If you are operating in the commodity market, you need to have an idea of the structure and dynamics of the supply and demand of the assets. Oil is a typical example, which is rapidly recovering lost positions, thanks to the growth prospects of global demand and the contraction of the surplus in the midst of the opening of the major world economies. Unlike Brent and WTI, gold is less sensitive to the conjuncture of the physical asset market, but at any time it can punish a trader who ignores the fundamentals.

Global demand for precious metals is dominated by jewelry and investment, which accounted for 48.5% and 29.2% in 2019. The share of gold purchased by central banks was 14.8% and the share of its use in the industry was 7.5%. The last indicator is very important. The fact is that silver is considerably higher, and the closure of industrial plants due to the pandemic caused the faster sinking of XAG/USD compared to XAU/USD. As a result, the ratio of the two metals plummeted to historic highs. It is logical that in conditions of recovery of the world economy it makes sense to expect a reduction of the coefficient, that is, to bet on a faster growth of silver compared to gold.

In the first quarter, the share of investments in the structure of global demand for precious metals increased to 49.8%, while jewelry shops fell to 30.1%. Gold consumption contracted in almost all areas compared to October-December and January-March 2019, with the exception of ETF and coins.

Changing the structure of demand is an important point for pricing. When this happens, we can talk about the stability of the existing trend. The shift from jewelry to investment is a sure sign that bulls dominate the market. Jewelry is too expensive, leading to a reduction in its consumption. On the contrary, the faster the stock of specialized funds traded on the stock exchange grows, the higher the stock price will be and the greater the army of buyers will be. Sometimes, in the context of an upward trend, gold is said to flow from east to west. In fact, the share of China and India in the consumption of precious metals in the jewelry industry in 2019 was 67%, while the main ETFs are located in the United States (including the largest fund SPDR Gold Shares) and in Europe.

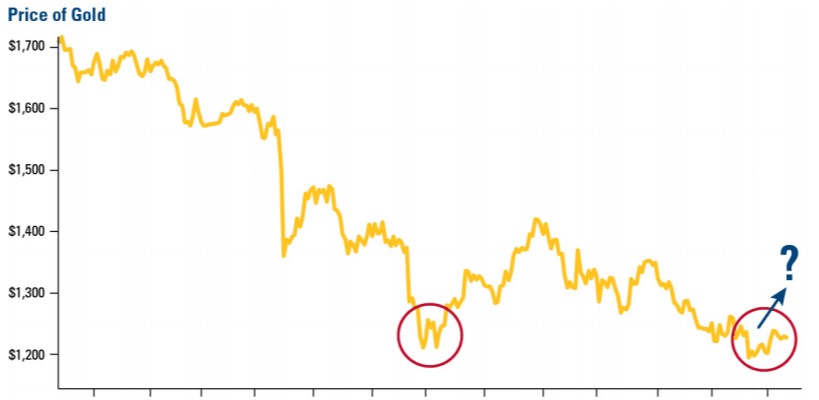

The main gold producers are China (404.1 tonnes), Australia (314.9 tonnes), Russia (297.3 tonnes), the United States (221.7 tonnes), and other countries. The impact of supply on price is limited. A typical example is 2013. Then many said that XAU/USD quotes will not fall below $1300-1350 per ounce, as this is where the equilibrium point of the mining companies lies. They say they will reduce production, leading to shortages and higher prices. In fact, existing hedging technologies allow companies to price and continue production at the same volumes. The gold fell considerably, punishing buyers for themselves.

But, it is necessary to know the offer completely. In 2020, amid the pandemic and company shutdown, investors felt a severe lack of physical assets in the negotiation of forward contracts, leading to increased trading premiums in the United States and Europe, contributing to the increase in XAU/USD contributions.

Therefore, the most important element in the pricing of precious metals is the demand for investment, the value of which, in the first place, is influenced by the monetary policy of central banks. Large-scale monetary expansion contributes to the weakening of the world’s major currencies, falling bond yields, and rising XAU/USD rates.