Q8 Trade is an established brand in the Middle-East and North Africa region, with goals of future expansion. Since being launched in 2017, the company has managed to attract a growing client base, while offering tier-level accounts and access to FX pairs and CFDs on American stocks, indices, and commodities. Beginners will likely find the broker’s education section to be highly attractive, although it would be important to take a look at the cost of trading and other details before making the decision to open an account. We’ve done all the work for our readers, so stay with us to find out all the facts.

Account Types

Q8 Trade offers five tier-based account types: Bronze, Silver, Gold, Platinum, and Diamond. Instead of choosing an account at registration, traders are placed into a category based on the size of their initial deposit. The broker also features special Islamic accounts of each status level that allow users to open positions 100% interest-free. As one raises to higher account levels, trading costs are reduced, bonus percentages are increased, and extra perks, like a direct phone line to customer support and an account manager, are added. We’ve provided an overview of each account type below.

Bronze Account

- Minimum Deposit: $250 – $999 USD

- Leverage: Up to 1:400

- Spread: From 3 pips

- Commission: None

Silver Account

- Minimum Deposit: $1,000 – $9,999 USD

- Leverage: Up to 1:400

- Spread: From 3 pips

- Commission: None

Gold Account

- Minimum Deposit: $10,000 – $49,000 USD

- Leverage: Up to 1:400

- Spread: From 2 pips

- Commission: None

Platinum Account

- Minimum Deposit: $50,000 – $249,999 USD

- Leverage: Up to 1:400

- Spread: From 1.5 pips

- Commission: None

Diamond Account

- Minimum Deposit: $250,000+

- Leverage: Up to 1:400

- Spread: NA

- Commission: None

Platform

Many traders will recognize the broker’s featured trading platform, MetaTrader 5. Offered slightly less common than its predecessor MT4, MT5 is a newer version of the timeless classic that has made some improvements, which come in the form of additional pending order types, more timeframes, languages, analytical objects, an economic calendar, and other added features.

Following in MT4’s footsteps, the platform focuses on providing a user-friendly interface that can be learned easily by beginners. Traders that are used to MT4 may be disappointed to see that it is not available as well, but most should find MT5 to be a suitable option. MT5 also supports a Trading Central plugin that is available to everyone who has made a deposit of at least $5,000 USD into their trading account and can be accessed on the web or downloaded on PC and mobile devices.

