USB Broker is a foreign exchange broker based in the United States. Their mission is to share happiness, a strange one for the forex broker but they aim to do this by giving their clients the tools for success and to listen to and share their stories. In this review, we will be looking into the services being offered by USB Broker so you can decide if they are the right broker for you.

Account Types

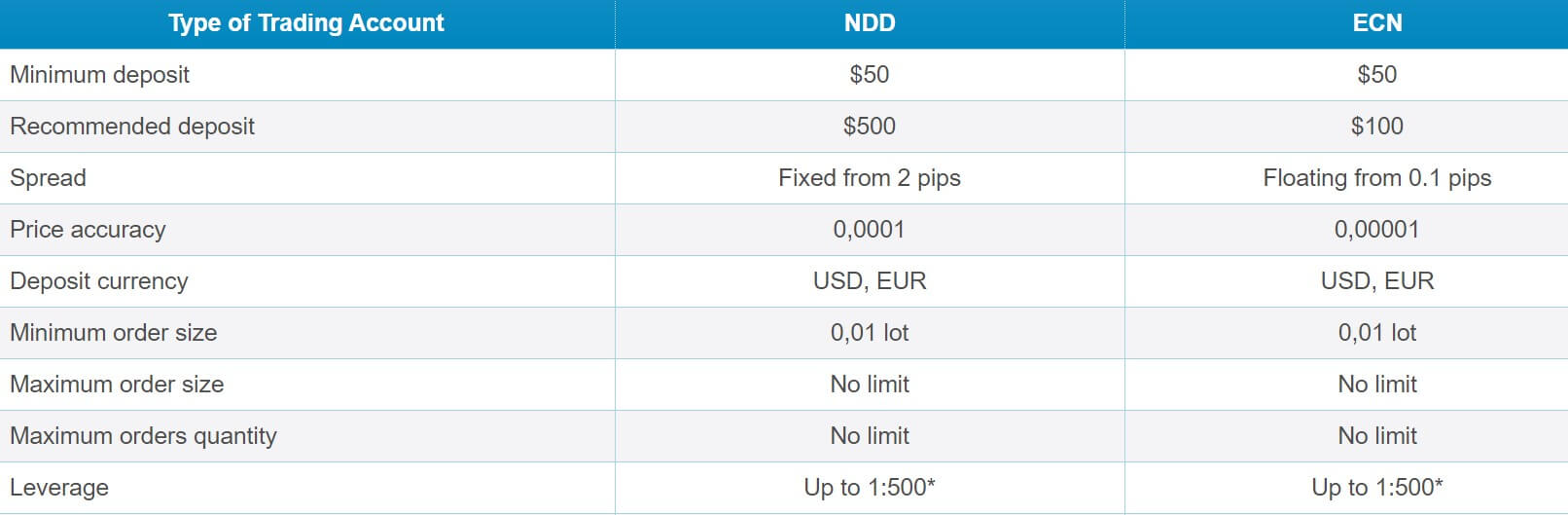

There are two different accounts on offer, including an NDD (No Dealing Desk) account and an ECN (Electronic Communications Network) account, let’s look at what each of them offers.

NDD Account: This account has a minimum deposit of $509 but a recommended deposit of $500. Spread is fixed from 2 pips and there is no added commission for forex markets, but there are for commodities and CFDs, a commission of $2 is added for them. The deposit needs to be in USD or EUR and the minimum trade size is 0.01 lots with no maximum trade size or a maximum number of open trades. Swap charges are charged on this account and the execution type is market execution. A margin call is set at 40% and stop out is set at 20%there is an interest of 10% for having funds in your account. Finally, leverage can be up to 1:500 on this account.

ECN Account: The ECN account also has a minimum deposit of $50 but the recommended deposit is now $100. Spread is a floating spread starting from 0.1 pips and due to this there is an added commission to forex pairs of $2 per lot traded, commodities, and CFDs also have a commission of $2 is added for them. The deposit needs to be in USD or EUR and the minimum trade size is 0.01 lots with no maximum trade size or a maximum number of open trades. Swap charges are charged on this account and the execution type is market execution. A margin call is set at 40% and stop out is set at 20%there is an interest of 10% for having funds in your account. Finally, leverage can be up to 1:500 on this account.

Platforms

USB Broker uses something called UTIP Trader 2.3, let’s see what this means:

U.S.B. Broker company offers a new universal trade-information platform “UTIP Trader 2.3” (Universal Trade Information Platform) to work on world financial markets. This trading platform is designed to organize the brokerage service on the financial markets, such as the FOREX market, forward market, and precious metals market. The trader’s tools include different types of trade orders, schedules with many time-frames and a wide range of settings; and also a full technical price analysis with multiple indicators.

