The EUR/JPY currency pair failed to stop its early-day losing streak and still flashing red around below 124.50 level mainly due to the intensifying coronavirus cases across Eurozone and lockdown restrictions in France and Germany, which keep fueling the worries over the Eurozone economic recovery and undermines the shared currency. These concerns got further lifted after the German Economic Minister Peter Altmaier said that COVID-19 infection numbers are still much too high in most regions, which adds further burden around the shared currency and contributes to the currency pair losses.

Across the pond, the prevalent optimism over a potential vaccine for the highly dangerous coronavirus infection urges investors to retreat from the safe-haven Japanese yen, which could be considered one of the key factors that help the currency pair to limit its deeper losses.

In the meantime, the Japanese Finance Minister Taro Aso said that the Japanese economy remains severe due to the COVID-19 virus, which added further burden around the Japanese yen and becomes the key factor that kept the lid on any additional losses in the currency pair. At this moment, the USD/CHF currency pair is currently trading at 0.9029 and consolidating in the range between 124.31 – 124.67

It is worth recalling that the prevalent optimism over a possible vaccine for the highly infectious coronavirus disease keeps boosting the market risk tone. However, the hopes of the vaccine were boosted after pharmaceutical regulators from the US, Europe, and the UK showed readiness for approving the leading vaccines that have shown almost 90% effective rates during the final rates, which in turn, boosted the hopes of the early arrival of the much-awaited cure to the pandemic. Thereby, the risk-on market mood tends to undermine the safe-haven Japanese yen, which becomes the key factor that lends some support to the currency pair to ease the intraday bearish pressure surrounding the EUR/PY currency pair.

On the other side, the rising coronavirus cases across Eurozone and back-to-back lockdown restrictions in Germany and Franc keep the shared currency under pressure. As per the latest report, German Economic Minister Peter Altmaier said that the COVID-19 infection numbers are still much too high in most regions, putting further pressure around the single currency and contributing to the currency pair declines.

On the contrary, the intensifying market worries regarding the continuous surge in new coronavirus cases in the US and Europe, which keep fueling the concerns over the global economic recovery through imposing new lockdown restrictions on economic and social activity, keep trying to probe the upbeat market performance. Apart from this, the long-lasting inability to pass the US fiscal package and the uncertainty over Brexit, and fears of a full-fledged trade/political war between the West and China also challenging the market risk-on mood, which might push the currency pair further down.

In the absence of significant data/events on the day, the market traders will keep their eyes on the US NFP data, which is due later this week. In addition to this, the updates about the US stimulus package will also be key to watch. In the meantime, the risk catalyst like geopolitics and the virus woes, not to forget the Brexit, will also be key to watch for a fresh direction.

Daily Support and Resistance

S1 122.99

S2 123.66

S3 124.09

Pivot Point 124.33

R1 124.76

R2 125

R3 125.66

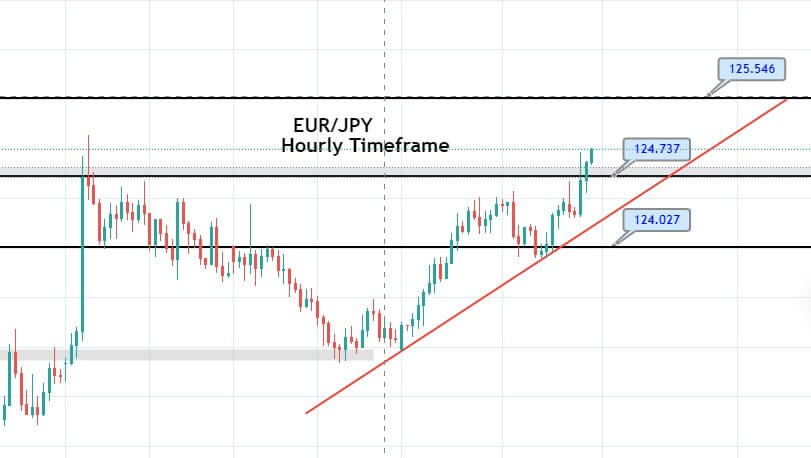

The EURJPY has violated the triple top resistance level of 124.730 level and above this it has strong odds of soaring until 125.450. Thus, we have entered the buying trade to capture quick green pips in the market.

Entry Price – Buy 124.932

Stop Loss – 124.532

Take Profit – 125.332

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US