Leverage

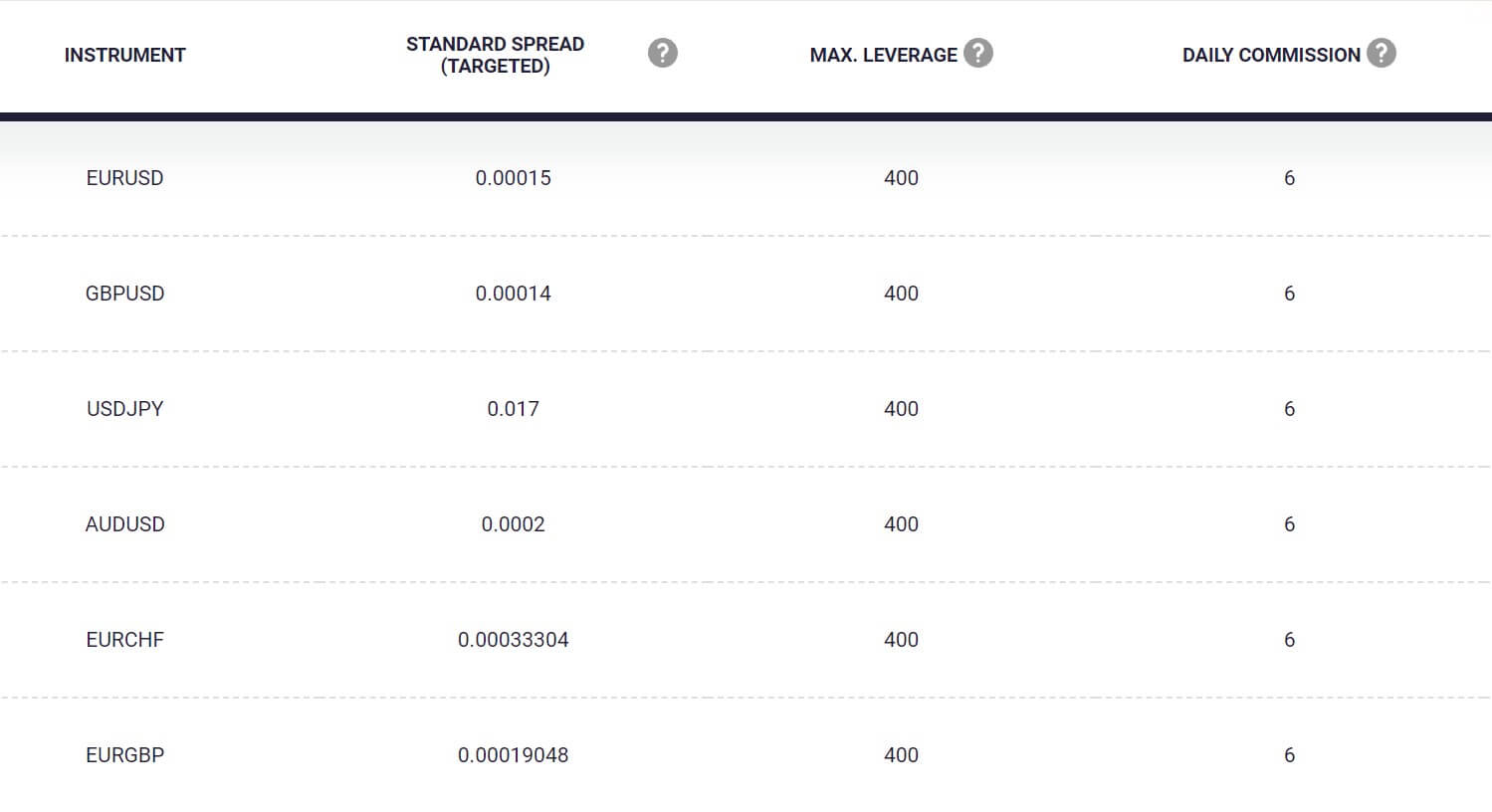

In place of offering specific leverages for each account level, the broker sets their leverage caps based on the instruments in question. This allows traders with higher equity to access especially high options that aren’t easily available elsewhere. On most of the FX pairs, the limit is set at 1:400 – some regulators actually restrict leverage to around 1:30 on majors, making this an ideal offer. Note that some exotic pairs have a lower limit in place, for example, 1:50 is the maximum on EURTRY and USDTRY. The standard leverage cap is lowered to 1:100 on commodities and indices and 1:10 on stocks.

Trade Sizes

Q8 Trade requires a minimum trade size of one mini lot (0.1) on all FX pairs, commodities, and stocks. When trading indices, the minimum size is raised to 0.2 lots. On accounts with fixed spreads, the minimum position size is pushed to 0.5 lots on all instruments. Scalping is allowed and traders can even speak with a scalping representative for more guidance.

Trading Costs

Applicable charges would come in the form of spreads, swaps, and inactivity fees. Q8 Trade explains that unlike traditional investment service providers, they do not charge commissions on trades, and instead profit solely from spreads. Many traders prefer this price model for the simple fact that it is easier to keep up with the cost of placing a trade, although this does cause spreads to be slightly higher. Islamic account holders are exempt from swaps unless a trade is kept open for 10 calendar days.

The broker also charges inactivity fees, which is a common practice for a broker that doesn’t charge commissions. On the upside, accounts can be inactive for 90 days before the monthly $30 inactivity fee will begin to be charged. The fee would be charged each month, or at a rate of $20 per year until the account’s balance is depleted or trading resumes.

Assets

Q8 Trade features the following tradable instruments:

-45 currency pairs; majors, minors, and several exotics, including the Mexican Peso, Turkish Lira, South African Rand, Swedish Krona, Danish Krone, Hong Kong Dollar, and Singapore Dollar.

