What is a rebate and what do you need the rebate service? How can you go about reducing spread costs? Read our step-by-step instruction for using broker rebates to reduce the costs associated with spreads.

Rebate is a type of refund (cashback) or partial compensation to the trader for its costs. In general terms, the model is as follows: the trader registers on the rebate service page and through the affiliate link passes to the broker’s website, opens an account, operates, and pays the spread (markup) to the broker/market. The broker transfers a part of its commission (spread, markup) by the customer attracted through the rebate service, which in turn refunds a part of its profits to the trader. Everyone is very happy. Pay attention to this reading if you want to have more detailed information on how the rebate works, its advantages for traders and brokers, and on how you can get a refund.

Tell me, did you know that trading costs can be reduced in part, that is, the amount deducted by the broker as a spread (markup) can be returned to your account? For the trader, it is completely free. And if we have such an opportunity, why not take it?

What Is a Spread Rebate?

Rebate is a partial spread compensation to the merchant. This is the most common definition on the Internet that needs to be clarified. The spread is the difference between the purchase price and the sale price of a financial asset and the STP or ECN type order processing model is formed by liquidity providers or business conditions. Using the rebate, the trader receives a partial compensation only from a part of the spread, which is the broker’s commission (the markup is the so-called broker’s surcharge on the spread).

The rebate is made regardless of whether the transaction is profitable or not. The periodicity of the surcharge is varied and depends on the conditions of the broker/rebate service: daily (for the closed trading day), weekly, monthly. The calculation formula may also be different for different accounts, for example, the spread percentage or fixed amount for each lot. Some brokers have differentiation: by turnover of up to 10 monthly lots – an amount of compensation, for a turnover of more than 10 lots – another amount, higher.

Rebuttal may be granted:

Straight down the corridor for his clients. This type of cashback and information about it is usually placed in the share and bond programs section.

For third-party resources, an independent rebate service that fosters cooperative relations with dozens of corridors.

You cannot be a participant in the spread compensation affiliate program and register at the broker’s site through the rebate service. You must choose one of the options, and both have their advantages. Most often they are the brokers who have the most compensation, as the partner chain does not involve an additional intermediary, with which they will also have to share.

Advantages of the Rebate Service

Distribution of the merchant’s monetary flows. In the first case, the merchant’s money (both the deposit and the rebate) remain under the control of the broker. In the second case, the compensation is deposited into the account opened at the rebate service. And if the broker-“cooks” under different pretexts refuses to withdraw money, the trader may at least withdraw the rebate. The consolation is small, but something is something.

Rebate service as a consolidation platform. Among the partners of the rebate service, there can be dozens of brokers who expose on the platform both the commercial conditions and the conditions of rebate. In other words, all trading conditions are collected here and the trader only has to analyze them instead of exploring dozens of websites. On the other hand, is there always relevant data on such a platform? In addition, the trader loses the opportunity to assess the advantages of other brokers.

Rebate service as a rating and analytics platform. Such positioning means that the platform creates a rating of brokers with the best trading conditions, better spread compensation conditions, and builds ratings based on the opinions of merchants. Can the objectivity of such ratings be trusted? Rhetorical question.

Compensation fund. Some rebate services declare the availability of the compensation fund which assures the trader of the potential loss of investments. It is true that it is unknown how it is formed. Also, about such payments, I personally have never heard of.

Free legal assistance. Another service that may have some rebate platforms. According to the owners of these platforms, they are willing to help in any way and defend the interests of traders in the event of disputes that may arise with the broker.

At first glance, it is best to receive spread compensation through the rebate service. But most of the reported benefits are only theoretical.

