Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the global market. Millions of people participate in Forex trading every day, making it one of the largest financial markets in the world. If you are interested in trading Forex, you will need to create a Forex account. Here is a step-by-step guide on how to make a Forex account.

Step 1: Choose a Forex Broker

The first step in creating a Forex account is to choose a Forex broker. A broker is a company that provides traders with access to the Forex market. There are many Forex brokers available, so it is essential to find a reliable and reputable broker. Look for a broker that is regulated by a reputable regulatory body such as the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia.

Step 2: Open a Forex Account

Once you have chosen a Forex broker, you can open a Forex account. Most brokers offer different types of accounts to suit different trading needs. You can choose from a demo account or a live account. A demo account is a practice account that allows you to simulate trading without risking real money. A live account is a real trading account that requires you to deposit real money.

Step 3: Complete the Application Form

To open a Forex account, you will need to complete an application form. The application form will require you to provide your personal information, including your name, address, email address, and phone number. You will also need to provide your financial information, including your income, employment status, and net worth. The broker will use this information to assess your suitability for Forex trading.

Step 4: Verify Your Identity

Most Forex brokers require traders to verify their identity before they can start trading. This is to prevent fraud and money laundering. To verify your identity, you will need to provide the broker with a copy of your passport or driver’s license and a utility bill or bank statement that shows your name and address.

Step 5: Fund Your Account

Once your Forex account is verified, you can fund your account. Most brokers accept various payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal and Skrill. The minimum deposit required to open a Forex account varies from broker to broker, but it is typically around $100.

Step 6: Download a Trading Platform

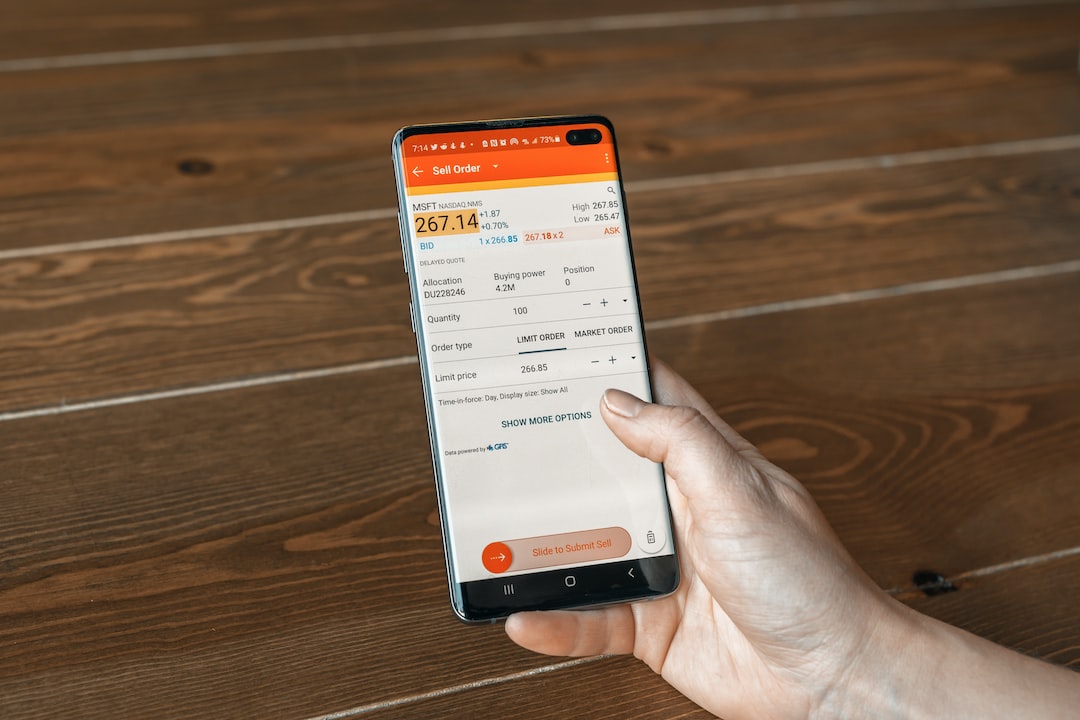

To start trading Forex, you will need to download a trading platform. Most brokers provide traders with a trading platform that they can download for free. The trading platform is the software that allows you to access the Forex market and execute trades. It is essential to choose a trading platform that is user-friendly and has all the features you need to trade Forex successfully.

Step 7: Start Trading

Once you have downloaded the trading platform, you can start trading Forex. The Forex market is open 24 hours a day, five days a week, so you can trade at any time that suits you. To start trading, you will need to choose the currency pair you want to trade, decide whether you want to buy or sell, and enter the amount you want to trade. It is essential to have a trading strategy and to manage your risk carefully.

Conclusion

Creating a Forex account is a straightforward process, but it is essential to choose a reputable broker and to verify your identity before you start trading. It is also crucial to have a trading strategy and to manage your risk carefully. With the right broker, trading platform, and strategy, Forex trading can be a profitable and exciting way to invest your money.