-45 currency pairs; majors, minors, and several exotics, including the Mexican Peso, Turkish Lira, South African Rand, Swedish Krona, Danish Krone, Hong Kong Dollar, and Singapore Dollar.

-15 + commodities, including Cocoa, Coffee, Wheat, Corn, Copper, Palladium, Sugar, Silver, Gold, and others.

-More than 150 stocks in American companies.

-29 indices (Dow Jones, US Oil, NASDAQ, etc.)

Overall, the broker manages to bring traders a pretty diverse asset portfolio with more than 240 instruments to choose from. Cryptocurrencies aren’t available, so traders that are looking for the option to trade Bitcoin and others may want to search for a broker that does support those types of assets or consider opening a secondary account to access those options.

Spreads

The website doesn’t offer us live spreads for comparison, or even a chart that lists the minimum spreads for all account levels on each instrument. This makes it difficult to compare options in more detail, although we are given a brief glimpse of the minimum spreads for each account status level. Take a look at the starting spreads below:

- Bronze Account: From 3 pips

- Silver Account: From 3 pips

- Gold Account: From 2 pips

- Platinum Account: From 1.5 pips

- Diamond Account: NA

Spreads can be fixed or floating, with fixed options typically being higher. Traders will notice that the starting spreads on the Bronze and Silver accounts are twice as high as the industry’s average 1.5 pips range. Spreads are even slightly above average on the Gold account, meaning that a deposit of $50,000 USD is required to access a basic starting spread through this broker. The spreads are slightly offset by the lack of commission fees, but traders could still find better options elsewhere.