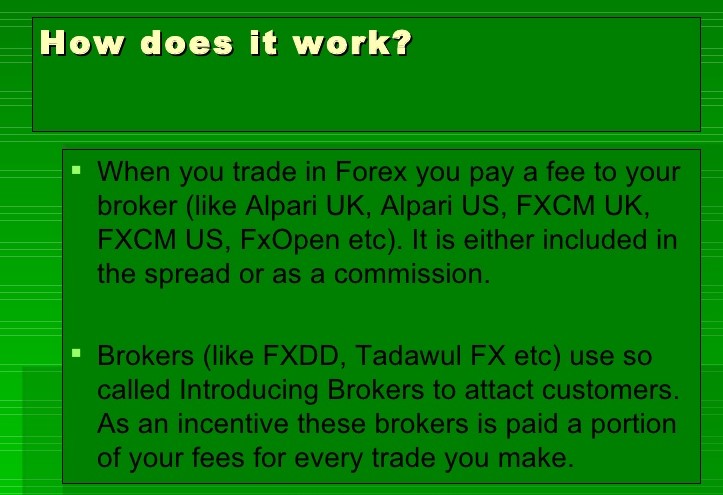

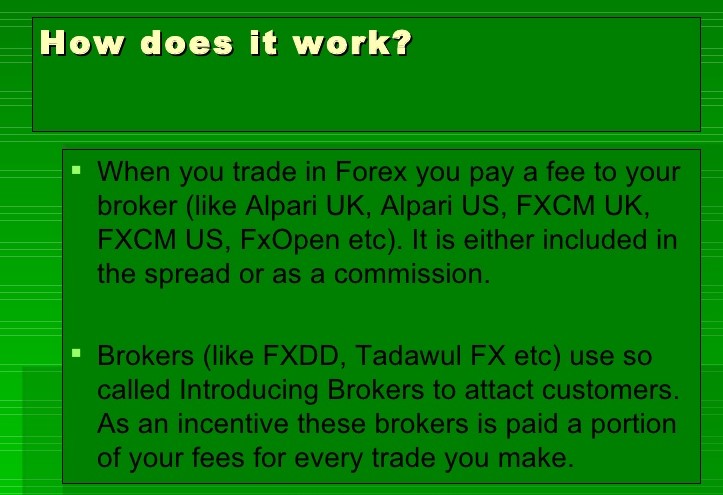

How Does it All Work?

In general terms, the operating scheme for the membership of the rebate service, broker, and the trader is as follows:

The trader registers on the website of the rebate service. The profile is necessary to be able to monitor the rebate statistics on all accounts. On some rebate platforms, the money is deposited into the account, opened together with the profile (Customer Area balance). You can then withdraw or transfer to a commercial brokerage account. On other platforms, money is immediately deposited in the commercial account because they are linked through the identification code.

The trader follows the affiliate link on the broker’s website, with which the rebate platform has an agreement. Open a real business account, check, start trading. According to the rebate offer, the trader will receive partial compensation. How much, where, and how – individual offer conditions. Now about how much you will receive from the compensation. The conditions of each forum runner are different. Even, they may differ in different trade accounts of a broker. I will give two examples.

Example 1. Broker «A» offers a 70% spread compensation on the Classic account, 80% of which the trader receives. In other words, the broker pays 70% to the rebate service, 80% of this amount is transferred to the merchant’s account (normally such conditions are indicated on the website of the service). The calculation of the compensation is as follows:

-The trader operates a daily volume of 0,25 lots. During the 20 working days of the month, the turnover will be 5 lots.

-For the pair EUR/USD with 1 lot of 100,000 units the price of a point will be $ 10. (for 4-digit quotes!).

-Spread in the account is from 2 points (I take the minimum value).

The spread costs for the trader will be 20 days: 5*10*2 = $ 100. This is the sum of the costs that the trader could have lost by working with the broker directly. 100*0.7 = $ 70 is the broker’s compensation. 70*0.8 = $ 56 is the sum of the rebate. The trader’s actual costs will be 100-56 = $ 44.

Example 2. The broker «B» offers compensation of $ 8 in the Classic account for each lot, 80% of which is returned to the trader. Here the calculation is even easier. The trader’s costs for a turnover of 5 lots is $100 (from the example above). The sum of the rebate is $40. (5*8). The merchant receives $32. (40*0.8) and its actual costs are $68.

The examples given are approximate. No one forces the trader to calculate by hand, but when choosing a rebate service the trader has to take into account the approximate figures to compare them with each other. Almost all rebate platforms on the website have calculators. It is logical that they cannot calculate the floating spread. In addition, the fixed spread is also of the minimum value in them. They are valid for comparison, although the actual compensation figures, of course, will not match those of the calculator in most cases.

Advantages of Rebate for Brokers and Traders

Logical question: why does the broker need to share his commission with the trader and even with the rebate service that serves as an intermediary?

Marketing tool. Different types of actions, loyalty programs and etc. are more effective than a simple discount (in this case, spread). In short, it is not enough to reduce the spread, it is also necessary to offer the trader additional “goodies” so that he can see that they take care of him and feel special.

Encouragement. Another psychological aspect of the rebate that encourages the trader to increase turnover, since the more you operate, the greater the compensation. In addition, with the size of the rebate, the broker can encourage the trader to work with less popular or higher risk assets by offering a higher level of rebate.

Outsourcing. Each broker is interested in attracting as many active traders as possible. Affiliate and rebate programs can be considered as outsourcing tools. By consciously marketing the brokers attract the traders and the brokers share their commission with them.

Advantages of the rebate for merchants:

Saving money. The trader loses nothing. Registration in the rebate service is free, with no fees or membership fees. It only takes a little time to control the profile of the rebate service, but in the rest, the trader only wins.

Implementation of strategies that can be disadvantageous without challenge. These are strategies in which spread forms a significant part of commercial costs:

Scalping. Let’s see an example: in the spread of 2 points, the trader must set the target of at least 3 points. If you are compensated for 50%, you can afford to lower the bar.

Algorithmic trade with high-frequency tactics, including networking.

“Exotic” trade characterized by a widespread due to the low level of liquidity.

