DeFi has been a strong driving force for the digital assets’ narrative this summer.In the third quarter of 2020, decentralized finance (DeFi) seized a major mind share of the crypto asset industry. With billions of dollars on public blockchains, the intuitive next step is to generate yield through an on-chain credit system aka the blockchain banking layer. What happened in DeFi this summer is a step ahead in an experiment to transform and banking on the blockchain. DeFi is tinkering with different financial products right from borrowing and lending to derivatives.

Currently, this movement is largely enabled by Ethereum blockchain as it offers compossibility needed for different money legos to interact with each other. Governance of these new money protocols is a major challenge and currently, governance token is the most popular solution. This token allows holders to vote on various proposals and entitles them to a share in profits of the protocol in some cases. Compound protocol ushered in a norm where the governance token is distributed through a mechanism called as liquidity mining wherein the protocol distributes its governance token to users based on their share of liquidity in the protocol. Tokens earned through liquidity mining can be thought of as the yield and therefore liquidity providers (LPs) are also known as yield farmers.

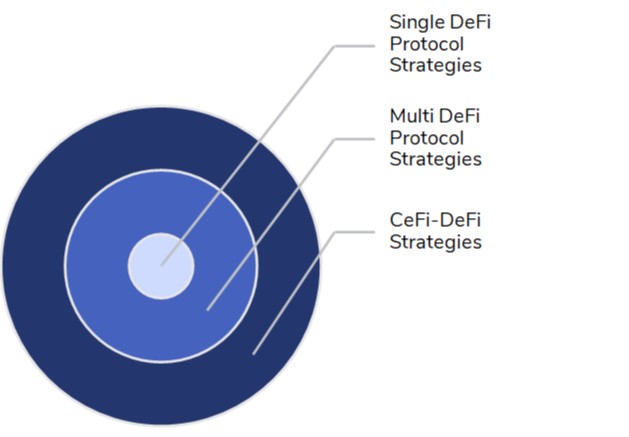

Yield farming activity gave way to a new investment theme in the digital asset ecosystem. Fundamentally, there were three distinct strategies to participate in this investment theme. In this article, we analyze and compare all of them. These are:

- HODL – passively holding ether (ETH)

- Buy/sell DeFi governance tokens – Momentum-based, DeFi-Degen mentality, or Rule-based approach.

- Yield farm governance tokens

HODLing

HODLers are crypto investors who buy and hold their positions regardless of price. Whether the market is up, down or sideways, these folks stay invested, confident in the long-term value of crypto. The term was created in 2013 in a Bitcoin chat forum by an investor who was watching Bitcoin’s price fall sharply but decided not to sell. He wrote a post titled, “I am HODLing,” meaning to write “HOLDing.”

HODLers are crypto investors who buy and hold their positions regardless of price. Whether the market is up, down or sideways, these folks stay invested, confident in the long-term value of crypto. The term was created in 2013 in a Bitcoin chat forum by an investor who was watching Bitcoin’s price fall sharply but decided not to sell. He wrote a post titled, “I am HODLing,” meaning to write “HOLDing.”

The misspelling caught on with the Bitcoin community. Eventually, working backward, they turned it into an evocative acronym: Hold On for Dear Life. Anyone who has watched Bitcoin’s recent volatility knows that the acronym can sometimes feel spot-on.

The HODL ETH strategy consists of holding ETH through the four months. Buy and hold is a time-tested investment method that has worked over longer periods. We use this strategy as a benchmark to verify whether there is any merit in more actively managed strategies.

DeFi Governance Tokens

The primary utility of governance tokens is to give control back to users. Holders of a governance token can suggest or influence critical decisions about the blockchain project through a voting mechanism.

The buy/sell DeFi governance tokens strategy is a generic name that encompasses three different ways to trade tokens: (a) DeFi Degen, (b) Rules-based, and (c) Momentum-based buy/sell.

– On the other end of the spectrum, the rules-based approach is calculative. For this analysis, we decided that one buys when the price crosses 50% of the listing price or the latest low and sells when the price is 30% down from the peak.

– The momentum-based strategy is a bit subjective with a balance between the rules-based approach and DeFi Degen. However, we believe that it stays true to chasing momentum by continuously looking at Twitter and other digital relays. It is not as calculative as the rule-based approach but still adheres to selling when the price drops by approximately 30%. This strategy has a simple premise. How would a portfolio look like if one would just HODL versus actively seeking out alpha returns in a market with no fundamental or technical driven valuations.

Yield Farming

Another popular way to participate in the DeFi ecosystem is yield farming or liquidity mining as we have stated in our previous Digital Investor. A significant advantage of yield farming over the buy/sell strategy is that investors can provide liquidity in pools such ETH-stablecoin so that they are not swapping ETH or stablecoins for new tokens that are yet to prove their mettle. The entire concept was brought to the focus with the #COMP governance token, primarily. Compound distributed governance token on June 15 which garnered unusual attention and spread like wildfire. The whole concept seemed to be effective and lucrative for the crypto enthusiasts, spreading to other Dapps, quickly fuelling the hype.

Liquidity mining or yield farming can be explained where users provide liquidity by stalking cryptocurrency in a DeFi platform and in return receive rewards for it. The primary focus is generating governance tokens for everyone who participates by providing liquidity and which further allows them to participate in the governance of the DeFi project. Liquidity providers make fund deposits in a liquidity pool, and this reserve caters marketplace where users can take out or offer loans and exchange tokens for Stable Coins for trading, scalping, etc.

Using these platforms involves a certain commission amount paid to the providers of liquidity in accordance with the share they hold in the liquidity pool. Thereby, earning interests or gaining returns for all the stakeholders.

Apart from the fees, token distribution also adds funds to the liquidity pool. It is the governance token that grants permission to holders for participating in the protocol decisions.