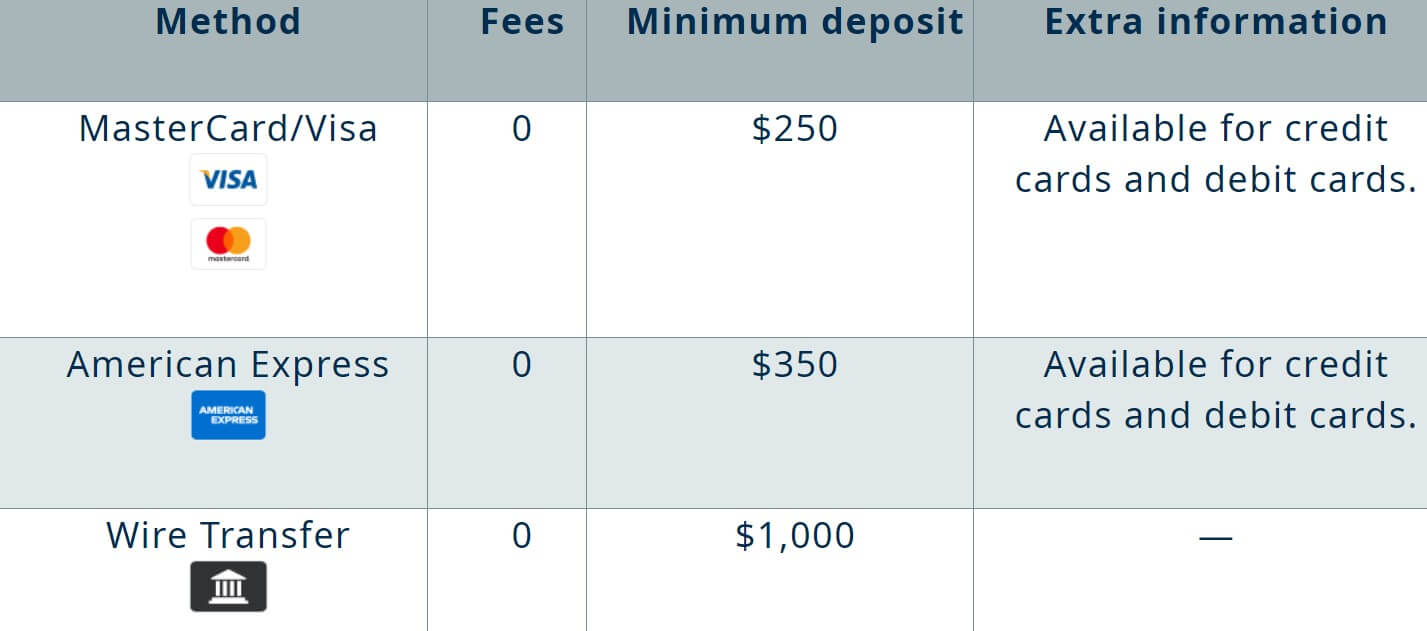

Minimum Deposit

Q8 Trade allows traders to open an account with a deposit of $250 USD. It’s a little disappointing that the broker doesn’t offer a $1 deposit minimum for their lowest status level since those account holders don’t get a lot of extra perks anyways. As traders reach certain deposit guidelines, the account status will increase, unlocking more perks and better conditions along the way.

We’ve provided the range for each status level below:

- Bronze Account: $250 – $999 USD

- Silver Account: $1,000 – $9,999 USD

- Gold Account: $10,000 – $49,000 USD

- Platinum Account: $50,000 – $249,999 USD

- Diamond Account: $250,000+

Traders will notice that it’s possible to move up to Silver status without making an outrageously high deposit, but it may be difficult for many traders to move up from that level due to the deposit requirement increase. Note that some payment providers require a certain deposit amount, which would affect one’s initial deposit or future deposits. American Express has a $250 requirement and the broker requires a $1,000 USD deposit to fund through bank wire transfer.

Deposit Methods & Costs

Accounts can be funded through the most traditional methods, bank wire transfer, and card (Visa, MasterCard, American Express), and KNET card is available for those located in Kuwait. The broker does not charge fees on incoming deposits from their side, but the website does mention that banking institutions and card providers may or may not charge their own fees. Traders will be directed to the deposit page during the registration process or can access the page later through the Dashboard.

