Any novice in currency trading will soon find out that there are a lot of different currency trading strategies. Therefore, any novice trader will always wonder, what is the best strategy for currency trading? Any foreign exchange trader wants to know which trading strategy should be selected (or created) for the most profitable trade. Indeed, much will depend on the type of trade you prefer, as some strategies are best in short-term trading, swing trading or currency scalping or day trading or positional trading. Certain strategies may be adapted to a day trader or long-term investor. This article explains three currency trading systems that have proven to be working in financial markets.

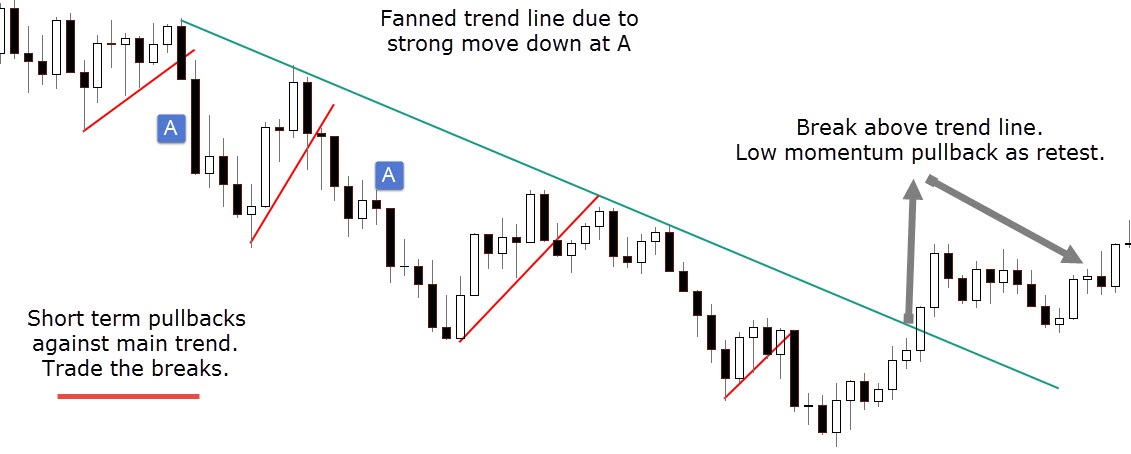

Number 3: Business Strategy of Trend Line Break

This is one of the oldest currency strategies that is based on trend reversal. The strategy indicates depending on price movements that a particular price level where the current trend will be reversed. This strategy also employs levels of resilience and support, and I understand that it is correct for all assets and all investors, ranging from currency pairs to CFDs or commodity stocks.

Well, let’s see how you can open positions to buy and sell with this strategy:

Find a clear trend and draw the trend line along with its highs/lows. We just need a single line that will break in case of a trend reversal. In the bearish trend, we need the resistance line (red), and in the bullish trend, we need the support line (blue);

Now, we have to wait until the market moves for the price chart to break this trend line. Only the moment when the price breaks and crosses the line is necessary for us to have a negotiating signal;

If the bearish trend breaks, it will be followed by a bullish trend, and so, let’s go into a buying operation (Buy). If there is an upward trend breakdown, the price will be reversed downwards and we will enter into a sale transaction (Sell);

You must enter a purchase transaction when the 2 main conditions are met: the price has been broken through the resistance level (red line), and the price reached the level of the most recent peak of the broken down bearish trend (level of purchase);

A sale transaction is introduced when the 2 main conditions for sale are met: the price has been broken through the support level (blue line), and the price reached the level of the most recent lowest of the decomposed bullish trend (sales level);

By the time the two conditions are met, we can already open a selling or buying position immediately if the price has reached the level we have discussed in steps 4 and 5;

A take profit is set at the maximum/minimum of the previous trend before the low/high where we open a position (Take Buy/Sell);

A stop loss is put on the low/high of the previously broken trend (Stop Buy / Sell);

As you see, this is a simple and cost-effective currency trading strategy that can be used at any period of time and provide a sufficient level of signal accuracy. Statistically, the benefit/loss ratio is approximately 65/35.

