During Friday’s Asian trading session, the safe-haven-metal failed to extend its previous-day winning streak and drew some offers near the $1,860 level as the Biden administration’s plans of huge spending to stimulate the U.S. economy undermined the safe-haven yellow-metal prices aggressively. It is worth recalling that the yellow metal refreshed a 2-week high on the previous day amid the weaker U.S. dollar, but the upticks were short-lived and temporary as the stimulus hopes and upbeat U.S. jobs data started to probe the gold bulls afterward. Besides this, the optimism over a possible coronavirus vaccine also played its major role in weakening the safe-haven yellow-metal prices.

On the different page, the downbeat comments from U.S. President Joe Biden over the coronavirus condition, as well as the recently appointed US Centers for Disease Control and Prevention (CDC) Director’s fresh doubts over the availability of vaccines, were seen as the key factors that could help the yellow-metal prices to limit its deeper losses. Meanwhile, the heightened trade/political war between the U.S. and China could also play its positive role in supporting the safe-haven yellow metal.

Across the pond, the broad-based U.S. dollar bearish bias, triggered by the prospects of massive fiscal spending in the U.S., was also seen as one of the key factors that cap losses for the yellow metal as the price of gold is inversely related to the price of the U.S. dollar. As of writing, the yellow metal prices are currently trading at 1,862.74 and consolidates in the range between the 1,860.15 – 1,870.87.

Looking forward, the market traders will keep their eyes on preliminary readings of January’s activity numbers from the U.K., the U.S., and Europe for fresh directions. In addition to this, the updates about the U.S. stimulus package will also be key to watch.

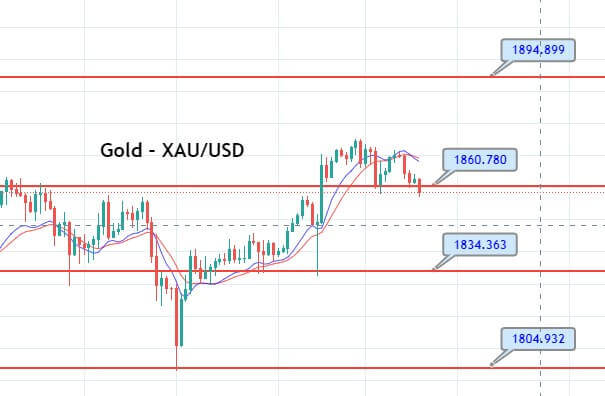

Daily Support and Resistance

S1 1834.44

S2 1851.21

S3 1860.76

Pivot Point 1867.99

R1 1877.54

R2 1884.76

R3 1901.54

Entry Price – Sell 1857.76

Stop Loss – 1863.76

Take Profit – 1850.26

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US