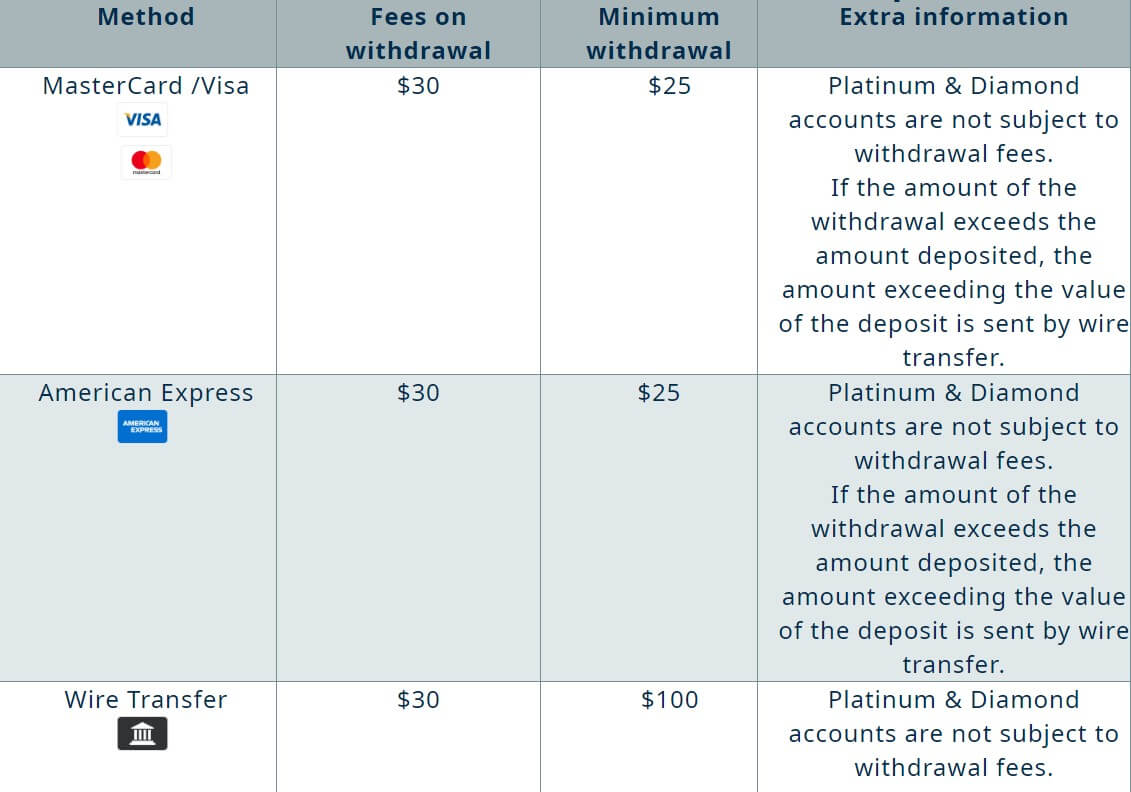

Withdrawal Methods & Costs

Following international laws & an anti-money laundering policy, the broker sets typical guidelines that require funds to be withdrawn back to the original payment method. Q8 Trade mentions that a “mere” $20 fee is charged on the first and second withdrawals each month. Any withdrawal afterward would be fee-free. Considering that many other brokers offer completely fee-free withdrawals, Q8 Trade’s $20 – $40 USD monthly charge isn’t the cheapest offer out there.

The fee will also be pushed to $50 if there hasn’t been any trading activity since the account was funded. Note that Platinum and Diamond account holders will receive a perk in the form of free withdrawals for the lifetime of the account. Withdrawals must be made for amounts of at least $25 on cards and $100 through bank wire.

Withdrawal Processing & Wait Time

Withdrawal requests are processed within a lengthy three to ten working days from the time that the request is submitted. Once funds have been released, it can take an additional amount of time for the amount to show up in the client’s bank account, with the exact amount of time depending on the bank in question.

Bonuses & Promotions

Q8 Trade focuses its promotional opportunities on their best account types. Those with accounts below the Gold status level will be out of luck when it comes to the broker’s Welcome Bonus, Upgrade Bonus, and the chance to receive a free iPhone 11.

Take a look at each account’s offer below:

- Gold Account: 5% Welcome Bonus, 5% Upgrade Bonus

- Platinum Account: 10% Welcome Bonus, 10% Upgrade Bonus, iPhone 11

- Diamond Account: Up to 20% Welcome Bonus, up to 20% Upgrade Bonus, iPhone 11

Eligibility may be restricted for some clients based on their country of residence. In order to receive the free iPhone, a minimum trading volume of 250,000,000 USD must be reached within a 180 calendar day time limit. Welcome bonuses are applied based on listed percentages on the client’s first deposit. Upgrade Bonuses are offered to clients who make a second deposit into their trading account. Certain conditions do affect withdrawal conditions for bonuses. Note that the company may feature trading contests or other promotional offers from time to time.

Educational & Trading Tools

Q8 Trade has invested a large amount of effort into the education section of its website. One of the highlights would be the Hawks Training Academy, which aims to certify traders as professionals by providing them with tools and knowledge, mainly through e-books and educational videos. A financial glossary, webinars, articles, courses, platform skills, and other resources are also available on the website, and account managers are provided to all accounts that are of Silver level or better. The website also isn’t lacking in trading tools, all of which have been listed below:

- Economic Calendar

- Market News

- Market Scanner

- Trading Central Signals

- Meta Trader Plugin

- Demo Account

Those that decide to open a risk-free demo account through the broker will be given a virtual credit of up to $50,000 to use in order to practice trading with all of the broker’s tradable instruments on MT5. One can open a demo by navigating to “Account” at the top of the webpage and then selecting “Demo Account” from the dropdown menu. The broker also provides a walkthrough of each step that is needed in order to finish the registration process and access the demo through the trading platform. Be sure to take note of account details, as these cannot be accessed later.