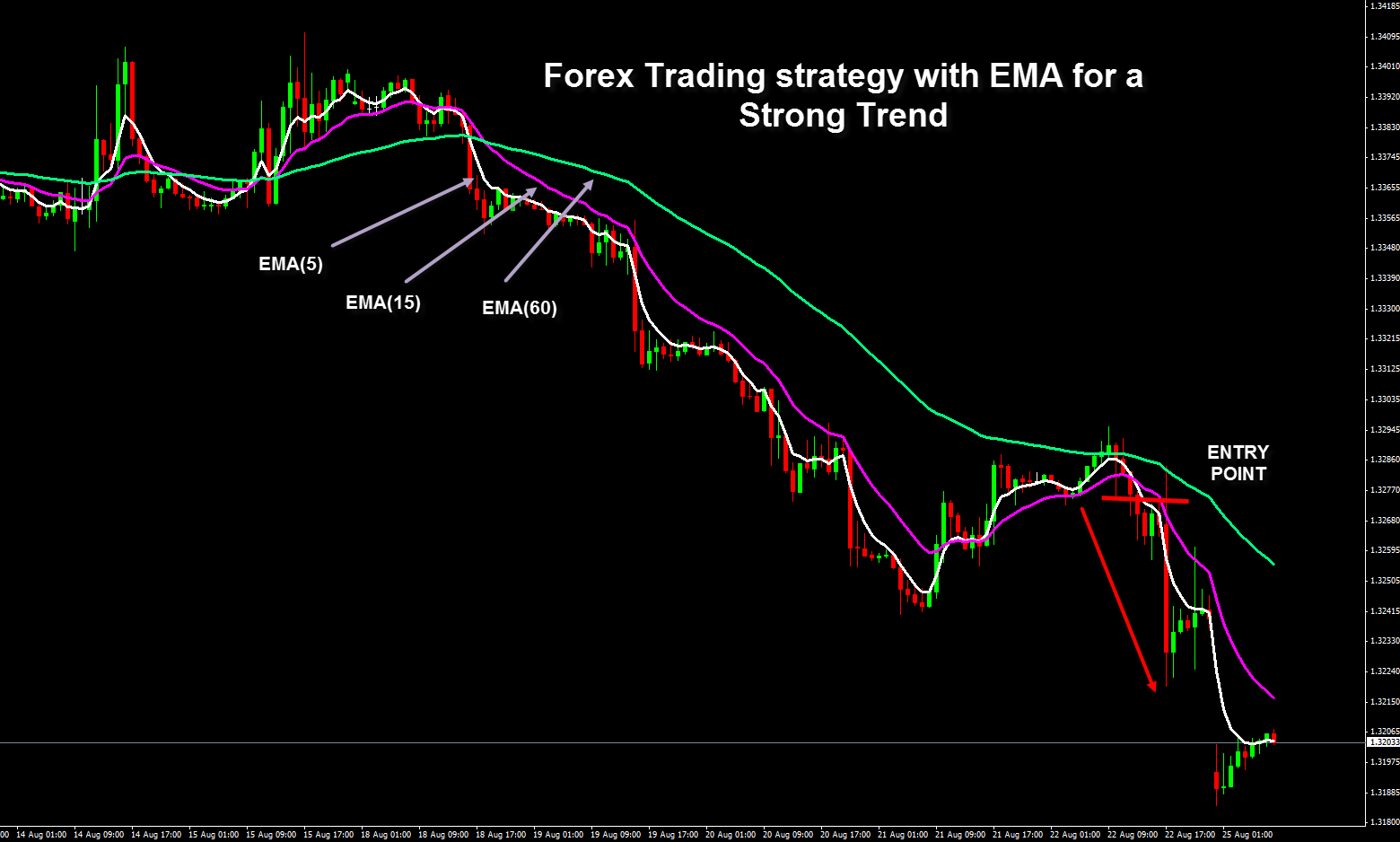

Number 2: Three EMA Rupture Strategy

This strategy is one of the basic strategies of the indicator and, like the previous ones, is quite simple and applies the principle of a trend reversal. This is a currency indicator strategy, so you will need to attach three moving averages to the chart.

Well, let’s see how you get into trading according to this trading system.

Place three EMA on the price chart. For convenience, they should be in different colors. In the first EMA, the displacement is -2 and the period is 21. In the second EMA, the displacement is -3 and the period is 14. The in the third EMA displacement is -4 and the period is 9;

Therefore, the blue EMA will be slowed down and when satisfied by other faster EMAs, input signals will be delivered;

A selling sign appears when the green EMA breaks through the red from above and the two lines cross the blue line from above (Sell 1,3,5);

A buy sign is sent when the green and red Mas cross the blue from below, and the red must be crossed by the green MA from below (Buy); The strategy does not suggest particular levels to put a Take Profit and Stop Loss, so, you leave the transaction depending on the market situation, you should be very careful to keep risk management under control;

You should close the position (with a profit or with a loss) when the green and red EMAs cross each other back in the opposite direction after they have entered the trade;

As you can see, this Forex trading strategy is also very simple. A simple average indicator provides clear signals with a profit/loss ratio of approximately 70/30.

Number 1: Commercial Strategy Based on Triangle Pattern Break

I assure you that this is one of the most optimal currency strategies. When you operate with this strategy in currency markets, at least know the main ideas of technical analysis, because you will need to find a triangle pattern on the price chart and mark your legs (limits) with trend lines, which are the levels of support and resistance ( blue lines). The triangle looks like a narrow side channel.

Well, let’s see how you enter operations based on the signals of this commercial strategy:

This strategy hardly offers signals to enter the market at the current price, it suggests the use of pending orders, purchase limit or sale limit order;

When you have already found a triangle pattern, you can start placing pending orders. You must place the order at the price level that will indicate that the price has broken down one of the pattern trend lines;

A purchase limit must be set to the maximum before the pattern resistance line break (buy 1). If a new high arises, the limit order must move a lower high (Buy 2), and it does so until the resistance line is broken;

A Sell Limit order is placed at the minimum before the break in the support level of the pattern (Sell 1). If a new bass emerges, you must move the pending order to the next minimum, and this will happen until the support line passes through;

When one of the pending orders works, you put a Take Profit at the maximum (if you buy) or at the bottom (if you sell) of the pattern;

A stop-loss will be set to the contrary end (low/high) relative to the end that entered an operation. For example, for a sale transaction (sell 2), a stop loss is set at the level of a possible trade purchase Buy 2);

This business strategy is a bit more complex and needs you to have experience in detecting a triangle formation in the price chart, but provides greater trading opportunities. Complexity is compensated with the high accuracy of trading signals with a profit/loss ratio of approximately 85/15.

So, now you know the three best currency strategies that any forex trader should try. We recommend that you test them out on a demo account for a while in order to get the hang of them first. After that is done, feel free to move to a live trading platform and start collecting your profits!