Introduction

One of the primary indicators of a country’s GDP is how the economy is performing presently. The current economic conditions are the best indicators of business and economic cycles in the economy. They can tell us whether the economy is going through expansions or contractions. Thus, the current economic conditions are the best indicators for establishing recessions or recoveries, and can also be used to forewarn about potential overheating of the economy.

Understanding Current Economic Conditions

The current state of the economy is a culmination of several macroeconomic and microeconomic factors. Previous economic trends, government and central banks’ policies influence the current economic conditions. Therefore, the current economic conditions can be said to be a gauge of the effectiveness of previous fiscal and monetary policies.

In the US, for example, the Federal Reserve published the current economic conditions in The Beige Book. The Beige Book published the current economic conditions of the 12 Federal Reserve Districts. Below are the components used to determine the current economic conditions.

Employment and wages: The current economic conditions assess the overall levels of employment and changes in wages. Here, the changes are assessed based on industry. It covers the number of people who were laid off, new hires and job vacancies.

Prices: The prices of goods and services produced within the economy are monitored for inflation. The levels of inflation can be used to assess the living standards and the changes in the cost of doing business.

Manufacturing: The changes in the levels of manufacturing shows the growth of the output and potential changes in employment levels.

Consumer spending: This shows the changes in the welfare of households. Consumer spending correlates to living conditions and could be used as an indicator of future economic expansion or contraction due to changes in aggregate demand.

Banking and financial services: This section shows the changes in the issuing of new loans and the rate of defaults. The changes in the number of loans issued correspond to the changes in economic activities. The changes in commercial and industrial loans indicate whether businesses are investing and expanding. The repayment schedules indicate the financial health of businesses. Credit standards, delinquency rates and deposits are also included in this category.

Real estate and construction: This category shows the changes in the construction of new residential and commercial buildings. It further shows the sale of new houses. The occupancy levels and the changes in rental rates are also included here.

Services: This section reports the changes in the demand for professional services such as the demand for payroll services, accountancy and deal advisory services. It also shows the changes in the activities in the services sector as a whole.

Agriculture, energy and natural resources: this section reports the changes in the agricultural conditions. It shows the changes in crop production, the market prices for the harvest, cost of farm inputs, storage costs, and any subsidies received in the agricultural sector. This section also shows the changes in the mining sector.

How can current economic conditions be used for analysis?

By businesses: The current economic conditions show the trends in demand. Businesses can use the data contained in this report to either scale up their production to match rising demand or lower production in case of shrinking demand. Furthermore, producers get to see the regions where their products are performing well and where the sale is dismal. This data can help them make informed decisions for targeted advertising to improve sales or to exit a particular market segment if the costs outweigh potential profits.

By governments and central banks: The data on the employment situation, consumer spending, inflation and agriculture are useful for the government and central banks to make informed policy decisions. The current economic situation effectively shows if the economy is contracting, stagnating, expanding or overheating. Therefore, this data is crucial in informing the type of policy that will be implemented by the central banks and the government. The policies can be expansionary, contractionary or stay the course, accordingly. Furthermore, the current economic conditions can be used as a scorecard to assess whether previous fiscal and monetary policies brought about the intended changes within the economy. If not, then the government and central banks will know how to tweak the policies to achieve the desired results in the economy.

Impact on Currency

When it comes to fundamental economic indicators, forex traders pay the most attention to how the data will affect future monetary policies by central banks.

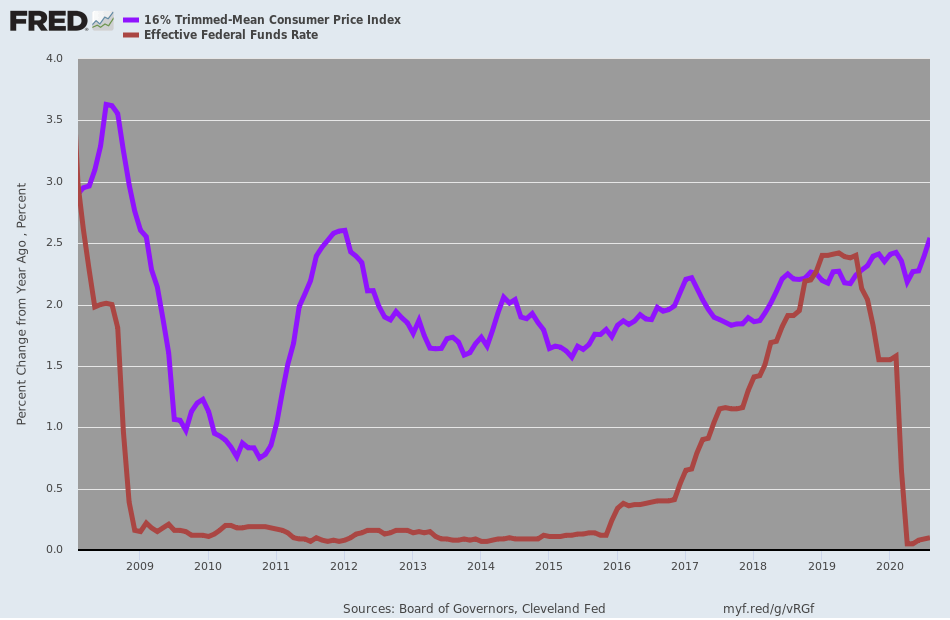

Source: St. Louis FRED

If the current economic conditions data indicate that the economy is in a recession, forex traders can then anticipate lower GDP levels, and adopt a bearish stance on the currency. Furthermore, they can also anticipate that expansionary monetary policies will be put in place to spur economic growth. Lowering the interest rates as an expansionary policy is negative for a country’s currency. Although the cost of money will be cheaper, investments will also have lower returns relative to other countries. As a result, the currency depreciates.

Conversely, if the current economic data indicates that the economy is expanding, reaching peak levels, forex traders can anticipate higher levels of GDP; thus, adopting a bullish stance on the currency. For the authorities, monitoring the current economic conditions helps determine if the economic expansion is too rapid, resulting in overheating. To prevent the overheating, central banks and governments will implement contractionary monetary and fiscal policies. These policies are meant to ensure sustainable growth in the economy by making the cost of borrowing higher to discourage excessive borrowing. However, the rate of return on investments and government bonds increases. This increase leads to increased demand for investments in the country and consequently, the appreciation of the currency.

Sources of data

In the US, The Beige Book is published by the US Federal Reserve Board. This report is released eight times a year, two weeks before each Federal Open Market Committee meeting since it is used to guide their decision of short-term interest rates.

In the Euro Area, the current economic conditions are published by the Economic Research Institute ZEW.