Think back to the beginning of your trading career: did you adopt a trading strategy that was promoted by others, or did you create your own system that was intended to be perfect? You’ve likely come across claims of “holy grail” trading strategies before and it can be easy to get caught up believing that these systems are a one-size-fits-all answer to all your trading woes. Unfortunately, the strategies you read about online might not always work for you, or a strategy you’ve created yourself may prove to be less than profitable. If you’ve been questioning your strategy lately, see if it fits in with the following sings so that you’ll know whether to keep it up or ditch it completely.

Sign #1: You Have Trouble Following your Trading Rules

One of the most important things you need to do once you have a trading strategy is to keep using it consistently and to follow all the rules you have set. If the rules are too vague or specific to follow, this is a good sign that they need to be adjusted if possible or that the trading plan might not be well thought out enough or just too specific overall. On another note, a plan with rules that are overly difficult can also cause frustration or lead to mistakes if you’re having issues determining what to do.

Sign #2: If you’re Feeling Burnt-Out

How much effort does your strategy take? It’s true that you’re going to have to put some time into trading if you want to make money, but you shouldn’t have to be online 24/7 to do it. If your plan is leaving you feeling burnt-out because it requires more effort than its worth, you probably need to ditch it for a less time-consuming option. After all, flexible hours are one of the main benefits of forex trading and there are many options out there that don’t require you to wake up at daybreak.

Sign #3: The Cost is too Much

It’s okay to spend money on indicators, strategies, and EAs and some of these systems can be profitable. However, it’s important to ensure that these systems are actually paying for themselves and bringing in some profits on top of the cost. You also need to be skeptical when the creators of these systems claim that they are foolproof or guaranteed to make a certain profit for you. Some of these options can be expensive, so be sure to look to see if you’re actually winding up with more or less money in your pocket at the end of the day.

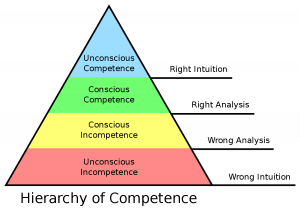

Sign #4: It isn’t Profitable

This sign might seem obvious, but some traders might have trouble letting go of a strategy that they imagined to be perfect. If you’ve already tried changing the parameters, testing, and trading under different conditions, and you still aren’t making profits, it’s better to just let the strategy go and move on. Keep in mind that some systems work great for certain traders but don’t work well for others because of the attention they require, difficulty levels, your trading personality, and other factors. In the end, if you just aren’t making money, you need to look for a strategy that better fits with your own personal trading style.