If you don’t know what the problems with your strategies are, you probably didn’t read the first article of this series. The short answers to your questions will be included in this article too, but, before you proceed, you should definitely read the first part where we talked about how trading plan issues can be the worst sabotage to your strategy and success.

If you think that making a trading plan will suffice, you are badly mistaken. That’s why today, as promised, we are moving on to another key area that will help you avoid the biggest traps in the world of trading.

- Part 2: Don’t Give a Darn about Trading Psychology

They say money is energy. Therefore, since energy goes where attention does, what you pay most attention to in trading will inevitably dictate the amount of money you earn. Interestingly enough, most traders who have the least success trading take very little notice of how their personality and habits impact their trading. And, many of you who assume you have everything going for you are also far from impervious to this hurdle.

What we want to achieve is the ability to control:

- Our emotions while trading

- Our reactions to losses

- Our compulsive need to correct things

You may notice that we did not say eliminate, and there is a crucial difference here. If you think about people who suffer from any addiction, you may remember that the first step towards recovery is acknowledgment and acceptance of the problem.

We cannot fix the problem if we don’t know that we have one or if we keep turning a blind eye to it constantly.

We always write our New Year resolutions, but we don’t stick to them. Do you know why? We rarely try to understand what lies behind our lack of motivation to lose weight or exercise for example.

That is why if you don’t recognize that, as a human being, you are prone to feeling different emotions before, during, and after trading, you are by default sabotaging your strategy. We will call this our step 1.

Emotions are in our DNA and there is no reason for you or anyone else to feel ashamed. While many people try to ignore this side of their personality, any attempt to disregard our affective responses leads to making wrong trading choices.

For trading to go well, you essentially need to meet two basic requirements:

- Trade your system

- Do not interfere

And, this always goes fine until emotions come into play.

Anxiety, fear, desire, need, tiredness, failure, continuous losses all leave a mark – a sensation followed by physiological changes in the body.

Even winning affects our brain. The moment traders’ percentage return goes way up from where it used to be, people start thinking of leaving their jobs. This is one of the major misconceptions about trading and a sure way to sabotage your trading. Trading alone, for the greatest number of everyday people, cannot suffice right away. The way trading is conceptualized will not allow this immediately as you may have initially expected, so don’t give in to these thoughts and feelings.

We cannot eradicate our emotions, but after we grasp their existence, we can choose what to do with them. This is step 2.

Losing will always be a part of this game and every trader, professional or not, goes through this experience sooner or later. The moment things start going really well for you, losses may become even more painful. You cannot lose your motivation and focus here. Like consolidation periods are a natural part of the market, so are the losses.

Therefore, it is not losses that should worry you, but your reactions to them.

Some traders find the 2% risk rule to be ridiculous because they want more and they want it now. Greediness can bring some amazing results but only in the short term. This has happened so many times to so many traders.

Some of the most successful forex traders earn a 20% yearly return. When you manage to ensure a consistent return year after year, you learn to appreciate the effort behind and stop believing everything you read.

Another massive sabotage traders are prone to struggling with is guilt. Guilt is such a dangerous trigger for a variety of harmful actions that you really need to change your perspective immediately. Any loss you took was meant to happen because you needed it to grow. Don’t cry over spilled milk and quickly return your focus to where it can actually serve you. This is step 3.

Instead of drowning yourself in regret and self-pity, do something useful – analyze what went wrong without any should-haves. Did you follow the guidelines for risk? Did you overleverage? Were you overtrading or did you cross any other boundary?

Especially as a beginner, you may regret not following your plan through and thus losing some pips. However, we need to learn to celebrate our small wins as well. You may not have earned as much as you intended at first, but you still managed to go through with the trade and ensure a positive return. Celebrate your success regardless of how big or small it is. Note this down as your step 4.

Now take your pen and write these words in this order:

❝I will never trade by feel or chase losses.❞

Do not allow your trading to be conditioned by something as transient as emotions. You are there for the long run. You want consistent results and sustainable trading.

So, we will always support recognizing emotions but you need to learn what to with them.

What will it take for you to stop letting your feelings drag you down? Is it more demo trading? Is it more testing?

The thing is…trading will never be perfect, like anything else in life. The more we seek perfection, the more we miss the bigger picture. Here are some of the famous quotes we should all strive to live and trade by:

- If you don’t make mistakes, you don’t make anything. (Joseph Conrad)

- Take chances, make mistakes. That’s how you grow. (Mary Tyler Moore)

- Mistakes are a fact of life. It is the response to error that counts. (Nikki Giovanni)

- He who is not contented with what he has would not be contented with what he would like to have. (Socrates)

- Skepticism is the first step towards truth. (Denis Diderot)

- Millions saw the apple fall, but Newton asked why. (Bernard Baruch)

- He who spends time regretting the past loses the present and risks the future. (Quevedo)

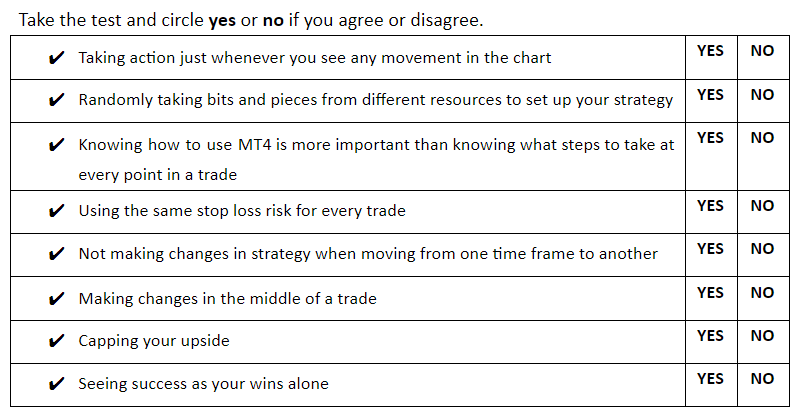

Your last step, step 5, concerns trading psychology tests. You do not have to wait for the big crash. Meet yourself now. Discover what situations could trigger your shadow sides and explore ways to bypass these issues in advance.

Be brave and smart now so you don’t have to pick up the pieces later. And, this is a perfect introduction to what we will be talking about next. Until then, start getting to know yourself better.

P.S. All answers in today’s test should be NO.