For every trading tool, the following types of charts are available: linear, bars, and candlestick. 21 kinds of time-frames are also available to make a detailed analysis of price movement dynamics. Over 50 inbuilt technical indicators and oscillators, and diverse linear tools make the analytical job easier. With the help of these analysis tools, it is possible to detect trends, find different price models, and define the level of position opening/closure, etc. At the same time, it is possible to use several analytical objects and therefore have a deeper analysis of the financial market price movement.

Besides the basic orders (Sell/Buy), the platform allows you to put forward a number of postponed orders such as orders closing the positions automatically: “Take Profit” and “Stop Loss”; and orders opening the positions automatically: “Buy Stop”, “Buy Limit”, “Sell Stop” and “Sell Limit”. The platform also has the function Trading Stop – floating order Stop Loss, which allows you to follow the order automatically without your direct action on the order, and at the same time keeping the profit gained in case the trend changes. The platform allows you to create your own indicators. Using an API you can write your own indicators in any programming language.

Leverage

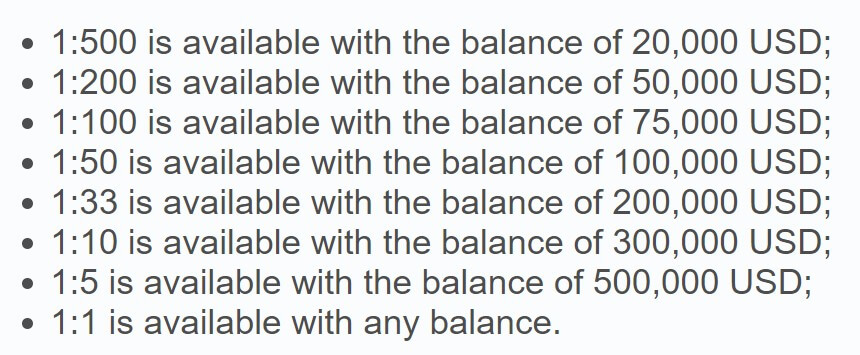

The maximum leverage is 1:500 for both account types, the leverage can be selected when opening up an account, and should you wish to change it on an already open account then you will need to get in contact with the customer service team to request this.

Trade Sizes

Trade sizes on both accounts start from 0.01 lots which are also known as a micro lot. The trades then go up in increments of 0.,01 lots so the next trade will be 0.2 lots and then 0.3 lots. There is no maximum trade size however we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage. There is also no limit to the number of trades you can have open at any one time.

Trading Costs

Trading costs depend on the account type that you are using and the instruments that you are trading, we have set them out below for easy understanding.

Commissions:

NDD Account:

Forex: No commission

Spot Markets: $2

CFDs: $2

ECN Account:

Forex: $2

Spot Markets: $2

CFDs: $2

As you can see, $2 is a very low commission when comparing to the industry standard of $6 per lot traded.

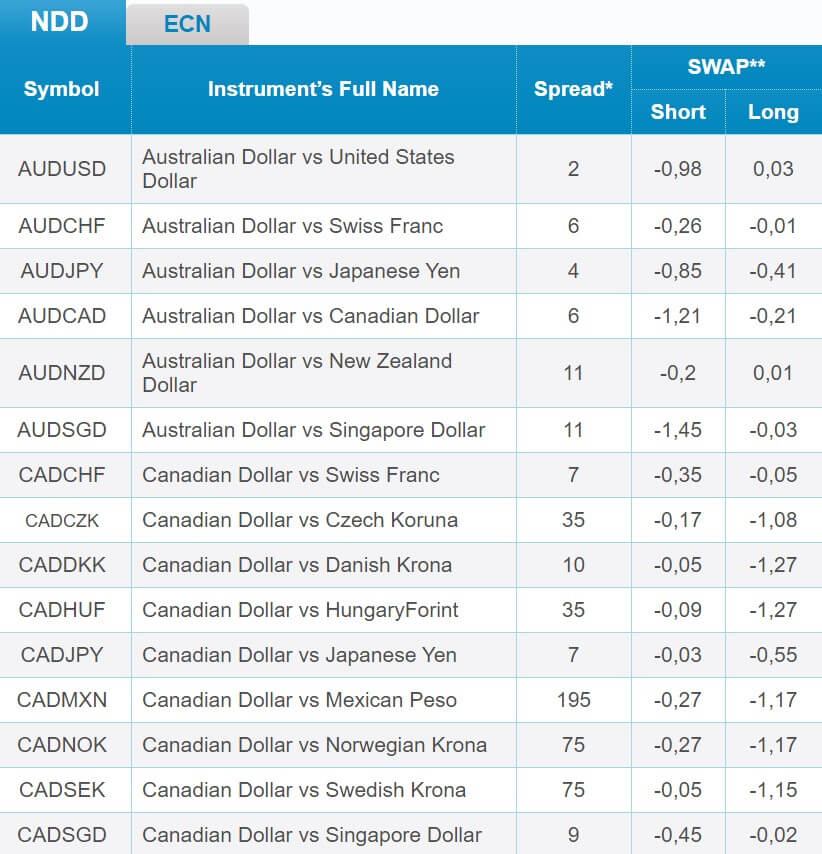

Swap charges are also present on both account types, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice, they can also be viewed on the product specification page of the website.

