Many people think of trading as a giant single entity that comprises Forex, Indices, Metals, Stocks, and more, when in reality each of the elements within the idea of trading is completely separate. Forex and stocks as an example are often thrown into the same bucket, but there are a lot of differences between them. In fact, the only similarity between them is that you are buying or selling them, pretty much that is it, everything else has differences. Some differences are large, others are quite small, but they are there. We are going to be looking at the differences between trading forex and trading stocks, there are a lot so we may not go over all of them, but you will surely get the idea that they are quite different beasts.

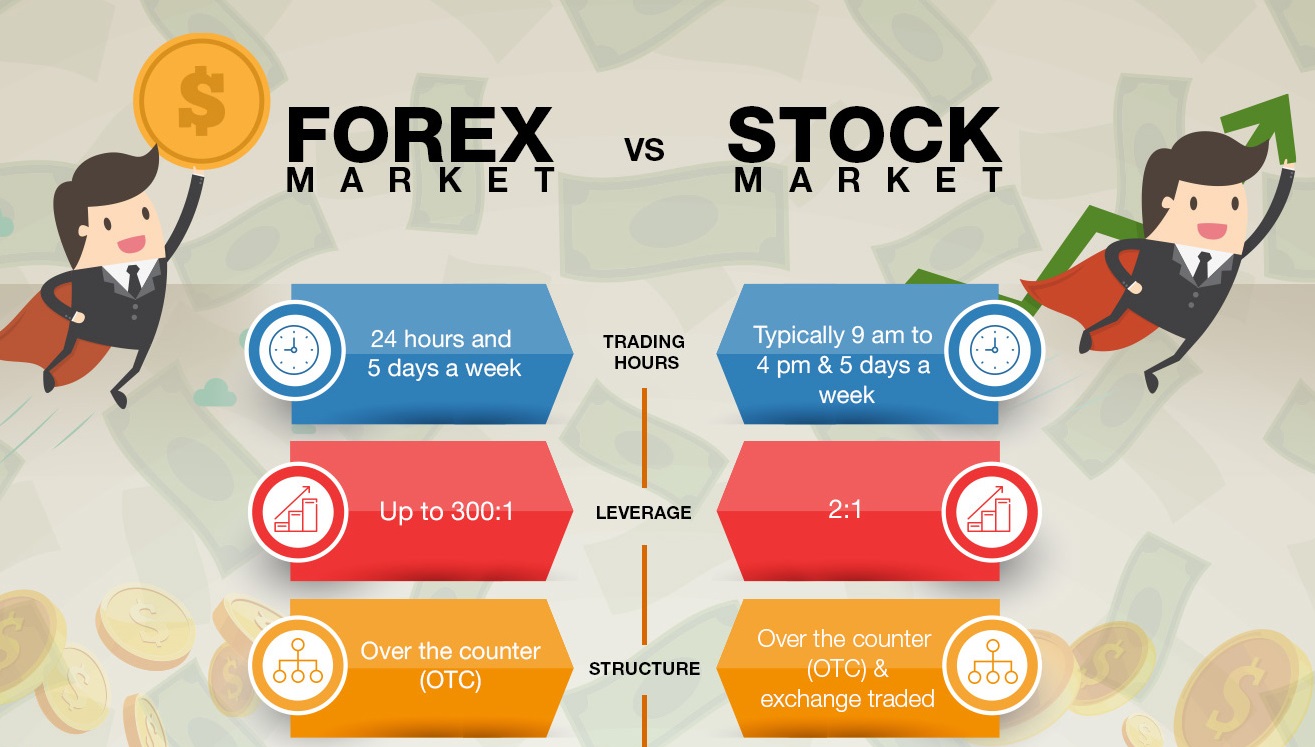

The first difference is the opening times of the markets, the time that the markets are open and you are able to place new trades. The forex markets are open 24 hours a day 6 days a week, only closing over the weekend and on certain holidays. This makes it hugely accessible, able to trade from anywhere in the world and at pretty much any time that you want. Share and stock trading are a little bit different, the trading times for stocks are often linked with the opening times of whichever particular exchange that the stocks listed on. These often close in the evening and open again in the morning, meaning that you are limited to trading during the day, extended hours are coming into play that allows you to trade outside these hours, but otherwise, you are more limited in the time that you can trade when trading stocks over forex.

Another major difference is the liquidity in the markets. Liquidity for those that do not know is about how easy it is to place trades, how much money is going through the markets at any one time. The forex markets are the most liquid in the world with over $5 trillion being traded each day. This makes it incredibly easy to put on trades. No matter the size of your trade, you will be able to put it on almost instantly without any issues. When it comes to stocks, there is a considerably lower number when it comes to the amount of money being traded and there are far fewer trades being made each day. Certain stocks like Facebook or Apple will have a lot more trades occurring each day, but other smaller companies will have far fewer which can make it a little harder to trade with potential delays on each transaction.

Volatility is a major difference, the forex markets are known for their volatility, their ability to move and to move a lot, this is where the profit potential comes from, but also the risks. There can be huge movements up and down, it can also move quickly. When it comes to the stock market, the volatility of the markets and the movement are often far more stable than when it comes to forex. This means that there is far more profit potential when it comes to trading forex, but if you are looking for a more stable and safer trading experience then stocks may well be the better option for you.

When it comes to trading, you have probably heard about leverage, this is the ability to kind of borrow money from the broker that you are using in order to trade with larger trade sizes than your account would otherwise allow. Forex is full of leverage, in fact, some brokers are offering as high as 2000:1 when it comes to leverage, which is incredibly high, a little too high. This does, however, give you the ability to make a lot more money than you otherwise would have been able to, it does of course also increase the risk and potential losses at the same time. When it comes to stocks, there are actually some brokers that are offering leverage on stocks, but it is far lower, normally not any higher than 10:1 if even that high. This means that the profit potential is limited when you compare it to forex trading. Many brokers offer no leverage at all when it comes to stocks, so the money that you have in your account is all that you have to trade with, some would argue that this is the best way of trading and the safest way.

The last difference that we will be looking at is the types of trades that you have., When it comes to forex, you can buy or sell, you are able to profit on the markets moving both up and down, it doesn’t matter, you do not have the physical asset so you are simply speculating on the price movements. When it comes to stocks, traditionally, you could only profit when the price rises, buying low and selling high. This has changed slightly these days, with the ability to treat them more like stocks, but you will need to find the right broker that lets you both profit on the buys and sells.

So those are some of the differences when it comes to trading forex and stocks. There are a lot of similarities between them in regards to the way that they are traded, and the opportunities that they give you, but there are a lot of differences. If you are looking for a faster-moving and more volatile trading experience then you would need to look at trading forex due to the volatility, liquidity, and leverage that is on offer. If you are looking for a more stable, slow-moving, and far safer trading experience then stock trading would be the right way for you to go. Of course, would then be limited to trading at specific times when the markets are open. Whatever you choose, you can also diversify and trade both, giving you the best of both worlds.