Mastering risk management

What is risk management in Retail Forex?

It doesn’t really matter how well you set up your trade, the bottom line is that you wont know the amount of volume that is trading against you in any particular situation. And so if you have a particular trade set up, which is producing returns on a consistent basis, that’s great news, however, there will always be times when trades will go against you, and this is when you must have a good risk management strategy (RM) in place. Also, if you are trying new trade set ups you especially need to be mindful of your potential losses if your trade does not go to plan. Again, this can only be done by implementing RM.

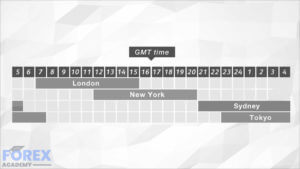

One of the biggest friend that you will ever have in RM is strong understanding the currency pair that you are trading, or thinking about trading. When you consider taking on a trade you should know whether or not there is a great risk of extreme volatility just about to commence in a particular pair as soon as you have pulled the trigger. Therefore, before you execute a designated Spot (on the spot) or Limit order trade you should be extremely cautious of looming fundamental reasons why the trade might very quickly go against you. For example, it could be that major fundamental, economic, news is just about to be released and where you had no knowledge because you had not researched this properly. Or, it could be that a finance minister pertaining to one of the currencies is just about to give a statement, or press conference regarding monetary policy. This could dramatically move the market against you. There is also a timing issue to factor in to your trade,for example; let’s say that you have a trade set up in mind, but the market is just about to move from one time zone into another (e.g New York to the Asian session). Traders in the new time zone might have a completely different view about the exchange rate on your chosen pair and then decide to move it in a different direction: against you!

But let’s say you have taken all the above, necessary, precautions and you are ready to pull the trigger on your trade. You should have a profit target in mind to exit your trade. But, what you should also have an exit threshold in the event that the trade goes against you and you want to cut your you’re losses. The most simple and effective way to mitigate against this is to use a stop loss order on your trade: a market order to close out your position, or a part of it, at predetermined exchange rate, in the event that the trade moves against you.

To be a successful Forex Trader it is a simple matter of mathematics: you need to win more trades than you lose and those losses should be less than your wins. Therefore you should aim for a minimum of 2 to 1 as a ratio. Example: you should be aiming to win $200 for every $100 loss. This is considered to be a positive risk to reward ratio and will be a minimum requirement for you coupled with more winning trades than losers.

Another area where new traders regularly have shortcomings is that they often take their profit too quickly and let their loosing trades run on too long. this is very often coupled with chasing losses: where traders take extra risks to try and win back losses. This will often come about by ‘doubling up’ and taking on riskier trades without validating set ups. This type of destructive trading can be mitigated against by adopting a trading style which is successful and with the above risk to reward strategy and then trading consistently without deviation.

One other problem which can burst a new trader’s bubble is a lack of understanding when it comes to leverage. By over leveraging your position you will be in danger of getting close outs due to margin calls (more to follow on both). By trading with over extended leverage you run the risk of blowing your account. In fact, over 70% of new Retail Forex trdaers will blow their accounts in the first 6 months of opening. And so learning to gauge how to trade with a reasonable amount of leverage relating to your account balance will allow you to develop a

consistently winning trading style. This is when to consider ramping up your leverage: when you are winning, not when you are losing!

And therefore, the most effective way to adapt a successful RM strategy is to remember that winning consistently at Forex will only ever happen with self discipline and by adopting the above methodology. This, in tandem with an uninterrupted work space, a cool head in stressful situations and some degree of self evaluation with regard to psychological suitability (trading isn’t for everyone) is a must if you are serious about trading successfully in the Forex market.