Scoring system is a tool some professional traders use for decision making for their trades. A lot of factors are accounted for in the system eventually producing a score for a particular asset. Based on these scores traders know where opportunities are, effectively cutting down false signals of any trading system you may have developed. The Scoring system should tell you the best currency pairs to search for strong, emerging trends. And we all know by now that trend following is scientifically proven as the most probable method for a winning trade. Of course, some market environments ask for a strategy switch but the Scoring system is all about guiding you to fertile lands.

Prop firms like to use hunting analogies for this system. Hunters first need to do some research before they start hunting for a game. They first need to know where to go, which location for finding the game is most probable. What weapons to carry, what time of day is good, how to spot trails, and so on. Once the hunter is positioned he will find a bunch of other animals that are not particularly interesting. A hunter/trader will need to wait patiently for the game to show up. It comes down to pull the trigger only when we assess the conditions, the signal, and put our capital at risk for that high probability trade.

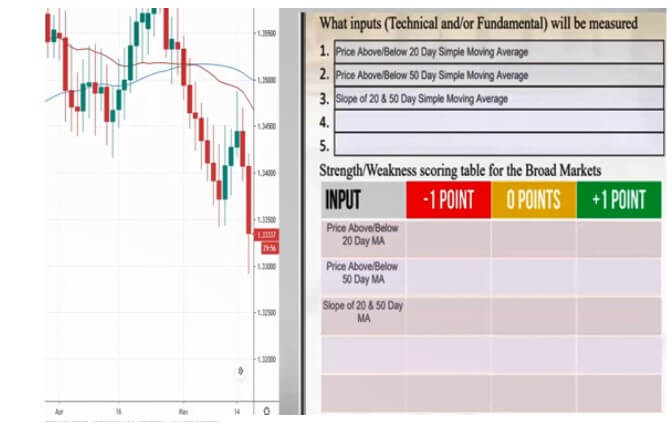

The Scoring system will need some input. Giving a particular currency a score of -1 or +1 will have to depend on some analysis, be in indicators, or some other fundamental factor you think is relevant for your trading or asset (trading session, for example). Once you have your symbol picks and analysis set, the final scores for each asset are compared, thus giving you an overview of where to place your trades. Now, you should have a trading system in place for trade entry confirmation, exit, and so on, Scoring system is just a first step so you do not search for signals at the wrong place/asset.

The Scoring system should rank your trading assets or currencies as weak, neutral, and strong. Sometimes, you will not have particularly weak or strong currencies. The scoring system is there to tell you that even if you have a signal from your trading system, that currency pair does not contain weak and strong currency but maybe ranging ones. This is not a high percentage trade, you may easily find out that the signal was a false breakout or just a temporary move. What a trader wants to find is a strong currency against a weak one and vice versa. Pairing these currencies carries the best opportunity and minimized risk it is a false signal you have found in your trading system.

Now, once you know where to look, how do you find weak and strong currencies? While some traders think your trading system should have enough filters so you know the right currency pairs to trade even without the Scoring system, prop firms usually have a Scoring system using currency baskets as well. This may mean less trading frequency as an additional element is used but high-quality decisions are what differentiates pros from others. Currency baskets or Indexes give us chart representation of how strong a currency is compared to other major 7 currencies. Currency baskets are easily built on tradingview.com but there are also indicators built for Metatrader platforms, although they are not that common. Some brokers may offer Dollar or Euro Index symbols but other currencies like the AUD or GBP Indexes are not offered. It is important to know when we build the baskets, equal weight should be accounted for each currency. EUR basket formula below should give you an idea of how to make for the other 7 major currencies.

Note that in some cases you will need to enter non-standard pairs like NZD/EUR to have a correct ratio for the index calculation and also pay attention to the JPY decimals as they are not as other currencies with 4 or 5 decimal presentation.

Prop firms advice to look at the bigger picture. Let’s say you are on the battlefield with thousands of participants, if you are a single soldier, you cannot see planes, warships, or artillery far away from your sight but they have an immense contribution to the battle outcome. As a trader, you need to see these factors by looking at two steps higher time frames from your target timeframe. If your system is giving a signal on a 1-hour timeframe, take a look at the daily. By doing this to each currency basket, for example, you may see your signal might be just an emerging correction of a larger trend and thus your probabilities of a winning trade are reduced since you are going against a major trend on a higher timeframe. Again, since the trend following method is considered the best, you want to have your trades aligned with the major trend direction. As a general view, a daily time frame gives you long term trends, 4H is intermediate and 1H is a short time overview of trends. Of course, you can find trends in every timeframe, but it is imperative your trades belong to a higher timeframe trend direction. When all timeframes, your target timeframe, and two steps higher are aligned, your odds are increased.

