The safe-haven-metal prices failed to stop its previous day losing streak and dropped to $1,725.96 while representing 0.12% losses on the day as the US President Donald Trump did not use military power to stop the riots which fueled the risk-on market sentiment and pushed investors to withdraw their money from the safe-haven assets.

The reason for the risk-on market sentiment could also be attributed to the slight optimism surrounding the coronavirus vaccine and the hopes of the economic restart, which also exerted some downside pressure on the yellow metal. The gold is currently trading at 1,726.49 and consolidating in the range between 1,721.04 and 1,732.12.

The tensions in the United States are showing the sign of slowing down mainly after the news that US President Donald Trump’s stepped back from its previous day’s decision to use Federal militaries to stop the on-going protests near White house, which eventually boosted the risk-on market sentiment. Moreover, the risk-on tone was further bolstered by the key US medical officer’s cautious optimism regarding the coronavirus (COVID-19) vaccine. As a result, the US 10-year Treasury yields gain 1.8 basis points (bps) to 0.697% while stocks in Japan, Australia, and China also report gains.

Looking forward, the market participants will keep their eyes on the US ISM Non-Manufacturing PMI, Factory Orders, and ADP Employment Change data. The US-China tussle and protest updates will not lose their importance.

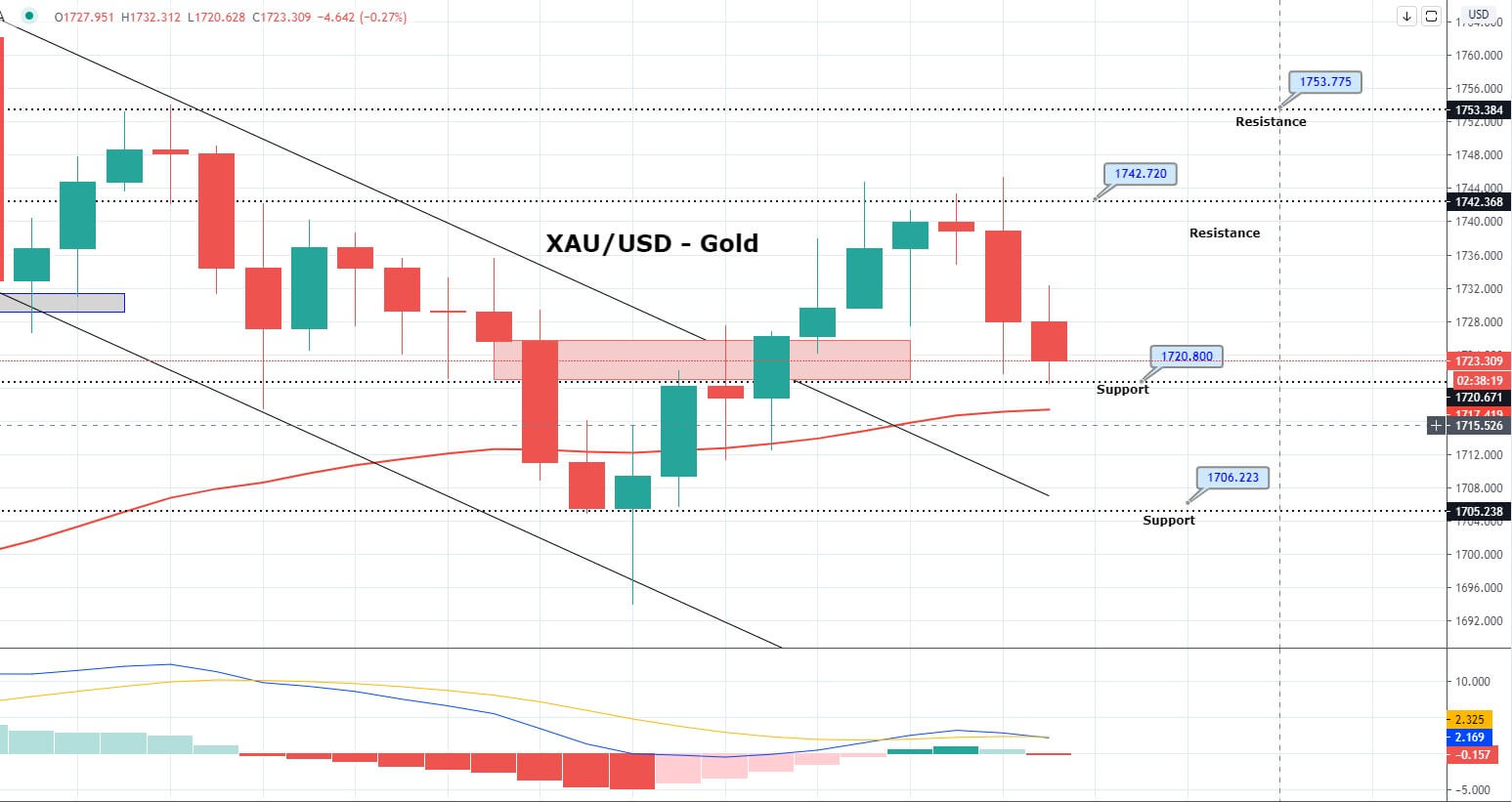

Gold is still consolidating in a sloping trading area of 1,743 – 1,724, though it’s facing a hard time to violate beneath 1,724 level to touch 1,714 level. Closing of candles beneath 1,724 level today can force selling bias unto 1,717 and 1,714, particularly on the announcement of better than expected ADP non-farm payroll from the USA while resistance exists at 1,729 today.

Entry Price – Sell 1721.44

Stop Loss – 1727.44

Take Profit – 1715.44

Risk to Reward – 1.00

Profit & Loss Per Standard Lot = -$600/ +$600

Profit & Loss Per Micro Lot = -$60/ +$60