Psychological support. Loss for many traders is an emotional shock and stress. The rebate, which is paid even for unprofitable transactions (i.e., reduces the size of losses) is a small consolation prize.

How to Select a Rebate Service

Runner needed on the list of partners. The potential trader may choose a rebate service rating broker, but I would recommend taking it as a starting point otherwise. Spread compensation is not the primary criterion for selecting the broker. Therefore, first, decide with whom you are willing to work and only then look for a company from the list of rebate services. This refers, above all, to active traders: if your broker is not on the list of partners, then bad luck, but this is not the reason to change the broker.

Compensation conditions. Typical error: the higher the compensation amount, the better. On the one hand, a large refund sum may indicate that rebate service has so many customers that it can afford to share most of its profits. On the other hand, it can be a scam to attract a potential merchant in any broker’s “your” rating. Consequently, you will also have to pay attention to the possibility of a daily surcharge for the compensation: after one day you will understand whether the figures correspond to the real ones or not. Follow your interests, goals, and intuition.

Frequently Asked Questions

How do the rebate services differ from each other?

The terms and conditions of the broker affiliate agreement and refund service. The amount that the broker transfers (lump sum or percentage of the trader’s spread), the frequency of the refund (every day, once a week, etc.) – all this at the end indirectly influences the amount of compensation, which is the main criterion for choosing the service.

Conditions for compensation for counter-trader service. It depends on the “greed” of the refund service: what part of your commissions are you willing to share with the customer?

Additional “goodies” for rebate service customers. Additional broker bonuses for customers registered through the service. As a general rule, they are immaterial, for example, 125% as a welcome bonus instead of 100% at the time of direct registration.

Here it is worth adding the safety of the service, as the trader runs the risk of not receiving the refund by relying on an unfair rebate service.

What risks does the trader run by collaborating with the broker via an affiliate link in the rebate service?

As a first comment, I would like to repeat very carefully that the trader does not take any financial risks. He does not pay commissions or fees. At worst, you risk simply not getting what you promised, but you will not lose more than you have. However, there are some risks:

Risk of wasting time. Study the conditions of compensation, pass the verification, and ultimately get nothing.

Reputation risk. Verification involves the provision of personal data to the service. From the security point of view, this is justified, although on the servers sometimes there are hacks. In addition, there are other ways to steal personal data from merchants. The more intermediaries there are, the greater the chance of hacking.

Risk of getting carried away by emotion in pursuit of rebate (cashback) forgetting compliance with the rules of risk management. And, obviously, it is necessary to comment that the passwords of the profiles in the broker and the rebate service must be different.

What if the amount of compensation is not what the trader expected, or if it has not been transferred at all?

Reread the compensation conditions and calculation formula. The examples shown in the above readings are approximate and do not take into account many details. For example, with floating spread it is possible to calculate the compensation in the spreadsheet (downloading the history), but the question is whether it makes sense to waste time.

Other steps are standard: type a question to the rebate service support, capture the screen of each step, and each answer. If necessary, you can connect to the corridor as well. Please note that the operation of rebate services is not regulated, so there is no point in having regulators.

Is the swap refunded?

No, and that’s logical because of the nature of the swap. The swap is formed by the difference in interest rates, the rebate is a part of the broker’s commission.

How is the spread refunded if the spread is the difference between the purchase price and the sale, established by liquidity providers or market conditions?

Sensitive issue. The phrase “Rebate is a partial spread offset” is simplified (as, for example, no one talks about trading with Fórex CFDs, omitting this term). The spread that the trader sees is the difference between buying and selling an asset + “markup”, the broker’s commission. He is willing to share a part of this commission, and this is a good sign for the trader: if the broker markup is 50% and is ready to refund 80% of the spread, it is better to ask if it is not a company-“kitchen”. And if not, what is the excess in the runner’s spread, if he is willing to give that difference?

How can the rebate be received from several brokers/services at once?

A particular account can be linked only to a particular rebate service:

You can open two accounts with a broker through the affiliate link of two rebate services. To one account will be deposited a rebate, to the other – the second.

You cannot open an account and link it to two different rebate services.

In a rebate service, you can open any number of accounts with several brokers.

Is the 100% rebate reward real?

If you actually received such compensation, it is infallible that you disclose the name of the broker and the service. In theory, such a rebate exists, but it’s rather promotional and it’s a marketing tool. Think about it, who will share all of their revenue?

How do you combine the rebate and bonuses?

While trading takes place in net bonds (not traded), it will not open any rebate. Once the bonds are converted into your own funds, you can count on compensation.

Contest the runner or contest through the service: what is better?

Brokers, who are partners in rebate services, can offer their own rebate. But the combination of both refunds in one account is excluded. What’s better? You decide. Someone has no desire to waste time on additional registration. For some, the terms and conditions of service will seem more profitable. So there is no single recommendation for all.