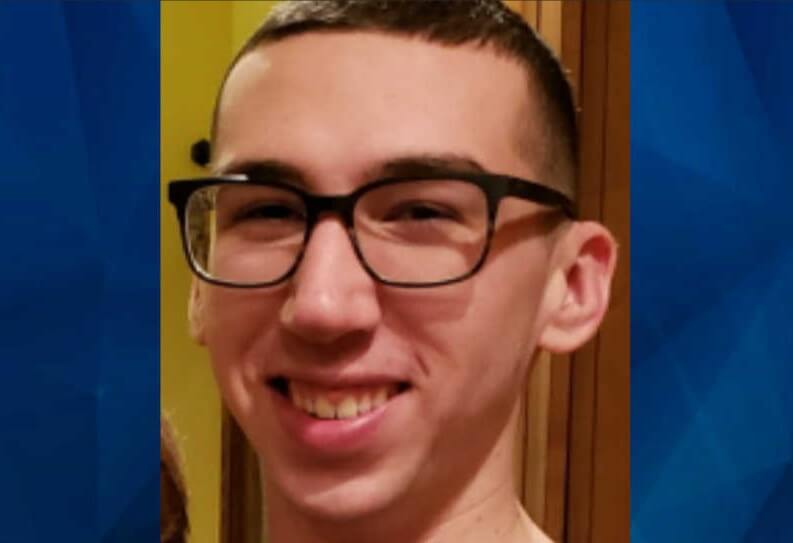

Many of you may have heard of Alexander Kearns, but for those that have not, it is a sad situation where a young man, just 20-years old took his own life due to an error in a trading system which showed him in approximated $730,000 debt with a broker.

When the Covid-19 pandemic hit, Alexander Kearns decided to take up trading. He took advantage of the fact that many brokers are offering their clients leverage, which is basically the act of lending you money in order to make larger trades than your account would otherwise be able to make. It was due to this leverage on offer that this mistake took place. His account showed a negative balance of $730,000, something that he believed he would have had to pay back in one way or another. Due to the immense stress of the situation, Alexander sadly took his own life. Of course, this was totally avoidable. Even worse, the balance was a mistake by the app, and the account wasn’t actually in the negative.

For those active in the trading community, they know that this sort of tragedy could have been easily avoided. Alexander came into trading with very little knowledge of how certain areas work, which is why it was so avoidable. Had he known that accumulating this sort of debt so quickly would be extremely hard to do, even for the worst traders out there, it would have helped him to understand the fact that many brokers now offer negative balance protection, preventing you from owning anything should you lose your account.

It is important that we learn from this tragedy in order to help ensure that nothing similar happens again in the future. In order to do this there are a few things that we can take away from this which could help prevent any further tragedies, so let’s take a look at some of the things we have learned.

Understand Leverage

Leverage is a wonderful thing, as it can give you the opportunity to make a lot of extra money. It basically increases the trading power of your account, but it also has its downside. While it increases profits, it can also increase potential losses. Remember you are now trading with larger trade sizes, so if things go the wrong way, you will ultimately lose more. You need to have an understanding of how this works before you begin to trade. Learn the ups and downs and ensure that you are not trading with leverage that is simply too high. Some brokers offer 2000:1 leverage, this is simply too high and very dangerous for a new trader.

Negative Balance Protection

One of the most important things for a new trader is negative balance protection. This is simply where a broker does not allow you to go into a negative balance. Instead, as things go the wrong way and your account equity lowers, the broker will automatically close all trades that you have open in order to prevent you from going into a negative balance. Of course, those trades will be closed at a loss and you will have lost the majority of money in your account, but at least you do not owe anything extra on top of that. The majority of brokers now offer this service, so be sure that when signing up for a broker you make sure that this is on offer. While we hope you will never have to use it, if you do, it could save you a lot of money and also help to avoid any situations similar to Alexander Kearns.

Understand the Risks

It is not only about understanding what the risks are, but also how you can manage them and potentially reduce them. There are a lot of different risks involved when it comes to trading, things like leverage, the markets going the wrong way, different risk to reward ratio, no stop losses or taking profits, and more. What we need to do is to get a good understanding of how to reduce them. Stop losses are a great way to prevent risk, so is using the appropriate lot size and trade size. When you create your strategy you also need to create a set of rules for entering trades as well as exiting them, you also need to decide on the trade size and anything else like this. Having all of this predetermined is a great way of ensuring that you stick to them.

Use Stop Losses

Stop losses are there to protect you and to prevent you from losing too much. Without them, a single trade could potentially make you lose your entire account. Instead, having a stop loss in place will mean that your loss for each trade will be fixed, this will help you to prevent huge losses with each trade and ultimately save your account. Ensure that with every single trade, you have a stop loss in place to help protect you, you should never be trading without one, under any circumstance.

Only Trade What You Can Afford

This is one of the big ones. You have probably seen this warning out there as you look through forex and trading related sites. You should only trade what you can afford to lose. If you think about the money that you are putting in, if you were to lose that money, would it hurt you? Would it prevent you from paying rent or anything like that? If the answer is yes to any sort of question like that then you should not be trading with it. You need to only trade with your expendable income and not any funds that you need.

Avoid Volatility

Volatility can be a trader’s best friend, but as a newer trader, you should try and avoid it. When there are big news events coming out or the markets are simply jumping up and down, you should try and avoid trading in this situation. Yes, it can increase your profit potential, but it can also increase your loss potential, which as a new trader, is far more likely to get you at one point or another. It is far better to simply avoid these situations rather than to risk trading.

Choose The Right Instrument

As a new trader, you need to be careful which assets you decide to trade. Some of them are far more volatile than some of the others. In fact, some should be avoided at all costs. As a new trader, you should probably try trading the major currency pairs rather than anything else, at least until you are used to trading and how it all works. Going for something different will simply mean that you are trading higher volatility which can be more dangerous.

So those are some of the things that we have learned from the tragedy of Alexander Kearns. It is important that we do what we can to try and avoid anything similar happening again in the future. Using what we have learned can make it safer for us to trade. As a new trader, learn from what we have written above and understand the risks before you put any money into your trading account.