Slippage is an inherent part of the forex market and it stands for the difference between the initial price of an order and the final one at which the trade in question was closed. Therefore, it essentially represents the discrepancy between a trader’s expectation and the real outcome. Slippage occurs with market orders, where a trader requires the best market price in the least amount of time, and stop orders, which essentially turn into market orders once the stop price is triggered. However, traders who opt for a limit order directly exclude the slippage factor because the price will not go beyond the limit.

Slippage will happen whenever there is a certain delay between the time of entry and the moment a broker receives the order, in between which price changes often occur. What is more, aside from the delay, some other traders could have already stepped in and sent the order before you did. This also includes the need to act fast as the price may disappear before the order has had the chance to arrive or you may simply need to queue before others who acted more quickly. Slippage has a tendency of appearing in more quick-paced, volatile markets and can, as a result, have either a positive or a negative effect on traders. This volatility naturally entails greater price movements and, consequently, more risk, which altogether can lead to slippage. Today we are going to analyze this phenomenon and assess how we can minimize the damage, avoid situations where we can take losses, and evade currency pairs where such negative occurrences may take place.

Last, Bid, and Ask

The three terms – the last, the bid, and the ask – are extremely important for understanding how an order is processed and where slippage might occur. The last, as the name suggests, is precisely the last completed trade, which naturally changes with the execution of new prices. Both the bid and the ask are live market orders that have not yet been executed. While the bid is the highest price offered by the buyer, the ask is the lowest price that a seller is currently selling. Only when they get filled, that is when two people agree on the price, will they become the last. As the bid is the highest buyer, who expresses willingness to pay a certain amount of money, he is actually making a buy order that is a limit order where the limit is set at a certain value (e.g. 1.0568). If any other trader managed to offer a higher price (e.g. 1.0569), the new price would then become the new bid price in the Level 1 screen, thus becoming the new highest bidder.

The ask price or the offering price states at which amount the seller is willing to sell (e.g. 1.0570), and as such it is still not an order that went through. As with the bid, another trader can step in and offer another ask price (e.g. 1.0569), hence becoming the new ask and placing the previously lowest ask price second in line. Each time a bidder (i.e. a bid) and a seller (i.e. an ask) willingly meet at a particular price, both orders disappear as they are executed. The executed prices are now the last, so the new bid and ask are the two prices that were the second in line. If either bid or ask happened to be larger than the other, a part of that bigger order would need to stay. For example, if a trader wanted to buy four lots but managed to fill only two of them, the remaining two lots would still be offered at that price.

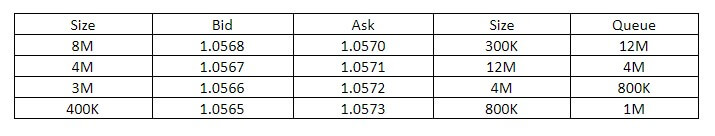

In terms of the size of the bid and the ask, Lever 1 quote screen provides all the necessary information. So, for example, we could see that the size of the bid priced at 1.0568 is 8 million, whereas the size of the ask priced at 1.0570 is 300 thousand. The example of the asking price further tells us that there are three lots or 300 thousand offered at the given price and, based on the prices’ discrepancy, we can conclude that the buyer is more aggressive. These figures with regard to the size always keep moving up and down, and these increases and decreases typically happen slowly in a quiet market as opposed to a more volatile market where the changes naturally occur more quickly. Aside from the details regarding the size and the price, the quote screen also provides traders with information on the related currency pair.

After the Level 1 quotes, traders may be interested in what is happening in the subsequent lines. The Level 2 quotes screen also tells us the sizes and the prices after the bid and ask, although these are more or less stagnant nowadays and you can typically opt to hide them from your screen. Modern technology also allows traders to show that they are bidding but display a smaller size than what it truly is, which means that it is now possible to make changes so as not to reveal the full extent of someone’s actions. Therefore, the line below the first one actually gives information on other buyers, their price, and size, and it is precisely these types of information that can provide traders with insight on where slippage occurs.