This is a simple guide on how to find the best trades. On some occasions, you may find a one-time frame is not aligned with the other two, and it does not mean you should not take the trade. Reversal patterns are most successful in the intermediate time frame, for example. At this point, if you have a system in place for reversal strategies, you may look out for a major trend continuation setup on 4H when your target hourly time frame and long term timeframe are aligned. It is likely the 4H timeframe will also get aligned to the major trend and a trader can take this trade even if it is not strictly by the rules. There are also exceptions on the target timeframe but prop firms emphasize all timeframes alignment conditions on the bullish or bearish trend for the best trade setups.

Trader’s patience is tested at this point. Waiting for all timeframe alignment means fewer trades and less exciting trading. Know that forex changes and this alignment is not going to happen, you may feel you missed your shot. Fear of missing out is another enemy of profitable trading in tandem with impatience. As with hunting, the best game is usually not in plain sight the moment we are in position. The experience will always remind us and motivate us to wait, alas experience requires trial and error many times. To sum up, small major trend continuation trades are the best practice according to professionals.

The Scoring system will have a set of measures based on which scores are made. If you are new to trading, start with simple measures and score range. Experienced traders already have a system they are accustomed to. Once you implement a scoring system, forget about all other info. Let’s say you have a signal on your MACD and the price is above your MAs. All is set up for a trade entry but you find out about a news report on Bloomberg tv that puts doubt in your decision. Waiting out might seem to be the right choice here but know there will always be some info for and against your decision. Put aside your thinking and feelings and just go with your system. When you set a +1 point if your MACD signals a long trade, +1 for MAs and +1 for other studies like Price Action pattern, agree you are looking at a bullish currency trend. Find a weak basket and look for that currency pair. Nothing else matters, keep it simple.

Now, here is an example of how to build a Scoring system. Start with a set of indicators or fundamental analysis you will measure. Each will give you a bullish or bearish score you can mark in your table.

Daily charts are considered as the best to start from to gauge trends. Start the scoring from this point. Applying this on a currency basket you determine which currency is weak, neutral, or strong against other major 7. Whatever you may think about this currency or political opinion about the country using it, is irrelevant. Know that you can win a trade even when your favorite team, company, or political party is losing. You may love your iPhone but know Apple Inc stocks are not always bullish, the score might be giving you -3 points. Separating your opinion from your trades will only provide you with more pips from your trading. Your Scoring could have more points and more inputs, it is up to the trader how many factors are accounted for. Setting up your rules based on scores is also subjective but know the point is to trade the strongest against the weak and vice versa. Testing your rules and the Scoring and trading system synergy is a must. Confirming your systems work can only be done by putting them in demo practice after backtesting.

The Scoring system makes finding the best trades easy. Interestingly few traders actually do it. It may be because basket or currency indexes are not a common sight. Making one in the TradingView platform is possible but we have found out the formula is not easily found. Most new traders to this free platform do not even know they can customize the chart presentation with different formulas, let alone create a basket currency formula. Metatrader platform is known as customizable with thousands of free indicators, yet index currency calculation indicators are not numerous. Some forums mention basket trading yet the topics are not extensively developed. So a trader without the tips found in this article may even just rely on this, non-basket trading setup which is generating more false signals. Traders without the Scoring system will more often than not trade currency pairs without strong or longer trends, regretting they had not taken that other cross currency. It may be somewhat hidden knowledge, but traders that try new things, who are curious, not conservative, will find about this sooner or later. This points to another key trait a trader needs to have a relentless hunt to improve the system.

To wrap up, the Scoring system is there to point you in the right market. Choose your timeframe, align the trend with 2 higher time frames, and look for continuation setups. If you are new you may not know your preferred time frame. This decision will have to be made according to your personality, needs, risk tolerance, and other factors. Try completing the trader personality test to know your pros and cons. Create your inputs for the scoring and sum up what currency is strong, neutral, and weak. Go trade the crosses with the biggest score differential. Now your trading system is put to work, combining the Scoring system result with your set of entry, exit, position management, and ranging filter indicators creates high probability trading setups. All you need to do is follow this checklist. Following simple rules seem to be, interestingly, the hardest thing to do.