What is scalping in Forex trading? The perception is that this is a type of trading where a trader enters several trades in a small period of time and closes them in just a few minutes. But this is not the most correct definition. Scalping suggests placing orders a short distance from the opening point. The trader leaves the trade in a short time, as soon as the price changes at least a few points, including the spread. Even an open transaction based on this principle already refers to scalping. Logically, to make a profit, a trader must make dozens of such transactions in one day, but their number is not that important.

Types of scalping and general examples of strategies:

Scalping in the news. At the time of departure of important news or the publication of economic data, there is a sharp increase in volume and volatility that can last from a few minutes to a few hours. This is the best time for scalpers. There are two ways to operate.

Placing opposite pending orders a few minutes before publishing statistics and removing the order that does not work after publishing. The opening of several short-term trades for directly correlated pairs in the first few minutes after the publication of news in the main trend direction. Making money using such a strategy is quite difficult. The two methods have their advantages and disadvantages, read more about them in this summary.

Types of scalping depending on the time frame chosen:

Pipsing. It is called the most profitable and risky strategy (in terms of profit, the issue is very controversial). Trading takes place in the M1 interval, transactions are carried out in the market for a few minutes. It happens that 1-2 points are enough for the scalper since maximum leverage is used (sometimes up to 1:1000).

Medium-term scalping Suggests a relatively fewer number of open trades, the duration of which is 5-15 minutes. The range is M5. The size of the leverage is determined by the trader.

Conservative scalping. Transactions can last up to 30 minutes, the time frame is M15.

Types of scalping according to technical strategies:

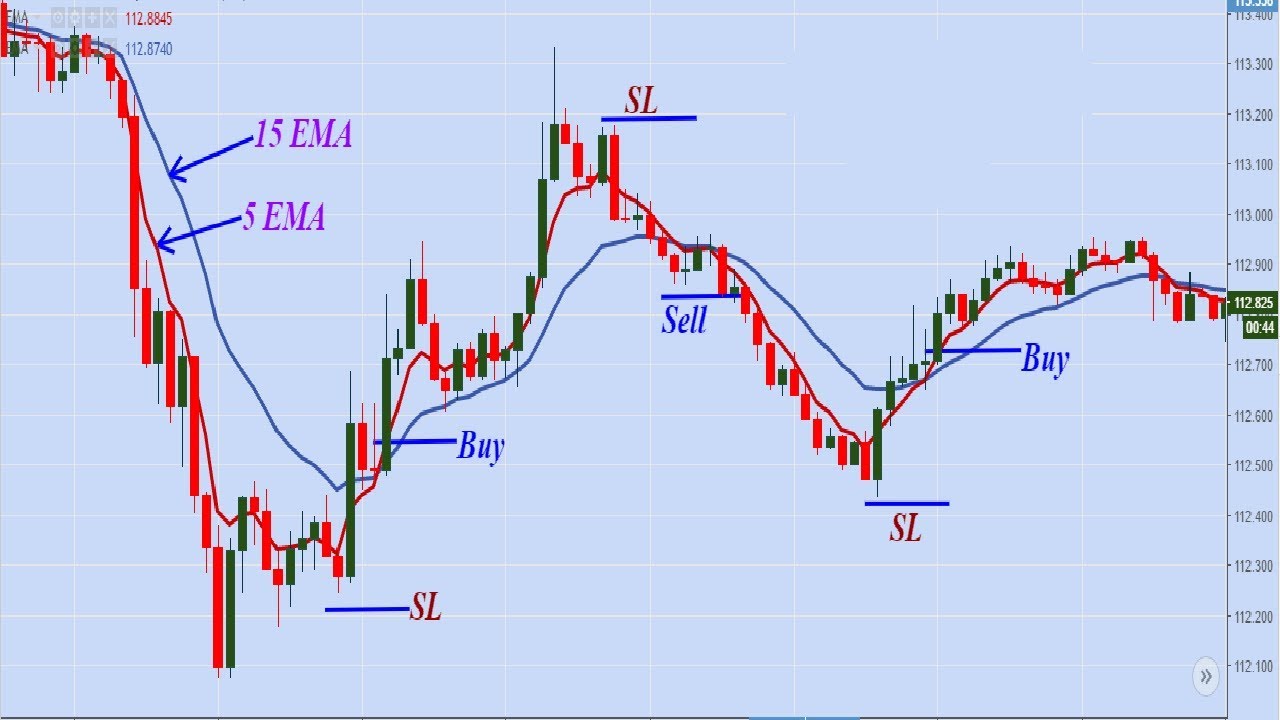

Scalping with analysis of various time frames. Such a strategy is applied when negotiating with the short-term trend. It is possible to invest at almost any time, so classic trend negotiation strategies for time frames per hour will not work there. Such a trend may arise, for example, during a brief pause before the news release, which is quite controversial, judging by the forecasts. Or you can start during a temporary balance of bulls and bears. The essence of the strategy: this type suggests that you identify the beginning of a trend in the H1-H4 range by means of a trend indicator or a confirmation oscillator. Then, analyze the market and look for signals in the M5 timeframe. It will be explained with an example of this strategy later.

