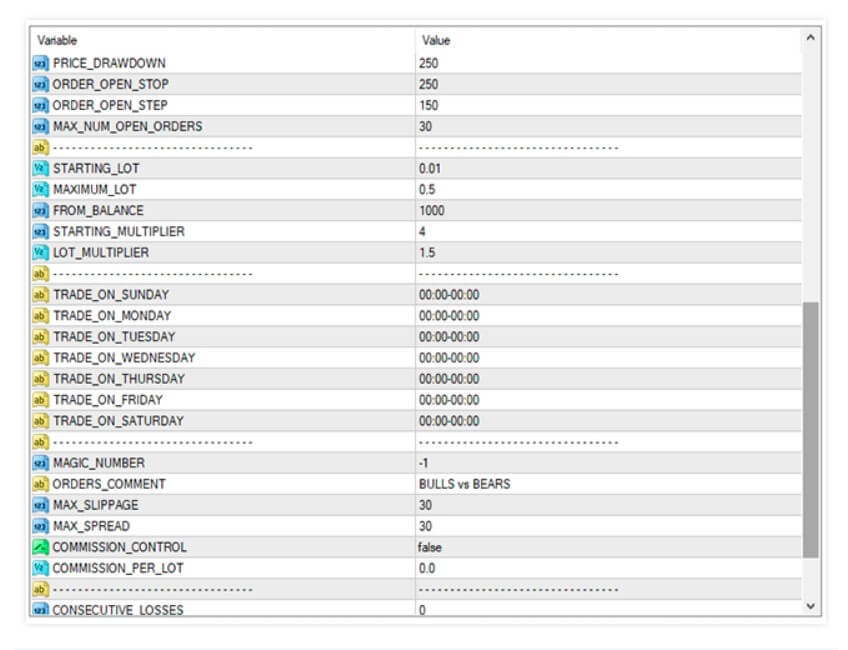

Bulls VS Bears is a tool created in April 2020 by developer Antonis Michos. Bulls VS Bears is an EA that generates advanced signals. Once the system establishes an order, the EA puts two TP points (one of them quite far from the entry point), based on essential levels. The robot, once it sets an order also provides a stop-loss point.

The developer recommends testing the EA in open price visual mode for faster execution. In the interface of the robot, there is an additional panel with two buttons (sell and buy) in the center of the table that you can use if you want instead of the MT4. This is optional functionality.

The EA will always generate two types of purchase signals and two types of sales signals. They are recognized because they have different colors and sizes. The smaller signal has less potential to reach the big Take Profit, but this will be more than 50%. The time frame used by this EA is M15, and 100% of the signals are non-coloured and strictly at the close of a candle.

The entries made by Bulls VS Bears are based on several trend indicators and the robot studies the moments when the bulls are stronger than the bears and vice versa. Bulls VS Bears also has the functionality of putting alerts and push up notifications for the phone.

https://youtu.be/1MTPWXocNqs

We are talking about a robot of which we have very little information. The creator does not even mention in which financial assets it is advisable to invest with the EA, if with Forex, commodities, indices… etc. As a tool of very recent creation, we do not have any comments or experiences from users who have already tried it and can tell us what results they have obtained. There are hardly any comments from any user who has tried the demo version and doubts whether Bulls VS Bears is really an EA or an indicator.

In conclusion, we could not recommend this EA until it matures a little on the market. What we can do is download the demo version and observe its behavior, as well as evaluate the results.

For the use of an EA it is always advisable to have a VPS or virtual server, and in case of not having, to keep the computer on 24/7. It is also important to note in a broker that provides an ECN account and has low latency so that the execution of the orders is as fast as possible.

If you are interested in purchasing this EA, you can find it in the MQL market for a price of 65 USD. It is not currently available for rent.