The number one concern professional traders have about trading is if their emotional and mental state is adequate for trading. To technical prop traders with systems for decision making, these two states are of less importance, because all they have to do is follow the signals. Now, this feat is not as easy as it sounds. Our minds and emotions tend to stay in the way in front of the proven trading system we have created. Most of the time, trader improvement is psychological, rather than technical improvements to the system. However, technical topics are still more popular, more interesting, and more important to beginner traders. Creating the system is important, although if you have a great system and mess with its decision signals, all that greatness means nothing. Depth of Market or DOM tool is one of the popular searches when looking for a “golden” indicator.

The interest comes from the fact it is not the usual indicator that uses the price action data to calculate a line or generate some other trading signal. Whatsmore, it is a tool the big banks use. If the big banks use it then it must be a good thing, right? It also looks like a secret window into the market data visible only to the big players. The DOM indicator almost sounds like a VIP only tool. When we ask a professional trader about it, we get another picture, something is missing here to be really useful. But this is not going to stop the exclusivity, the search for a secret signal with half information. The popular lure to this indicator included in the MT4 platform by default is ever-growing, yet the information on how to use it in trading systems is almost non-existent. Now, if traders only focused similarly on psychological and money management aspects of trading, we would have much better percentages of traders making it in this business.

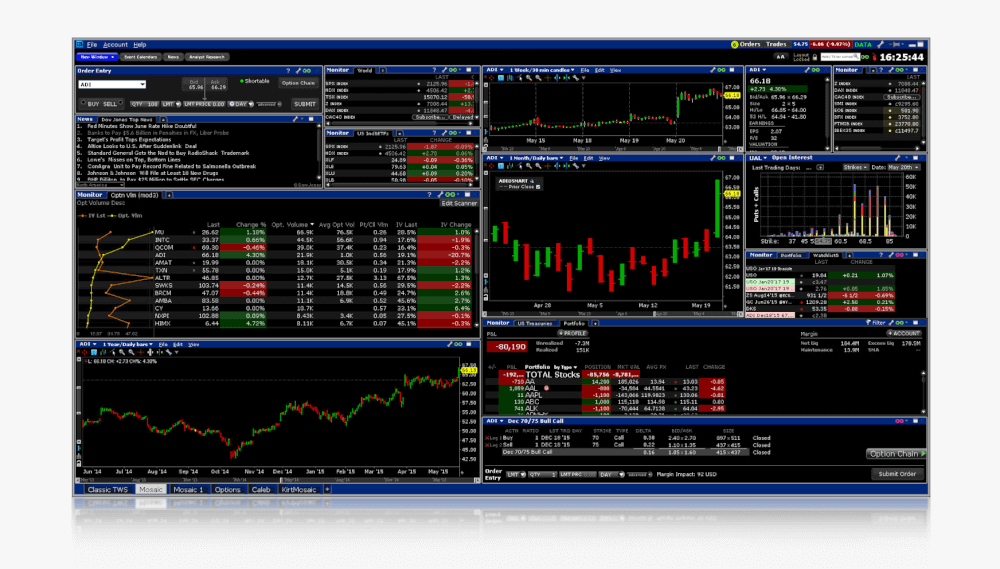

The DOM indicator can be found within the context menu in the MT4 platform, not in the Indicators section. This tool shows a table with the bid and ask levels on a currency pair or other asset, provided by the broker the platform is connected to. Also, the volume is shown to these bids and ask levels to provide information about what is going on behind the chart. When you see higher volume at one of the price levels, you can see where most of the traders have set their positions. If you are not familiar, big banks tend to use these clustered levels to trigger stop losses and also move the price in a direction contrary to the sentiment. Logically, the most popular assets are the big banks’ targets for this activity whereas alternative currency pairs and assets do not show as much sentiment negative correlation to the price. If the DOM tool provides all the information the big banks use, just trading as them is a very good recipe for forex success.

Before we give an opinion on the DOM, let’s see how it is used. Most of the traders will use the DOM for trade entries. Some might find it easier to use the DOM window to set stop loss, take profit, and have a glance at the price range. However, when technical traders look for indicators to include in their systems, they have a role. The roles cover several aspects of forex such as volume measurement, trend entry signals, exit signals, and money management tools that define how much risk (trade size) we put into every trade.

When a tool does not provide any information about these categories, traders are not interested. At least the ones using technical systems to trade. The DOM indicator seems not to cover any of these categories, unfortunately. It is a good tool to see the volume structure across price levels, but how you can use this information in trading is very limited. Whatsmore, if you have a dealing desk type broker, the volume part is not available. ECN brokers, on the other hand, should provide this information.

Even when you have the volume of information from the broker, the DOM tool still does not provide completely useful information. The range to which the volume is shown is just too short. You do not know if that volume is sustainable in the longer term (day). You will need this info to determine the strength of a movement. Volume or volatility need to be high enough for a trader to enter a trade, otherwise, the signals you have from your system will not be reliable enough. So if we want to put the Dom into the volume meter category, it does not provide us with enough range. Additionally, the volume presented in the table does not show what kind of orders make that volume at that price.

Are people going long at that price or short? What is the percentage of traders long and short right not for that asset? How does this volume cluster effect that percentage or sentiment? If the volume cluster structure has the same long to short ratio, it will not change the price direction much. Finally, are the banks going to react to that cluster? The answers to these questions are withheld with the big banks. When all is said and done, the DOM indicator does not give you much, probably the best use of it is for trade entries and typing the stop loss / take profit levels. For making trade decisions, you will need more data this DOM tool integrated into the MT4 platform does not provide. Even if you deal with a broker who provides level 2 quotes, you cannot know how Market type orders will affect the price action.

So let’s pretend you have the ultimate DOM tool, with all the volume ranges, sentiment ratios, and other useful insights. The tool can easily become a trader deception tool by the big players. For example, big banks can split the high volume position they want to be realized into smaller pieces, making the position invisible as it blends with other volume levels. Then, we have EAs or robots that do not have to place pending orders on the broker servers, they have them in their memory and trade market orders as seen by the broker when the memorized level is reached.

Another form of manipulation is deliberate placing high volume (trade position) on one price level by the big banks to make traders see it and attract more trades in one direction. The big banks then cancel the order and place it on the other side, triggering traders’ orders and pushing the price in another direction again. If you want to trade like the big banks you will have to differentiate institutional positions from retail or traders’ positions, which is not possible without a very deep insider insight.

Curiosity is a great trait, exploring other indicators and tools you can use for your system is key to success. However, it also means you will find better ones less and less. Often, you will spend time testing tools and indicators that fail to beat your current best, but this should not avert your quest to improve your system. Maintaining this curiosity as you discover unorthodox tools will be rewarded in many ways. Unfortunately, it looks like efforts to make use of the Depth of Market tool the way we want is in vain. As with many indicator types, there are versions based, mixed, and upgraded with different elements, ultimately creating a tool that can be one of the best on your list.

The DOM indicator has a few variants made by enthusiasts, most of the time it is not for free, but even these have not found a place in our systems. You might find one by the name of the Volume Profile Index, Sentiment tools, etc. If we try to trade the big banks way, we will always be one step back, we lack the information and the power only the big banks have. Instead, prop traders like to stay under their radar, their monitoring for the trader position clusters, and trade only high percentage setups. This is done by trading less popular currency pairs, avoid news trading, popular tools, and focusing on what matters the most – money management and psychology. Hopefully, this article will save you a lot of time when it comes to the DOM tool.