Trading based on major currency pairs. The main pair is the pair, through which the scalper makes trading decisions, but carries trading on a correlated pair that is a bit behind. For example, the EUR/USD pair reacts immediately to the publication of US statistics. If EUR/USD and USD/JPY are increasing, then EUR/JPY will also increase.

Intuitive scalping. Considering that a scalper has little time to make decisions, there is a category of traders that use their intuition. They understand the market in such a precise way that they do not need to use any technical indicator.

I will not describe the subdivision by the type of indicator (graph, level analysis, etc.) as it is logical. The rating can be expanded, and I would appreciate it if you, my dear readers, would help me by offering your scalping strategies variants in the comments located at the end of the article.

Rules for successful scalping trading:

There should be no restrictions by the broker to employ such strategies. There should be no restrictions on the offer with respect to the number of open trades and the minimum waiting time.

Instantaneous execution of orders: It depends largely on the broker, liquidity providers, the Internet connection, and the trading platform itself.

Great financial leverage: Professional scalpers work with leverage of 1:500-1:1000, but according to European regulators’ standards, maximum leverage is reduced to 1:50.

The instrument should have the best liquidity.

So what is scalping in trading? I think the answer is clear. Let’s move on to the advantages and disadvantages of strategy.

Advantages of Forex scalping strategies:

Trading should be based on fundamental analysis. Technical indicators are rather used as complementary tools due to price noise in shorter time frames. Although it is not recommended to beginners to negotiate with news, in terms of training and use of simulators, this can be easier and more interesting than technical analysis. It’s all subjective, but I’d say this is a benefit of scalping.

It gives you a chance to do something important for profits. Everything is very relative, but if you consider yourself a professional, scalping trade can generate higher returns compared to daily trading strategies. In scalping, a trader manages to win on almost all price changes in both directions, while in intraday trade, a good part of the profit is “lost” by the existence of setbacks and corrections. Besides, it doesn’t depend on the trend.

Scalping allows for profit when the market is traded unchanged. There are no swap costs (to keep the position open until the next day). I’d say the biggest advantage is training to negotiate scalping. Thanks to high-frequency trading, the trader better understands the moments of entering and leaving the trades, learns to develop intuition, and knows the nature of the market. After mastering scalping which is much more complex, intraday and long-term strategies will seem easier.

Disadvantages of Forex scalping strategies:

Spread. No matter how long your position stays open, the difference will be the same. A scalper takes most of the benefits.

Technical problems. Slippages, delay in execution of orders, platform failure, etc. In scalping, only a second is sometimes important, and a delay can result in a loss that can exceed a small gain.

In scalping, only a second is sometimes important, and a delay can result in a loss that can exceed a small gain.

Market noise. Random price changes, insignificant for long-term periods, can close the order with a stop in short-term periods.

Limited choice. Only liquid currency pairs with moderate volatility are suitable for Forex scalping trading. Exotic pairs are not appropriate.

The problem of precise quotations and broker restrictions. Some companies prohibit scalping or there is a restriction on the minimum waiting time for negotiation.

Stress, you must be constantly focused on the small details. You must control your operations all the time and make your decisions quickly. At any time, a reseller may feel emotionally exhausted and lose concentration. This dilemma could be solved in some way by scripts and robots.

To have profitability in the scalping, it is very necessary to use high leverage, and this significantly increases the risks. But even so, despite all the downsides of scalping trading, scalping is, in the first place, satisfaction and excitement. That’s why many traders like it a lot.

Best currency pairs for scalping:

Knowing how to choose the right instrument of negotiation is very important for scalping, but, in scalping where, you fight for each point, and a sudden change usually translates into losses, its importance is fundamental…

Basic requirements for a better currency pair for scalping:

The narrowest and most floating spread possible. This condition is fair for highly liquid pairs and large transaction volumes: EUR/USD, GBP/USD. If you want to compare differentials for the pairs offered by the different brokers, you can use the data from the MyFxBook portal.