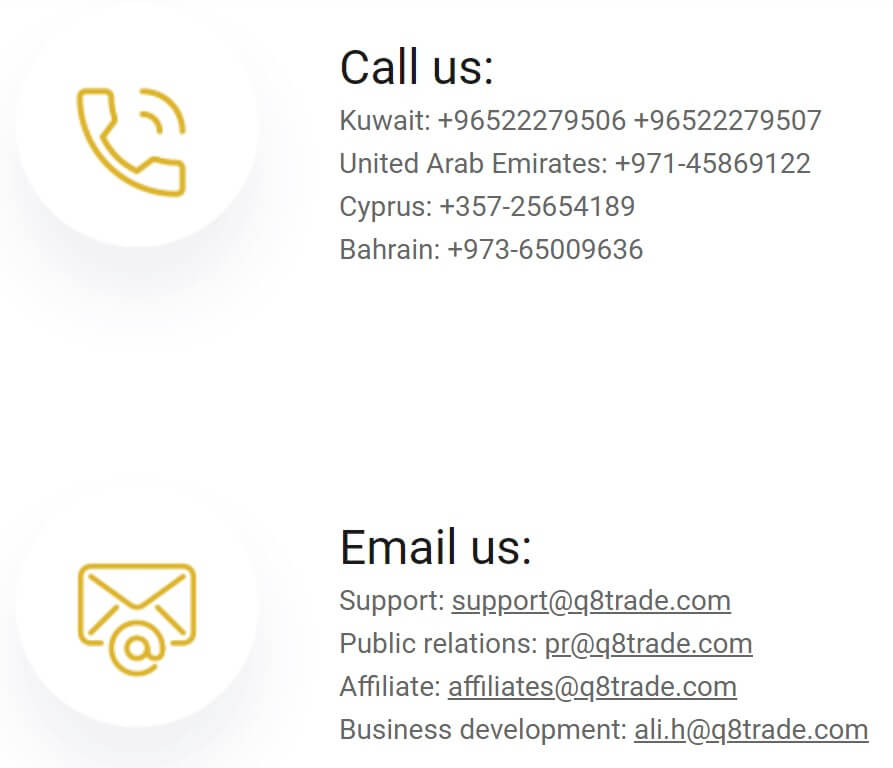

Customer Service

Everyone can reach out to support through chat and email during daily working hours (07:00 – 00:00 GMT+2 on weekdays and 07:00 – 18:00 GMT+2 on Saturdays.) However, our experience with the instant chat option proved that support isn’t always readily available on chat, and we were given a message to check back during working hours, even though we did try to chat when agents should have been available, according to their advertised hours.

Following in their pattern of offering the best options to higher account levels, the broker only provides a direct phone line to Platinum and Diamond account holders. If you fall in that category, then reaching support shouldn’t be too much of a hassle. Everyone else will need to reach out to [email protected] and wait for a response.

Countries Accepted

Q8 Trade does not offer services to clients located in the United States – in fact, the website wouldn’t even allow us to access to registration form based on our location. Following a similar pattern used by other brokers that take regulatory restrictions seriously, the Q8 Trade has an IP address recognizing popup-blocker set up to stop certain traders from opening an account. If you’re also greeted by the popup blocker, chances are that you won’t be allowed to sign-up. Of course, if you feel that you’re being wrongly targeted, feel free to reach out to support to ask for complete clarity about your country of residence.

Conclusion

Like many other brokers following a tier-based system, Q8 Trade tends to focus more of their efforts on the best account tiers, offering those account holders better trading costs, direct access to customer support by phone, higher bonuses, fee-free withdrawals, and other perks. Unfortunately, those with lower account status levels may feel ignored by the broker, while being subjected to higher 3 pip spreads and basic customer support options. For those reasons, Q8 Trade is better suited for traders that can afford to make a larger deposit (around $50K) and those traders can benefit from the high 1:400 leverage ratio that is available to all account holders.

There are some additional benefits like a vast amount of educational resources and a diverse range of instruments available for trading as well. Ultimately, it is up to each individual trader to consider which account level they would fall under and whether the associated advantages and costs warrant opening an account.