Today in the European trading session, the yellow metal prices failed to stop its early-day losing streak and still gaining negative traction around the $1,885 level, having hit the low of $1,873 level on the day. However, the broad-based U.S. dollar strength could be considered one of the main reasons behind the bullion losses. Hence, the U.S. dollar was supported by a strong U.S. housing market against rising global COVID-19 cases.

Apart from this, the bullish bias in the U.S. dollar was further bolstered by the U.S. stimulus package’s hopes. Across the pond, the on-going progress around the S&P 500 Futures, backed by the hopes of the COVID-19 vaccine and further U.S. stimulus, also weighed on the yellow metal price. Elsewhere, the reason behind the upbeat S&P 500 Futures could also be associated with U.S. positive data, which tends to fuel the hopes of the U.S. economic recovery.

On the contrary, the geopolitical tensions between China and some notable countries like the U.S. and U.K. became the key factor that helped the yellow-metal prices limit its deeper losses. The coronavirus (COVID-19) crisis also keeps challenging the market upbeat trading sentiment, which might give some support to the yellow metal prices.

Despite the concerns about the 2nd-round of coronavirus infections, the market trading sentiment has been flashing green since the day started. Thus, the on-going positive tone around the equity market tends to undermine the safe-haven metal. However, the market sentiment was being supported by the strong U.S. housing market.

Detail suggested that the existing home sales rose to 6 million in August, the highest level in nearly 14 years. Moreover, the market risk sentiment was further bolstered by the Fed Chair Jerome Powell’s measured comments. He said on Tuesday that it might be possible for the Fed to raise interest rates before inflation starts to average 2%. This, in turn, underpinned the safe-haven U.S. dollar and contributed to the currency pair.

Moreover, the market trading sentiment was further bolstered by the reports suggesting that the U.S. House of Representatives has announced a bill to support government spending ahead of a shutdown, which also boosted the Us dollar and contributed to the gold prices losses.

As a result, the broad-based U.S. dollar managed to maintain its previous session gains and still flashed green on the day amid upbeat U.S. data and pullback in technology shares. However, the U.S. dollar gains seem rather unaffected by the upbeat market tone and held its gaining streak, at least for now. Thus, the U.S. dollar gains kept the gold prices under pressure as the price of gold is negatively related to the U.S. dollar price. Whereas, the U.S. Dollar Index that tracks the greenback against a basket of other currencies edged up 0.18% to 94.162 by 9:38 PM ET (1:38 AM GMT). Furthermore, the second round of coronavirus infections keeps challenging the market risk tone, which might help the gold prices limit its deeper losses. As per the latest report, the U.S. has crossed 200,000 COVID-19 deaths tolls, and multiple European countries are imposing lockdown restrictions. Meanwhile, the U.K. set stricter measures on Tuesday, suggesting that the previous lockdown may need to be reimposed.

Looking forward, the market traders will keep their eyes on the preliminary readings of September month PMIs from the U.K., Europe, and the U.S. for fresh direction. Meanwhile, the USD price dynamics and coronavirus headlines will be key to watch. Across the pond, the Fed Chair Jerome Powell’s second day of the congressional testimony will also b key to watch.

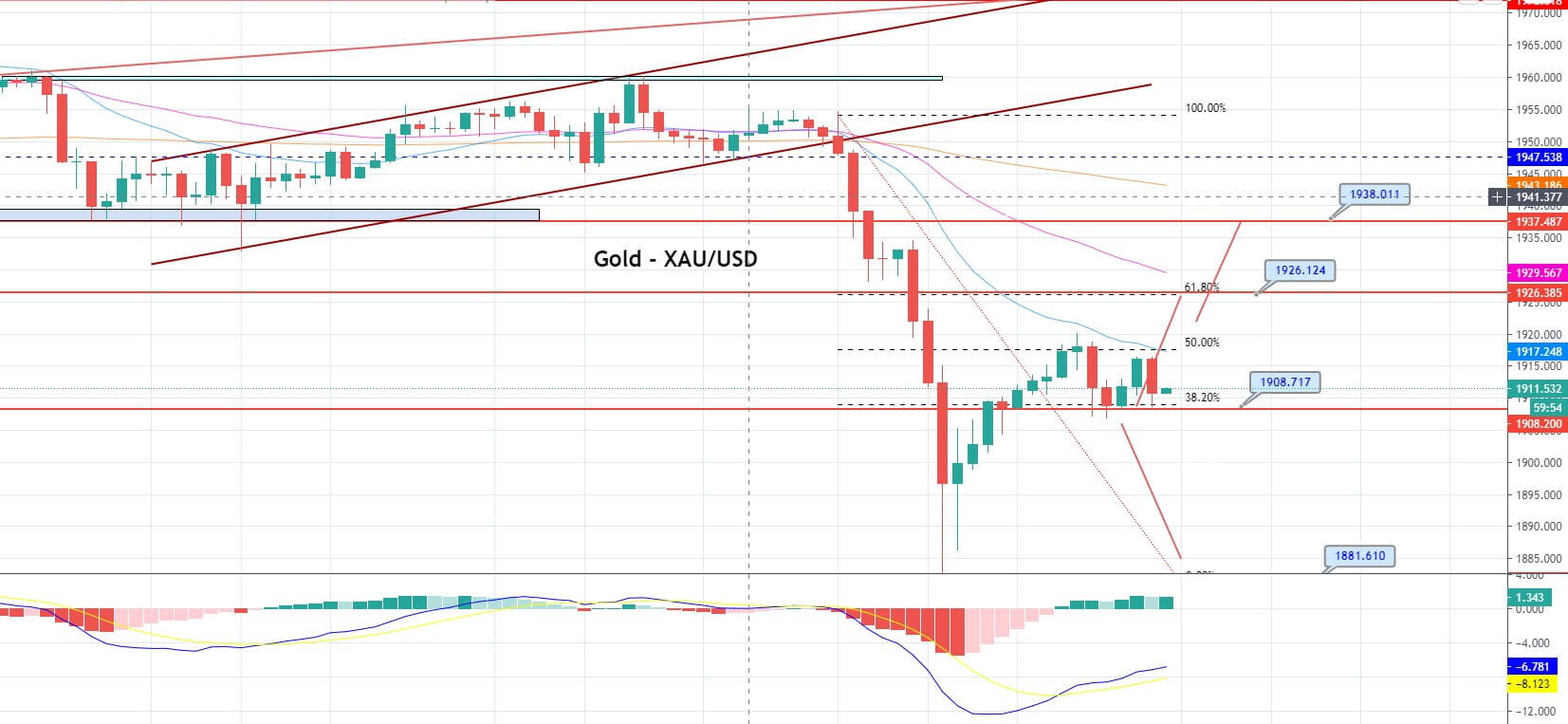

Daily Support and Resistance

S1 1858.21

S2 1881.21

S3 1890.7

Pivot Point 1904.2

R1 1913.7

R2 1927.2

R3 1950.19

Gold price extends to trade distinctly bearish at 1,890 level, disrupting the triple bottom support level of 1,903. On the lower side, gold may sink further until the next support level of 1,877 and 1,862. At the same time, resistance holds around 1,903 and 1,919 level. The bearish bias remains dominant today. Good luck!