Causes of Slippage

Slippage, as stated before, happens when you enter a queue after a market order is made. The order will be filled only when you get to the front of the line at the best price available. However, if the size of the ask is 300 thousand and its price is 1.0570, any buy order exceeding this size will need to be divided between Level 1 and Level 2. If a trader is making a 5 thousand buy order, he/she would be able to buy 3 lots at the Level 1 price, whereas the 2 remaining lots would need to be sold at the price offered in the very next line, i.e. 1.0571 (see the table below). The size is extremely important on several levels: the more buyers and sellers, the better because this entails a lot of action or a lot of liquidity at these prices. In addition, whenever there is a lack of depth (i.e. fewer buyers and sellers), slippage occurs. In such cases, the orders are filled at the stated price, yet there is usually some type of lag involved when sending out a market order.

Due to these delays and lags, it is important to choose the right software that will be continuously praised for price and speed execution. Aside from the buy market, traders may also place an order to sell at the market. A particular trader may want to sell 400 thousand, and it could become a problem if there were other orders lined up before. A number of selling orders typically pile up around major news events, so an influx of orders follows whenever important news announcements (e.g. the impact of FOMC on the USD or RBNZ on the NZD) come out. Among the selling orders listed above yours, the first one (equaling 12 million for example) would be divided into the 8 million bid at the price of 1.0568 (see the first line in the table below) and 4 million bid at the price of 1.0567 (view the second line). The other queued sell orders would be filled accordingly one by one until your order’s turn comes.

However, since your order was the last in line, you would not be able to get the price you set your eyes on but the last one in the row (i.e. 1.0565). With major news announcements, the price discrepancy could be even greater due to several different reasons. As we saw from the previous example, there could be other sell orders queued up before you placed one yourself, leading to slippage of 10—20 pips. Nonetheless, it is not uncommon for bids to be pulled quickly in the face of the news events due to traders realizing the volatility of the market under such circumstances. Even the most experienced traders avoid trading news announcements because of the involved risk and some even claim to have witnessed 200-pip slippage in the past.

Gapping

Gapping is one of the causes of slippage in the forex market and, although it is an unavoidable phenomenon, experts provide reassuring thoughts for anyone concerned. Gapping originally comes from the stock market where it occurs regularly, while forex traders can typically see such occurrences on weekends due to the nature of the market. The forex market runs continuously until weekends, so any gapping that takes place in forex normally occurs on Monday (or Sunday depending on where you live) candle, typically following a specific news event that took place the previous weekend. At times, traders can see how big banks’ involvement affects gapping and the forex community on Twitter is often quite vocal about these occurrences. Most traders experience fear because they believe that a certain gap would run past their stop loss and keep running, thereby causing a major loss. While the gaps do happen often, such massive losses are highly unlikely to ever happen and, even when they do, they almost always follow a certain trend and they are tightly connected to the activity of the big banks.

The big banks will always notice the greatest concentration of traders in the chart and, as many of them keep going after reversals, the big banks will ensure that the price stays on the same course over a longer period of time. Gaps here serve only as a faster vehicle for the big banks to get in between and impact the majority of traders, experts suggest. If you find yourself among this majority, having slipped and taken a loss, the odds of it being vastly destructive and insurmountable are rather low. Even if take a look at the span of one year, the probability of you finding more than 2 places with a gap exceeding 30 pips is increasingly low. What is more, in order for any trader to be affected by gaps as huge as 70 pips, one would need to be already in a trade, going in a certain direction with a stop loss at a specific place. Therefore, not only is this quite improbable an event but it is also demonstrative of the extent to which someone’s emotions (i.e. irrational fear) can affect trading.

