Forex, or foreign exchange, is the market where currencies are traded globally. In this market, traders buy and sell currencies in hopes of making a profit. However, to understand the dynamics of forex trading, it’s important to grasp the concepts of “high” and “low” in forex trading.

Simply put, high and low refer to the highest and lowest price levels that a currency pair has reached during a particular trading period. These price levels are crucial in determining the performance of a currency pair and can help traders make informed decisions about their trading strategies.

High and low can be defined in different ways depending on the context. For instance, high and low can refer to the highest and lowest points a currency pair has reached in a day, week, month, or even a year. The time frame is important because it reflects the market’s volatility and the direction of the trend.

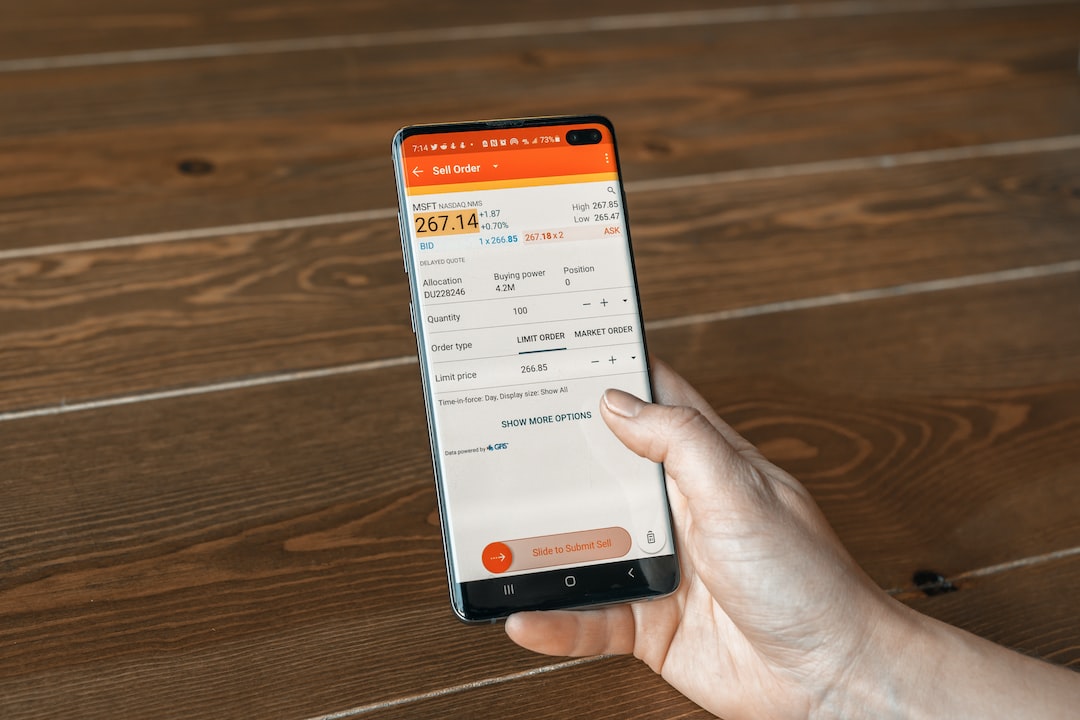

High and low can also be used to describe the bid and ask prices of a currency pair. The bid price is the highest price that a buyer is willing to pay for a currency, while the ask price is the lowest price that a seller is willing to accept. The difference between the bid and ask prices is called the spread, which is the cost of trading.

In forex trading, high and low are used to identify support and resistance levels. Support is the price level at which buyers are willing to enter the market, while resistance is the price level at which sellers are willing to exit the market. These levels are important because they can indicate the direction of the trend and the potential price movements.

When the price of a currency pair reaches a high, it means that the buyers are in control and the price is likely to continue rising. Conversely, when the price reaches a low, it means that the sellers are in control and the price is likely to continue falling. Traders can use these price levels to enter or exit a trade, depending on their trading strategy.

High and low can also be used to calculate technical indicators, such as moving averages, oscillators, and trend lines. These indicators can help traders identify potential entry and exit points, as well as the strength of the trend.

For instance, the moving average is a popular technical indicator that calculates the average price of a currency pair over a specified period of time. By comparing the current price to the moving average, traders can determine whether the trend is up or down. If the price is above the moving average, it indicates an uptrend, while if the price is below the moving average, it indicates a downtrend.

Similarly, oscillators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, can help traders identify overbought and oversold conditions in the market. When the RSI or Stochastic Oscillator reaches a high level, it indicates that the market is overbought and the price is likely to fall. Conversely, when the RSI or Stochastic Oscillator reaches a low level, it indicates that the market is oversold and the price is likely to rise.

In conclusion, high and low are important concepts in forex trading that help traders identify potential entry and exit points, as well as the strength of the trend. By understanding these concepts, traders can make informed decisions about their trading strategies and increase their chances of making a profit in the forex market.