Description

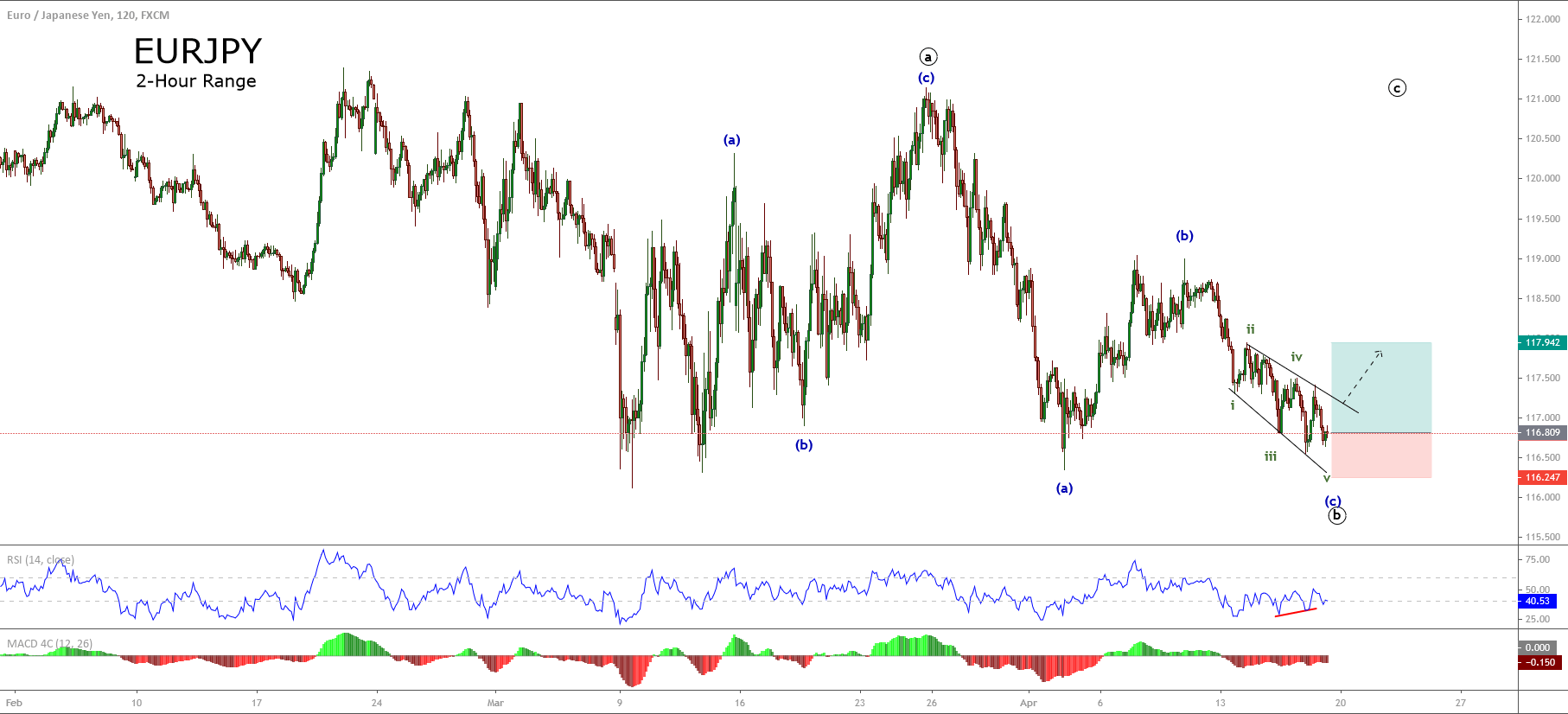

EURJPY, in its 2-hour chart, shows the completion of second bearish move corresponding to a wave ((b)) of Minute degree identified in black.

The short-term Elliott wave structure calls for the completion of a wave (c) labeled in blue, which corresponds to an Ending Diagonal pattern. At the same time, its internal sequence shows that the EURJPY cross moves in its fifth inner segment.

On the other hand, the expected weakness in the Japanese currency could be accompanied by the current risk-on sentiment in the stock market.

The next path after the bearish sequence completion, the cross should begin an upward sequence corresponding to wave ((c)) in black, which in our conservative scenario could reach the end of the second wave of Subminuette degree in green at level 117.942.

The level that invalidates our bullish scenario locates at 116.247.

Chart

Trading Plan Summary

- Entry Level: 116.806

- Protective Stop: 116.247

- Profit Target: 117.942

- Risk/Reward Ratio: 2.02

- Position Size: 0.01 lot per $1,000 in account.