How to Avoid Slippage

Experts in the forex market suggest that it is best to altogether avoid trading live orders or trading major news events, wait for the announcements to come out, and wait for the initial surge to settle. The impact becomes weaker after a few minutes and, even though the volatility is still present, slippage is less likely to happen. The massive slippage of 200 pips mentioned above happens exceptionally rarely and immediately after the first blow, which is why it is wise to avoid live orders letting the market calm down. In terms of choosing which currency pairs to trade, various experts offer different viewpoints. Some say that it is wise to choose the most liquid pairs such as EUR/USD, USD/JPY, and GBP/USD. Other currency pairs such as the ones involving the NZD, the CAD, and the AUD are less liquid and should thus be avoided, according to this group of traders.

Some other prop traders insist that currency pairs such as EUR/USD are so heavily monitored by the big banks due to the number of trades done that it is also one of the charts where gapping is more likely to occur as well. Aside from choosing the right pair to trade, it is vitally important to use stop limit orders that can prevent most slippage, especially at trade entries. Even if the market becomes extremely volatile, the stop limit will prevent you from taking losses in a situation when the price starts and keeps moving sharply. So, for example, you are looking at a pair trading at 1.0655, willing to enter if the price started to break higher. You could put a buy stop, which is a form of a trigger, as you want to buy once it starts to break higher. A stop can either be a market order asking for the best possible price or a stop-limit where the stop is triggering a limit order.

Therefore, if you want to get in at 1.0655, you would probably be looking for a trigger if it breaks above 1.0680. You can then put a stop at 1.0681 at which point you may want your order to go to the market and get filled. You can also then decide on your buy limit, which reveals how far you are willing to go (e.g. 1.0698 allowing for a window of 70 pips). Such a move also prevents you from paying an exorbitant amount at order execution on any pair you are trading regardless of liquidity. If your trade moves beyond your buy stop (e.g. moving directly to 1.0750), your order will not get filled, which is still a positive outcome despite not winning. Put simply, it is always better not to enter a trade which is that far from your desirable price.

The challenge in these types of situations is putting overwhelming feelings and sensations aside and striving to maintain a rational viewpoint. To achieve a more sensible perspective, traders only need to look at numbers and break down the fear analytically. For many of them, trading has only recently become part of their everyday lives, especially trading the daily chart, so they may naturally still be in the process of weighing out how much control and caution they need to exert in order to prevent losses from happening. This question frequently extends to weekends regarding which, however, prop traders keep a positive attitude, reassuring new traders not to worry about slippage.

This further means that trading on Friday should be carried out naturally and in the same manner as on any other day of the week. In addition, aside from the fact that forex experts calming thoughts on gaps and slippage, claiming that they can hardly cause any worries, they also believe can have certain benefits as well as we discussed above. Moreover, as gaps are triggered by news events, it is always wise to trade the daily chart where many events that occur on weekends simply hold little importance. Furthermore, trend traders will not even have the opportunity to experience any damaging effects of gapping as gaps typically along with trends. If you do, however, happen to be on the negative side of a trade, feeling the effects of slippage, simply close the running trade and take the loss. Find comfort in understanding that the likelihood of this happening again or any time soon is extremely low. Nevertheless, should you find yourself in a position where you take frequent losses in a span of one year, consider changing your trading system where the root of the problem probably lies.

As trading is never about technical aspects alone, besides understanding the importance of figuring out the depth of the market and putting stop limits, it is also valuable to explore other factors that directly contribute to success. Therefore, it is also crucial to try and grasp when and how the market is manipulated by the big banks and why so many traders lose so often. Also, in order not to rush in any trade, feeling greedy about money and winning, learning about risk management and money management alongside trading psychology can be exceptionally fruitful for your overall trading. This approach will help you stop yourself from reacting impulsively especially when the market starts acting unpredictably after an event. As a result, you will never really need to worry about slippage and, although it sounds too simple to be true, many professional traders agree with this approach. Additionally, even if you take a big loss, you have probably had greater fails in trading currencies than this one. Simply keep going as before and work your way up, understanding how and where you left room for a loss to happen.