During Monday’s Asian trading session, the EUR/JPY currency pair managed to gain positive traction and edged higher above the 130.00 level due to the market risk-on mood, which tends to undermine the safe-haven Japanese yen and contributes to the currency pair gains. Hence, the upbeat market sentiment was supported by optimism over a potential vaccine/treatment for the highly infectious coronavirus, which boosted the sentiment around the shared currency and helped the currency pair to stay bid.

On the contrary, the worsening Coronavirus (COVID-19) Condition in Europe keeps fueling the worries over the Eurozone economic recovery, which could be considered one of the key factors that kept the lid on any additional gains in the currency pair. At the moment, the EUR/JPY currency pair is currently trading at 123.31 and consolidating in the range between the 123.02 – 123.34. Moving on, the traders seem cautious to place any strong position ahead of the German/ Eurozone flash PMIs. However, the big miss on expectations would suggest that worsening Coronavirus (COVID-19) is taking a toll on the Eurozone economy, which could lead to big declines in the shared currency.

As we already mentioned that the market trading sentiment remained well supported by the renewed optimism over a possible vaccine for the highly infectious coronavirus disease, which instantly boosted the market risk tone. The vaccine hopes were bolstered after reports came that the vaccinations against coronavirus disease in the U.S. will likely start in 3-weeks, as the FDA is showing readiness to approve drugmaker Pfizer and German partner BioNTech’s experimental candidate in mid-December. Apart from the U.S., the U.K. is expected to give Pfizer’s vaccine a green signal this week. This, in turn, boosted hopes for a global economic recovery in 2021. Therefore, the risk-on market mood tends to undermine the safe-haven Japanese yen, which becomes the key factor that lends some support to the currency pair to put some bids.

Moreover, the market trading sentiment was further bolstered by the positive developments surrounding the Brexit talks between the U.K. and the European Union (E.U.). It is worth recalling that the European Union (E.U.) and the U.K. are very closer to breaking the deadlock over fisheries’ key issue.

On the contrary, the worsening Coronavirus (COVID-19) condition in Europe keeps fueling the worries over the Eurozone economic recovery, which could be considered one of the key factors that kept the lid on any additional gains in the currency pair. However, the shared currency’s ability to stay bid will be tested on the day as a survey-based indicator(Eurozone PMIs) is set to show the true amount of damage to the economy caused by the resurgence of coronavirus. Thus, the big miss on expectations would suggest that worsening Coronavirus (COVID-19) is taking a toll on the Eurozone economy, leading to significant declines in the shared currency. Conversely, the Upbeat PMIs, especially Germany’s manufacturing sector, could push the single currency higher.

Across the pond, the gains in the currency pair were further capped by the latest statements of Christine Lagarde, President of the ECB, that the ECB will be taking action in December and caused the shared currency to come under pressure against its rivals. In the meantime, the Italian Prime Minister Giuseppe Conte said they are considering starting setting nightly curfews in the country, while the German Chancellor Angela Merkel said they are expected to limit contacts between people in private for all winter months. This, in turn, becomes the key factor that kept the lid on any further gains in the currency pair.

Looking ahead, the market traders will keep their eyes on U.S. Markit Manufacturing PMIs along with the German/ Eurozone flash PMIs, which are scheduled to release later in the day. All in all, the updates surrounding the Brexit, virus, and U.S. stimulus package will not lose their importance.

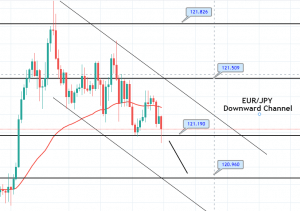

Daily Support and Resistance

S1 122.27

S2 122.74

S3 122.94

Pivot Point 123.21

R1 123.41

R2 123.68

R3 124.16

Entry Price – Buy 123.281

Stop Loss – 122.881

Take Profit – 123.681

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US