Most of the time, when I explain to people what my way of life is, they think that the forex trading I do every day is actually some kind of gambling. There are, after all, some things that are similar, as no trader has a crystal ball to predict how the markets will move. Even so, there are many ways in which forex traders can understand markets and make educated decisions, decisions about their positions. Seeing this, I would like to suggest that before accusing a forex trader of being betting, you should consider how the trader operates and what your long-term goals are.

Coincidences Between Trade and Gambling

Consider some of the coincidences between trading and betting. The most realistic thing is that there is no guaranteed result. In both cases, participants invest their money in the market and expect to make a profit instead of losing. From this point of view, buying the Swiss franc or betting on the outcome of a game is not going to be very different. You win or lose.

A professional poker player and a professional forex trader should accept that it is impossible to predict with certainty the outcome of a bet or trade. In both cases, you put your money at risk in the hope that it will produce a return. Both professionals must understand that losing is part of the afterlife.

To negotiate or to gamble? It is also possible that a “black swan event” occurs in the world of currency trading that has an equivalent in the world of betting. In the world of financial markets, a “black swan event” is a big headline that crosses the wires causing the market to have a very volatile reaction. For example, a headline could appear in which one country is threatening another with military action. This will usually send foreign exchange markets on a wild trip. An example would be when Iraq invaded Kuwait. Not only did it affect currency markets, but it also affected the oil market, as might be expected. In the betting world, a black swan event would be the equivalent of your opponent having four bundles at the poker table, something that can happen but is very rare and will cause many problems.

Finally, a great coincidence between betting and trading is the psychological strength that both activities require. Gamblers and traders must be prepared to deal with losses, such as not overreacting to losses and avoiding over-trading or over-gambling in order to compensate for losses.

Differences Between Trading and Betting

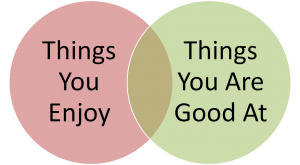

It is obvious that there are many differences between trading and gambling. For beginners, if you are a proficient currency trader you will have a trading system with positive long-term expectations. As a professional trader, you should have tried your trading system, you will know the advantages and disadvantages and you will understand that there are times when you will lose money consistently, but over time you will recover. When it comes to gambling there is less science and much more luck, so your results over time could not be as consistent.

Similarly, if you are a professional trader, understand that there are specific circumstances that make you put money on the market. This is called your trading edge. As a professional trader, you will probably not bother trading in inappropriate circumstances, because you understand that this is not the time when you will make money. In this sense, there is a big difference between trading and betting- trading, when done properly, there has to be some process behind it, while gambling does not have this.

Technical analysis is also a great contributor to the differences between trading and betting, as it can have a battery of indicators or a trading system that gives you a clue as to when conditions might be right. Obviously, it will be a little different in each game, but in general, it is not simply betting on a random result on dice, cards, or the wheel of fortune, in fact, it does not have much to support its thesis, certainly not as much as a financial chart.

Finally, one of the biggest differences between trading and a beginner’s betting is money management. A professional trader will not risk much of his capital on a particular operation, while a novice gambler could bet everything, which is reckless.

Trading is Betting? That’s Up to You

In the end, the answer to this question depends on you. For many novices, trading is betting, because they are carrying out operations based on their emotions and not on analysis. But, as you develop your skills and strategies, there is no doubt that forex trading can become more like a science than luck, separating you from betting in an important way.

Success for both traders and gamblers relies heavily on controlling emotions. But this coincidence doesn’t make them the same. Although there are some correlations, a solid currency trader will feel secure in the science of trading, allowing him to get a “trading edge” that will take him much further than bets could carry him.