Assets

There is plenty to trade when it comes to USB Broker, we have broken them down into various categories for an easy understanding of what is on offer.

Forex: Loads of currency pairs on offer including AUDUSD, CADMXN, EURUSD, GBPUSD and, NZDSGD.

Cryptocurrencies: These are marketed as a currency on USB Broker, Bitcoin, Ethereum, and Litecoin are available to trade.

Spot Metals: The usual suspects of Gold and Silver are there along with Platinum and Palladium.

Stock CFDs: Plenty of stocks available including Amazon, Facebook, Tesla, and Coca-Cola.

Commodities Futures CFDs: These include Brent Crude Oil, WTI Crude Oil, Corn, Natural Gas, Soybeans, Sugar and Wheat.

Bonds CFDs: 2 Year Bond US, 5 Year Bond US, 10 Year Bond US and Treasury Bond US are the four bonds available for trading.

Indices: Finally, we come to Indices, Dow Jones, S&P 500, Nasdaq, DAX 30, CAC 40, FTSE 100, and Nikkei are all available for trading.

Spreads

Spreads depend on a few different things, firstly is the account type you are using, if we look at AUDUSD, on the NDD account spreads are fixed at 2 pips, on the ECN account they are floating from 0.1 pips. Floating (or variable spreads means that when the markets are being volatile, the spreads will often be seen higher. Fixed spreads mean that they do not change, no matter what happens in the markets. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like EURCAF may start slightly higher, in this case, 7 pips.

Minimum Deposit

The minimum deposit in order to open up an account is $50, this is relevant for both account types, however, the recommendation is to deposit more. Once an account is open the minimum required for further top-ups is reduced down to just $1.

Deposit Methods & Costs

The following methods are available to deposit with: Bank Wire Transfer, Visa Credit / Debit Card, MasterCards Debit / Credit Card, American Express, MoneyBookers, WebMoney and, Account Transfer. There are no added fees for any of the deposit methods, however, be sure to check with your bank or card issuer to see if they add any fees of their own.

Withdrawal Methods & Costs

There are slightly fewer methods available for withdrawal as USB Broker does not allow you to withdraw from Visa, MasterCard, or American Express, MoneyBookers.

The following methods are allowed: Bank Wire Transfer, Webmoney, Account Transfer.

There are no added fees but once again be sure to check with your bank or card issuer to see if they add any fees of their own.

Withdrawal Processing & Wait Time

USB Broker will aim to process withdrawals within 48 hours, once this is done it will take between 1 to 5 business days for your money to be available to you dependant on your bank or processor.

Bonuses & Promotions

There are a few different promotions and bonuses on offer, so let’s see what they are.

15% on Account Refilling: Receive up to 15% extra in bonus funds every time you deposit, these funds are intended to help you trade and are not withdrawal, however, any profits made using them are fully withdrawable. The bonus stays on the account until it is lost.

30% When Opening An Account: When opening an account you can receive a bonus of 30% as bonus funds. These funds are intended to help you trade and are not withdrawal, however, any profits made using them are fully withdrawable. The bonus stays on the account until it is lost.

There were two other similar offers however they have now expired such as a Christmas bonus.

Educational & Trading Tools

The main tool available is an economic calendar that tells you about upcoming news events and what markets they will affect. Apart from that, there is nothing in terms of education, which is a shame as a lot of brokers are now trying to improve the trading of their clients so it would be nice to see USB Broker follow this trend.

Customer Service

USB Broker offers plenty of ways to get in touch, you can use a number of different email addresses relating to Information, Technical Support, Payment Services, and Employment Services. Ther is also a phone number for their main support line.

There are also phone numbers and addresses for the following locations: New York, Chicago, Pittsburgh, San Francisco, Toronto, Vancouver, London, Norwich, Amsterdam, Copenhagen, Stockholm, Gothenburg, Kaliningrad Sity, Krasnoyarsk, Novosibirsk, and Tyumen.

Demo Account

You are able to open an easy to use demo platform, you are required to download the trading platform and then click on the open demo account tab. You can choose the leverage and account currency but that is it. You are required to use the NDD trading account conditions. You can start getting acquainted with the trading platform, trade tools, and technical analysis tools. Moreover, the training platform will save you at the beginner’s stage from the risks of trading at financial markets with real funds and will help you to hone your trading skills.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

USB Broker offers a couple of different trading environments using different trading architectures, so you can use the one you prefer, the trading conditions are ok, with spreads a little high but nothing crazy and commissions are kept low. Plenty of assets to trade along with some decent bonuses.USB Broker does not seem like the worst place you could choose to trade so the decision is up to you.