The fact that there are approximately 3 billion ounces of fine silver in circulation around the world naturally impacts the way we perceive this commodity. Interestingly enough, gold seems to be much greater in quantity than silver but is, at the same time, much more difficult to obtain. Silver is used in a number of different industries as, as such, is an important commodity for the creation of batteries and medical instruments, among others. This scarcity and ease of access naturally affect its price, demand, and our choice of trading strategies. While there are minor differences between the FX and the XAG markets, trading metals is said to be similar, if not even easier, than trading currencies. Today, we are going to see how we can trade silver, listing all vital pieces of information to help you in the process.

The Metals Market Vs. the Forex Market

Half of all silver, like some other commodities, is completely used up after production. Due to its limited quantity, supply and demand lie in the core of this market, which is also true for stocks and crypto. Unlike metals, the value of currencies revolves neither around traders’ willingness to purchase something at a specific price nor its quantity, at least not for individual traders and investors. While the big banks do sometimes manipulate the prices in the metals market, this is much more visible in the spot forex. As we trade silver against a currency, we need to take a different approach because of their inherent differences. Therefore, the strategies traders use to trade silver cannot completely mirror the ones utilized in trading stocks or currencies.

Half of all silver, like some other commodities, is completely used up after production. Due to its limited quantity, supply and demand lie in the core of this market, which is also true for stocks and crypto. Unlike metals, the value of currencies revolves neither around traders’ willingness to purchase something at a specific price nor its quantity, at least not for individual traders and investors. While the big banks do sometimes manipulate the prices in the metals market, this is much more visible in the spot forex. As we trade silver against a currency, we need to take a different approach because of their inherent differences. Therefore, the strategies traders use to trade silver cannot completely mirror the ones utilized in trading stocks or currencies.

Requirements for Trading Silver

You first need to have a broker who allows spot metals trading. Since brokers who give interest rates for metals are few, finding a broker like that can be more difficult, especially in the US. Still, you do not need to use the same broker for trading currencies and metals. What you should do, however, is open a new account for trading silver.

You first need to have a broker who allows spot metals trading. Since brokers who give interest rates for metals are few, finding a broker like that can be more difficult, especially in the US. Still, you do not need to use the same broker for trading currencies and metals. What you should do, however, is open a new account for trading silver.

Brokers

Different brokers will offer different options, so some may allow you to trade only currencies, while others will only let you trade metals against a few currencies. Oanda is believed to be very useful for educational purposes, while Blueberry Markets is a well-known broker for traders living outside the US. Markets.com, another broker praised for its ease of use, customer service, and safety, offers interest rates for various markets from metals to stocks, commodities, indices, EFTs, and crypto. What is more, not only is Markets.com available on the MT4 and MT5 but it also offers its own trading and charting platform for US citizens. Other alternatives exist with mostly unregulated crypto deposit brokers.

Trading Pairs

Generally speaking, metals can be traded against many different currencies; however, professional traders seem to love the XAG/USD pair. Usually, it is silver that determines the cross’s movement in the chart, but there are some exceptions. For example, if the metal is stagnating, the USD will take over. However, most major USD moves typically end up driving the metal in question. Other combinations include the XAU/XAG. Although there are no strict positive correlations between the two, silver often runs alongside gold.

Generally speaking, metals can be traded against many different currencies; however, professional traders seem to love the XAG/USD pair. Usually, it is silver that determines the cross’s movement in the chart, but there are some exceptions. For example, if the metal is stagnating, the USD will take over. However, most major USD moves typically end up driving the metal in question. Other combinations include the XAU/XAG. Although there are no strict positive correlations between the two, silver often runs alongside gold.

Technical Analysis Specifics

Reversals: While trading reversals are welcome in trading silver, trend trading is still said to be a better approach. Professional traders suggest for the leverage in trading reversals to be lower than for trend trading. However, try not to use outdated and inapplicable tools that would perform poorly in this market, such as calling tops or bottoms. Rather, look for more modern or suitable tools and instruments and test their performance.

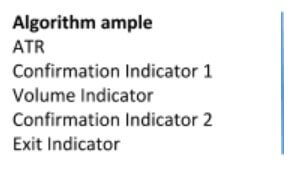

Algorithm: The algorithm for trading currencies and silver could be the same. The algorithm below is an example of what you can use for trading silver. Make sure you use different indicators that work better with precious metals. Naturally, you should test out everything and make choices based on what suits you best. For example, your confirmation and exit indicators may differ from the ones you used for trading currencies.

Algorithm: The algorithm for trading currencies and silver could be the same. The algorithm below is an example of what you can use for trading silver. Make sure you use different indicators that work better with precious metals. Naturally, you should test out everything and make choices based on what suits you best. For example, your confirmation and exit indicators may differ from the ones you used for trading currencies.

ATR: Any forex trader might immediately notice how metal pairs exhibit really high ATR levels and daily volatility, but with proper risk management, any trader should be able to manage this fast-moving commodity successfully.

Spreads: Spreads for the metals market are higher than what you may find elsewhere, but this should not be a cause of concern.

Spreads: Spreads for the metals market are higher than what you may find elsewhere, but this should not be a cause of concern.

Volume indicator: Similar to continuation trades in forex, if the overall trend is long and you get a long signal, you can still enter the trade even if your volume indicator seems to disagree. However, professionals recommend that you listen to your volume indicator in all counter-trend and reversal trades.

Sentiment indicators: While chasing sentiment is a bad idea in the world of forex, it may be applicable to trading silver in specific cases. For example, if you see a major discrepancy between traders who go long and the ones that go short, which did happen in the past, do not do what the majority does. Analyze this ratio and see if there is room for you to go short or long.

News: Luckily, with trading silver, you should only worry about the news events concerning the other half of the pair (e.g. USD interest rates and elections).

News: Luckily, with trading silver, you should only worry about the news events concerning the other half of the pair (e.g. USD interest rates and elections).

Strategy: Owing to its nature, most traders want to buy and hold silver. Not only is this approach a secure way to protect one’s finances in general but it is also a great way to stay on top during economic downturns. Holding precious metals long term is also a perfect hedge against inflation and currency wars.

Anyone interested in trading the XAG should know that it takes time to start earning money in this market. However, you should also bear in mind that the wealthiest silver traders actively trade spot metals. While silver might be a new source of income for you, you may also consider expanding your portfolio to other metals because of the financial rewards. For example, trading fewer metals pairs can prove to be equally beneficial to trading all 28 major currency pairs. If you are already getting good results in spot forex, why not add on and double your return? Finally, remember not to give in to the ease of trading silver because using risk management, money management, and psychology tips you used in currency trading and investing are equally important here. Carry out testing as you would normally do for your forex algorithm and currency pairs and then fully enjoy the benefits this market has to offer.