Moderate volatility. Liquidity and volatility have a kind of reverse correlation. It is difficult to buy/sell a currency pair with high volatility. And vice versa, high-liquidity currency pairs have low volatility. It is very important to maintain balance, the volatility calculator can help you to do so. According to the calculator, the best currency pair for scalping is EUR/USD.

For night scalping (flat), you can trade the pair with relatively low volatility USD/CAD, AUD/USD. I want to emphasize that the meaning of the best currency pair for scalping is subjective. Price movements depend as much on external macroeconomic factors as on foreign exchange manipulations by large investors (market makers). Then, depending on the time, the different currency pairs of major currency pairs or cross pairs can become the best for scalping. So, there are some tips on how you can select the best pair for scalping:

You must feel comfortable when you operate. Find your own trading style and the most suitable currency pair, investing all the time you need in training in a demo account.

Be flexible. Today you get positive results by trading in one currency pair, tomorrow, in another currency pair.

Manage foreign exchange risks. In addition to the general rules on the volume of open positions, there is one more rule regarding scalping: you should not open transactions for the two increasing currency pairs at the same time. While it can double your profits, it also doubles your potential risks, as both pairs can be reversed at the same time.

There are no recommendations on the best indicators and technical tools for scalping. Everything is individual here. Someone is satisfied with the standard MT4 indicators, someone installs unique authoring tools. Trading performance does not depend as much on the tools as on the ability to use them.

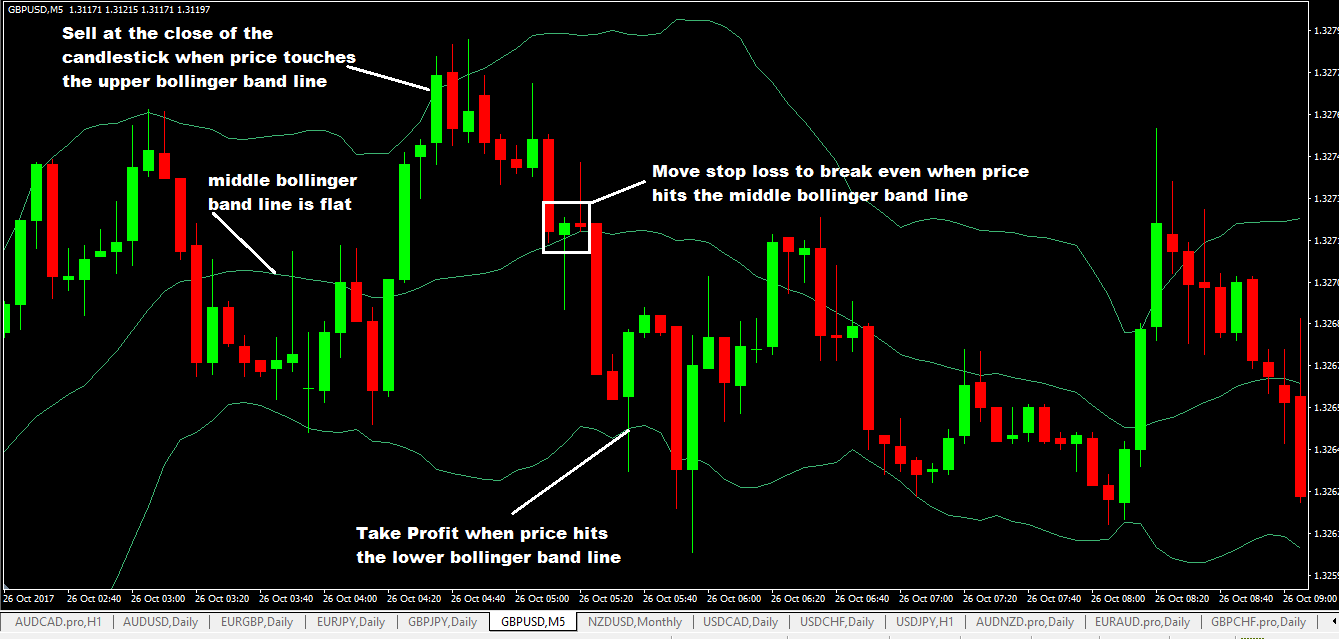

Forex scalping strategies: practical examples

Scalping requires the trader to be monitoring permanently trades and open positions. The strategies described below are based on technical indicators but are used as complementary tools for intuition and practical experience. Therefore, before you start using these strategies in a real account, practice them over and over again until they are fully automatic. And remember that there are no perfect strategies and the suggested ideas are just the basics. ¡ Don’t be afraid to perform certain experiments by adding something of your own, create something of your own, unique based on this basis!