The safe-haven-metal prices extended its 4-day winning streak and rose to the fresh 7.5-year high of $1,760 level since November 2012 while representing 0.90% on the day, although the Federal Reserve’s President Jerome Powell rejected negative rate once again. However, the reason for the gold upticks could be attributed to the renewed tension between the US-China trade tussle. Whereas, the dollar index, which tracks the value of the greenback (gold’s biggest nemesis) against majors, is also sidelined near 100.34. At this moment, the yellow-metal prices are currently trading at 1,761.78 and consolidate in the range between the 1,743.02 – 1,764.73.

The central bank repeatedly showed disagreeability to using negative interest rates to respond to the economic impact of the coronavirus pandemic, Federal Reserve’s President Jerome Powell said CBS during a 60-minute interview held over the weekend.

Despite this, the gold rose to multi-month highs mainly due to the White House trade advisor Peter Navarro said during his this week interview that China sent hundreds of thousands of passengers on aircraft to Milan, New York and around the world through planning to spread the virus after hiding it from all over the world for almost 2-months.

In the meantime, the reasons for the intensified trade tension could also be attributed to the statement to blocking chip supplies to Huawei Technologies. On the other hand, the uptick in the stocks, which usually have an inverse relationship with gold, also failed to erase gains in yellow-metal.

Whereas, the Federal Reserve Chair Powell said that both the Central bank and Congress should help the economy recover from the virus outbreak recession. As markets were pricing negative rates earlier this month, President Trump called them a gift enjoyed by other countries. However, Powell destroyed expectations for negative rates on Wednesday. Elsewhere, Bank of England (BOE) Governor Andrew Bailey and Bank of Japan (BOJ) Governor Haruhiko Kuroda on Thursday hinted that their focus is on bond purchases and other lending programs to keep borrowing costs low and recover the economy from the virus outbreak recession crisis.

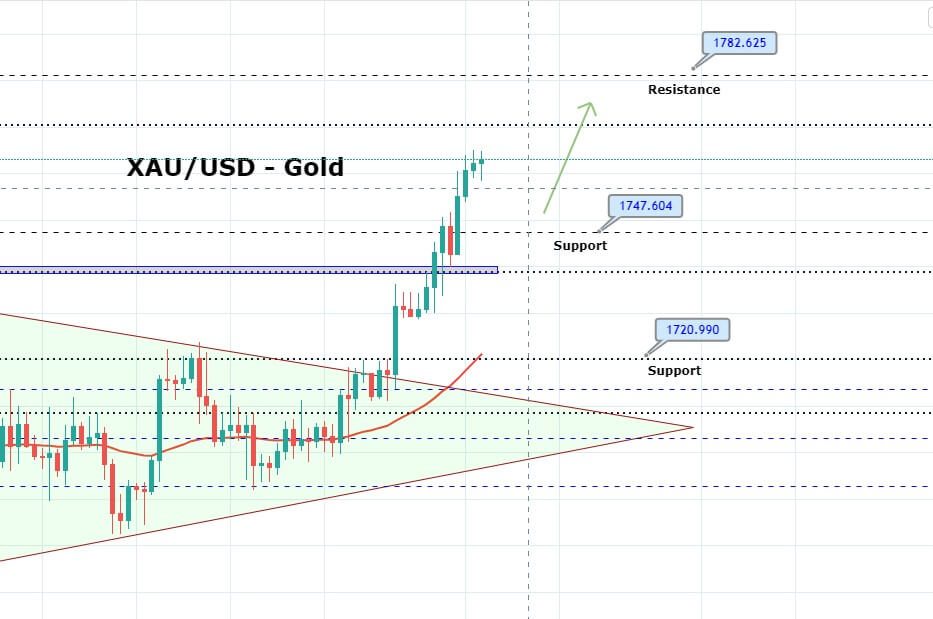

Gold – Technical Outlook

Support Resistance

1758.2 1771.4

1750 1776.4

1745 1784.6

Pivot Point 1763.2

Gold prices continue to trade on a bullish run, and it seems to head towards the next resistance level of 1,770. Overall this marks a 138.2% Fibonacci retracement level, which holds around 1,780 level. On the lower side, the precious metal gold may find support at 1,756 area and 1,738 area while the continuation of a bullish trend may lead to gold prices towards previously suggested target levels of 1,770. The 50 EMA and MACD both are supporting bullish bias for gold. Let’s keep an eye on 1,763 now to stay bearish below and bullish above this level. Good luck!