Let’s say you are interested in starting to trade for the first time but you are not sure what exactly you need to do so as not to mess up all your entire investment; or, alternatively, you could have already tried trading, but all your results are far from satisfying. In any scenario you might be living at the moment, you need those key tips to make a real difference in your life. You feel tired of vague ideas, failed attempts, and hours spent on futile research. If you are that practical type of person who wants to grow his/her experience, we are offering you a never-seen-before series of educational texts that will provide you with constructive and applicable advice you can immediately start applying as you read. Whether you are an absolute beginner, a demo trader, or a professional one, you will finally know what position to take in trading currencies to see actual benefits from investing your time and money.

Why should I care about risk management?

Risk management is a topic that we use for so many different areas of life and work, but you may be wondering why and how you should use it in trading. First of all, you must know that it’s the one thing where you must start – it’s your foundation and the basis of any success you may have in the future. The way you manage your risk is equivalent to how likely you are to succeed in forex. Without proper risk management, you are setting yourself up for a big failure, and while there may be thousands of articles that may scare you to death with their lists of dos and don’ts, we actually really want you to get it right from the very beginning. That is why your number one lesson is to start with risk management and slowly build your position along with learning how to protect your assets.

Where do I stand with my risk management skills?

Let’s say that you have 50,000 USD in your (demo or real) trading account. You start trading with whatever skills and knowledge you have obtained so far but, unfortunately, take a loss. Your account suffers tremendously, and it is only expected that this one loss should turn into a series of misfortunes. Now, individual storylines may differ quite a bit, but we know that forex is primarily about preventing losses, even more so than winning. Whether you experienced one severe loss or taken several ones in a row, you are now in a desperate situation, as you are left with 40,000 USD in your account. You are now impatient to fix the mistake you made, so you start behaving recklessly and invest even more, hoping that you will somehow make up for the previously lost 20% of your account. This way, unfortunately, you are only pushing yourself further down in that hole, still hoping for an extraordinary return that will miraculously get you out of that rut.

As a result of your lack of education on risk management, your account decreased to 25,000 USD, and you are officially missing 50% just to get back to where you started. However, this would require skills that not even the most successful forex traders have, and even if you did somehow master forex trading skills all of a sudden, you would still need years to make up for the loss you took before. If your stream of thoughts resembles what we wrote here, you should truly use this opportunity to the best of your abilities to learn everything you can about forex risk management.

What should I do if I take a major loss?

Well, since we have already established what impact one bad decision can have on your account, what do you believe the best strategy here is – a) invest more immediately, b) wait for a lucrative opportunity and then enter a new trade, or c) stop and learn how to trade? If you chose the last option, you guessed it right. Your money is much better off stashed somewhere safe until you learn what we are going to share in this article. Whether you are demo trading or trading real money, you absolutely must understand where the glitch occurred and why you lost a portion of your account like that before you proceed with another trade.

If you, however, find this approach to be silly or cannot see its purpose, please read the previous paragraph again. Although many successful forex traders admit to having lost everything they had before finally learning how to trade safely, there is no need for you to go all the way down to zero. All wealthy people first think about minimizing their risk regardless of their market of choice, so why should anyone else with an average income even consider rushing in before securing their position? Now is the time to take a pen and paper, and start taking notes.

What is my risk?

It is now a well-known fact that 90% of traders lose their accounts within the first several months of trading, and the only way for you to avoid that fate is (prepare your pen) to write down this number – 2%. This number translates as the entire percentage of your account that you can let yourself lose at any moment. Therefore, with a 50,000 USD account, your 2% risk amounts to 1000 USD. Next time when you wonder what your risk is, just do the math and calculate what 2% means in relation to the amount of money you have in your account at that particular moment.

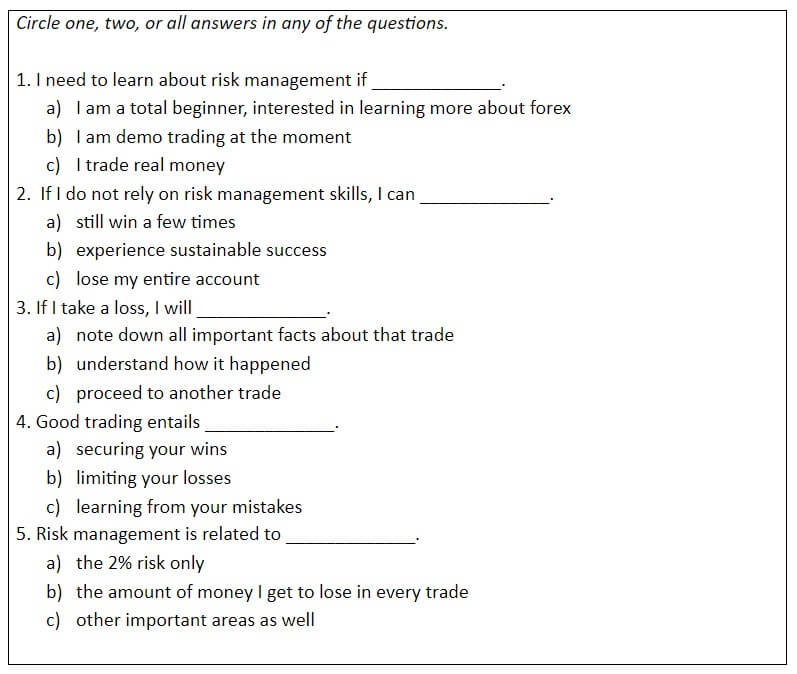

Luckily, if everything else is done correctly, your losses should rarely come close to the 2% risk anyway. Still, we would like to make sure that you understood the importance of learning about risk, so we invite you to complete the following exercise.

Well done! Your first lesson is over! Know you know where to start, but be mindful of the fact that this is only the beginning. The best position you can take in trading currencies is a complex topic but, at the same time, it is not something that you will not be able to manage. Stay tuned because next time we will be explaining how you can secure your position following other important tips and figures that must always be incorporated in your trading to see the best results.

P.S. You can check your answers in the next article about the best trading position. Watch for part two to be posted tomorrow!