mechanisms differ as well.

Understanding CeFi

CeFi stands for centralized finance and signifies any transaction in which there is a centralized aspect overseeing the said transaction. This can be anything from a company to the government, or even just an auditor, or otherwise uninvolved third party. Most CeFi service providers implement Know Your Customer (KYC) and Anti Money Laundering (AML) practices to abide by their respective jurisdictions’ rules. That means users have to share their personal information and make sure the funds are not coming from criminal activities.

Many CeFi services operate with custodial wallets, which store users’ private keys. Custodians would do everything possible to keep and manage clients’ crypto funds conveniently. Whenever you trade on popular crypto exchanges like Coinbase, Binance, Bybit, you deal with a CeFi service. These are platforms run by centralized entities responsible for matching buyers and sellers, offering the required features, and making sure the rules are followed by everyone accordingly. As with any business, the profits from fees are shared among company stakeholders.

Besides trading services, companies fall under the CeFi umbrella that offers borrowing, lending, margin trading, and other financial services.

Understanding DeFi

DeFi stands for decentralized finance and applies to any transaction which is simply peer to peer with no third-party involvement. DeFi can also refer to a number of other occasions where people are able to obtain loans or other banking products from dapps.

In a nutshell, DeFi represents a trend or movement that promotes blockchain-powered infrastructures and open-source software to create all kinds of financial services and products, including traditional ones. You can think about services such as lending, trading, issuance of money, payments, insurance, over-the-counter (OTC) trading, staking, financial data, asset management, and more. To visualize it, DeFi is all about transforming traditional banking services into decentralized architectures. So that communities could manage them instead of banks, governments, or regulators.

DeFi is a formidable trend right now, resembling the craze of initial coin offerings (ICOs) from late 2017. The new ecosystem revolves around financial applications developed on blockchain networks. The decentralized applications (dApps) integrate secure permissionless, trustless networks, and eradicate central authority managing the services.

Similarities Between DeFi and CeFi Investments

DeFi and CeFi share some similarities in the sense that they both involve the same financial services. Sometimes the end-user wouldn’t even notice if a crypto service relies on a DeFi or a CeFi infrastructure. At the moment, both CeFi and DeFi enable the same group of financial services, including spot trading, derivatives trading, margin trading, borrowing and lending, payments, and the creation of stablecoins.

Speaking about trading, both CeFi and DeFi platforms can create intuitive interfaces so that newbies could be onboarded effortlessly. Often, the same people and organizations are involved in the development of both CeFi and DeFi projects. After all, both trends are advocating the use of blockchain and digital currencies.

