Today in the early European trading session, the GBP/USD currency pair managed to maintain its bullish bias through the first half of the Asian session and remained bullish around above the mid-1.3500 level. However, the bullish trend was mainly sponsored by the selling tone surrounding the US dollar, which fell to fresh multi-year lows amid increasing bets about the possibility of additional financial aid in the US. Apart from this, the losses in the greenback were further bolstered after the US registered the first case of the covid variant, which instantly put doubt over the US economic recovery and undermined the US dollar.

Meanwhile, the Federal Reserve showed readiness to maintain low-interest rates for a too long period. This, in turn, put additional pressure on the greenback and was seen as one of the key factors that benefitted the GBP/USD currency pair. Across the ocean, the currency pair got an additional lift after the UK health department announced that the government had accepted the proposal by the MHRA to approve the vaccine for use in the UK. On the contrary, the escalating market concerns about the continuous surge in new coronavirus cases and the imposition of new restrictions in the UK keep fueling the doubts over the UK economic recovery, which could cap the gains for the GBP/USD currency pair. At a particular time, the GBP/USD currency pair is currently trading at 1.3573 and consolidating in the range between 1.3494 – 1.3579.

As per the latest report, the UK said that regulators had authorized the use of the AstraZeneca/Oxford coronavirus vaccine. The UK health department declared that the government had accepted the recommendation by the MHRA to authorize the vaccine for use in the UK. This progress remained supportive of the already upbeat market mood, which continued weakening the US dollar’s safe-haven demand and contributing to the currency pair gains.

Apart from this, the bearish trend around the US dollar was also sponsored by the rising bets about the likelihood of additional financial aid in the US. It is worth reporting that US Congress members keep struggling to deliver $2,000 paychecks after Senate Majority Republican Leader Mitch McConnell showed a willingness to block the payments earlier in the day. Despite this, the policymaker put forward the bill as a part of the procedure. Meanwhile, the US Treasury Secretary Steve Mnuchin’s announced that the qualified US residents could start receiving the direct stimulus payment of $600 soon, which boosted the market trading sentiment. The market trading sentiment got an additional lift after the President-elect Joe Biden showed readiness for more support measures, which puts additional pressure on the US dollar.

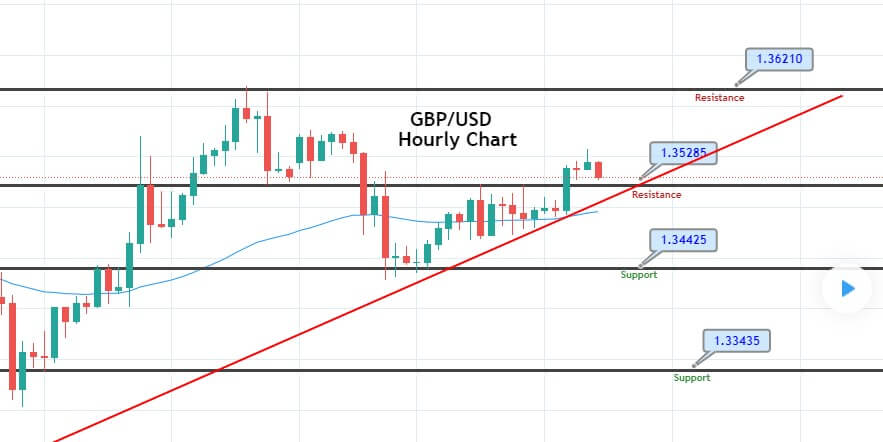

The GBP/USD pair has also violated the resistance level of 1.3520 level, and on the higher side, the next target remains at the 1.3580 level. On the lower side, the GBP/USD pair may find support at the 1.3520 level now. We can expect a continuation of an upward trend in the Sterling today as the MACD and RSI suggest a bullish trend. Alongside, the GBP/USD pair may soar until the 1.3620 level today as the 50 EMA also extending bullish bias for the Cable.