When you have made a loss or a couple of losses in a day, it is easy to want to trade more in order to try and get some back, but what would happen if they also ended up losing? Would you be willing to risk the entire bank account balance just to make back a few of your losses?

Whether you are new to trading or have been trading for years, I am sure that you have been told how important risk management is, normally people refer to it in regards to a single trade, but it is also relevant when looking at your account as a whole, this can be broken down into months, weekends, days, trades and any other increment.

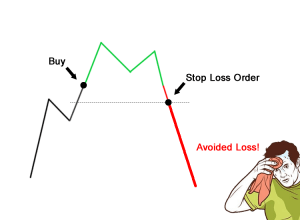

There will be times that your trades go the wrong way, maybe your fault, maybe there was an unannounced news event, this is inevitable. What is important is that you take steps in order to help protect your account from these events and moves, this is why it can be important to set something that we call a daily maximum loss.

So what is the daily maximum loss, well it is a figure, either monetary or percentage that is the hard stop level for our trading, if you hit this level then you need to step away from your trading platform, take a break and then come back tomorrow with a fresh head. When you are incurring losses, you start to get into a psychological battle with yourself, so stopping and stepping away is a method of resetting that battle in your head.

Having a bad day isn’t something to worry about, it is something that everyone, even the very best suffer from. What is important is how you deal with those bad days.

So how would you set these goals? There is no set way to do it, each of us will have a different approach and each of us will have a different ability to deal with risk, so it is up to you, but here are a few suggestions to give you ideas.

Use a percentage to gauge your losses for the day, gives yourself a set amount, maybe 2% of the account or 5% depending on you and your strategy, as soon as your account hits that percentage, stop and walk away.

A monetary amount, this will depend on your account and can also make the losses seems more real, if you have a $10,000 account, set your maximum daily loss to $500 or $300 whichever you feel is best for you, once that amount is hit, take a break and come back tomorrow.

One way to work out percentages is to base it on your average gain. Would you be willing to lose one day worth of winnings or would you want to lose less, if your average gain is 1%, then set your maximum daily loss at 1% or 0.5% depending on your own thoughts.

You could also set this amount via a longer period of time, give yourself a max loss of 10% per month, this can then be divided down into days, so if every day you lost to your limit, you would only be 10% down.

Set a maximum number of losses, instead of looking at percentages or monetary values, you could set yourself limits based on trades, this is a little risky as it can still result in high losses (although you should have stop losses in place), but if you set yourself to two or three losing trades in a day, then stop and move away until tomorrow.

It is important that you come up with something of your own that you know you will be able to adhere to,m there are a lot of dangers to not following a maximum loss plan, mainly that it can put your account in danger as you go back into winning back mode or through desperation to either make your money back or to simply have a winning trade to end the day.

It is important to stop and walk away fro the day, this could give you the opportunity to properly analyze the trades that you have made to find out why they have lost, or to simply sit down and relax for the rest of the day, taking your mind away from the stresses of trading.

Just remember, protecting your account is the number one key to successful trading, not only will it protect your equity, but it will also help to protect your mind from the stresses of loss.