Differences Between DeFi and CeFi

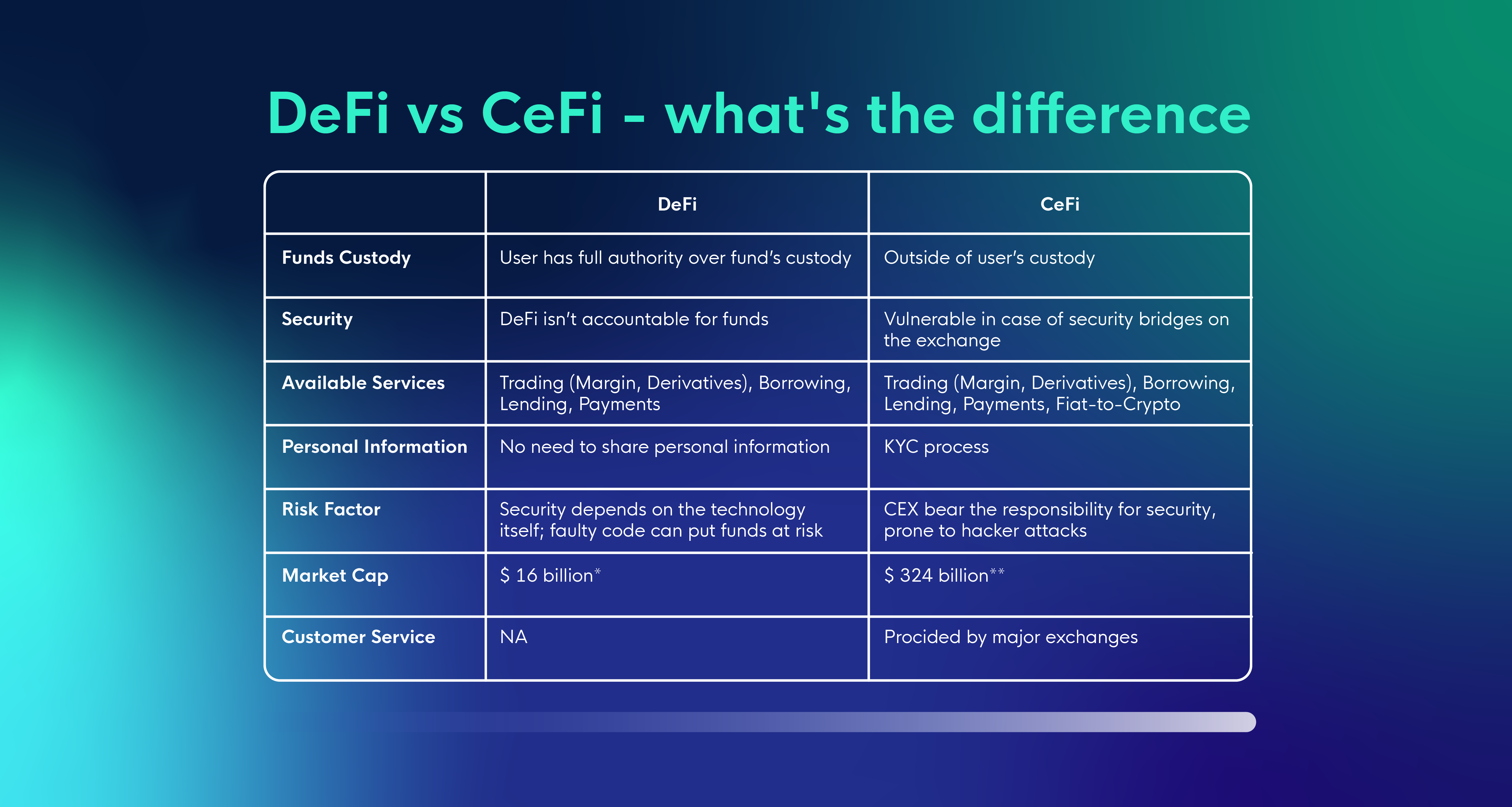

Even though both trends’ fundamental goals are the same – to promote the adoption of decentralized ledger technologies (DLTs) – several significant differences split DeFi and CeFi into two different worlds. Here are the main aspects that differ.

Features– CeFi and DeFi services provide various features that are unique for each group. For example, most CeFi projects offer custody solutions and have dedicated customer service teams, generally not available in DeFi.

Fees- Usually, centralized exchanges charge higher fees to maintain the platform, pay salaries to the staff, improve their products, and more. Elsewhere, DEX platforms are more affordable to trade on, as they don’t provide custody services and don’t have any team involved in the governance process. Generally, the fee revenue is shared among liquidity providers and token holders that choose to stake their tokens. An example is Uniswap, a crypto swap platform that distributes the funds from fees among liquidity providers.

Regulation- Initially, when the first crypto exchanges facilitated fiat conversions, there was no regulation whatsoever, as governments didn’t fully understand Bitcoin and blockchain. Nevertheless, today most jurisdictions try to regulate crypto operations directly or indirectly. So, this is one of the reasons why most CeFi platforms require KYC verification. In the US, Coinbase is registered with the Securities and Exchange Commission (SEC), while other global platforms moved their headquarters to crypto-friendly jurisdictions like Malta or Estonia. Meanwhile, the European Commission is about to create the most comprehensive legal framework aimed at cryptocurrencies. All in all, there are more jurisdictions in correlation to CeFi services.

Security– Even though CeFi platforms do their best to maintain a high degree of security, you can regularly find out about some significant exchange being hacked. At the beginning of the year, Chainalysis said that 2019 saw the most hacking attacks ever, though the number of stolen funds had declined drastically compared to 2018.

Liquidity- The way liquidity is achieved in DeFi is very different. In CeFi projects, the platforms match buyers’ and sellers’ orders similarly to forex or stockbrokers. In DeFi, all trading is not carried out automatically on blockchain. Instead, DEX platforms rely on AMMs, an innovative concept in which both sides of a trade are pre-funded by liquidity providers incentivized to locate their funds.

Sources:

- https://blog.bybit.com/learn/defi/defi-vs-cefi-differences/

- https://medium.com/bitcoin-news-today-gambling-news/cefi-vs-defi-the-showdown-which-is-better-7c7b1d9c182a

- https://www.ledger.com/defi-vs-cefi-how-defi-measures-up#:~:text=DeFi%20refers%20to%20the%20decentralized,with%20the%20new%20digital%20asset

- https://101blockchains.com/defi-vs-cefi/

- https://www.fxempire.com/education/article/decentralizing-traditional-finance-bridging-cefi-and-defi-675078

- https://www.blockchain-council.org/blockchain/defi-vs-cefi-a-detailed-guide-for-beginners/

- https://coinfunda.com/centralized-finance-vs-decentralized-finance-defi-vs-cefi-a-comparison/