Today we’re gonna talk about what diversification means and gold as part of a diversified portfolio. Finally, we will analyze the gold, what has happened in recent months, and what we expect from it in the coming months.

If we want to define diversification we could do it as a way to invest in different assets with the aim of reducing portfolio risk. There are different theories and formulas, but the important thing is to understand that the assets in which you invest have to be totally or partially uncorrelated. Investing in BBVA and Telefónica at the level of decoupling is of little use. It obviously implies a small diversification (although only sectoral), but they are quite correlated assets. If the bag goes down or up, as the beta of the two is very similar, the two will go up and down. As we can assume, this is not the best way to reduce risk or volatility. The same would be extendable, for example, to the case of buying the American stock exchange: within being diversifying (geographically), we would be doing it with a highly correlated product.

If we want to define diversification we could do it as a way to invest in different assets with the aim of reducing portfolio risk. To make effective and real diversification we have to do it by investing in assets that have a correlation close to 0, both positive and negative. To diversify you can combine many assets, but there is a limit after which, even by increasing the number of assets in a portfolio, you do not reduce risk (It is called systemic risk).

Some theories say that this number varies between 8 and 12 assets, but depends a lot on whether they are separate assets, funds, or sectoral indices. To make effective and real diversification we have to do it by investing in assets that have a correlation close to 0. To build an efficient portfolio, we need to know the volatility (variance of the assets that make it up), and its correlations. Thus we can estimate the optimal diversification of a portfolio (also called an efficient border).

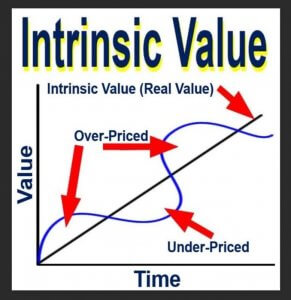

It is important to note that the correlations of these assets, which make up a portfolio, vary over time. For this reason, the composition of the portfolio has to be adjusted if we want to have optimal and efficient diversification.

One of the great virtues of the Seasonal Quant Multistrategy Sphere, FI is precisely that it is not correlated with any other asset as it develops a unique strategy based on the seasonalities of raw materials. For this reason, it can perfectly be part of the diversification of an efficient portfolio, more when it has really low volatility and therefore is suitable for the vast majority of investors.

Lately, there have been many comments from permanent portfolios, which are always on the market, but we think that in the case of gold this is not entirely true. You have to know how to choose the moment, as in many other investments, since gold can bring negative returns to the portfolio at certain times and even increase volatility. Let’s see it.

For starters, let’s compare the long-term behavior of gold with the SP500 index and 10-year American bonds (treasuries). We take the VOO (ETF of the SP500), the GLD (ETF of gold), and the TLT (ETF of long-term bonds). The comparison began in 1974 after the gold standard with Nixon ended in 1971. It coincides that it is the first year that has long-term bond data. “Heavy spending for the Vietnam War”

Gold has its moments, in 1974 it goes up 72%, while the SP500 goes down 26%. During the dot.com bubble gold rose by 21% (2000-2002) while the SP500 fell by 38% and in the last crisis 2008, the SP500 fell by 38% while gold only rose by 8%. In 1980 gold was quoted at 590/oz and in 2005 it was worth the same.

Combining an asset always with another asset with which it has a near zero or negative correlation does not help much if the asset in question is not of absolute return. And it has its times as bad as gold. I mean, you have to know the time to have it in your wallet.

Gold may be a safe haven currency, it even seems to beat inflation during the comparison period, but not having much more utility should not be added to a permanent portfolio as a long-term investment, because in many cases it has very negative returns and adds volatility to the portfolio. In addition, it often does not serve as coverage in bad times, as has been shown.

“If you look at the March data, we see that they have all dropped, gold, equity, and bonds. Something incredible. We call this total correlation.”

Let’s give an example, if we stop to observe in the March data, you see that they’ve all gone down, gold, equity, and bonds. That’s amazing. We call this total correlation. Assets that a priori should not move in tandem, do so and this destroys any portfolio. This is the reason why the management team of the Seasonal Sphere Quant Multistrategy, FI thinks that you have to have gold in your portfolio, but selectively and punctually. We have already taken a position and will continue to ponder it as long as external factors indicate that it is reasonable to have it because it can provide profitability and control of volatility.

What happened in the past months and what we expect from GOLD in the coming months? What happened in March to make everything correlate? To find out the best time to have gold in the portfolio we believe it is important to know what happened in March and the previous months with gold.

There are two main reasons for this March downturn. The first is in the futures market. The fact that speculators are strongly positioned long hands does not like it. The good thing about being all leveraged is that with a small move you clean up the market and this is precisely what happened. Strong hands shake the tree a little so that those who can’t keep warranties close (they’ll buy back in highs and help raise the price further when strong hands come off.).

There are two main reasons for this March downturn. The first is in the futures market. The fact that speculators are strongly positioned long hands does not like it. The good thing about being all leveraged is that with a small move you clean up the market and this is precisely what happened. Strong hands shake the tree a little so that those who can’t keep warranties close (they’ll buy back in highs and help raise the price further when strong hands come off.).

And the cleaning of the market came:

We have seen the fastest decline in the equity market in years, even I think we can say the fastest in history (in days). Liquidity has been reduced even in the high-quality bond market and all accompanied by a rise in bestial volatility.

A rise in volatility leads to higher collateral margins for participants, that is, the money they need to take into account every day in order to keep their leveraged positions open. And as many operators lost in equities and fixed income the shortage of volume made them sell at worse prices, because many chose to sell what was still in profits and had liquidity. This dragged to the market at the time when everything went wrong. It rarely happens, but it does happen, so it’s important to diversify a portfolio with the right assets.

In addition, the market needed to be cleaned up so that something out of the ordinary could happen and the market could return to highs. We can observe that during the mass liquidations of March, more or less 100,000 contracts (100000x100x1720= about 17.2MM (nominal billion) have left the market, giving the green light to see new highs. In addition, there have been two more events, the Coronavirus (Covid-19) which is an event not expected by anyone (we have also seen how it has put the world economies against the wall) and of course, as expected, central banks all agree to mass-print money (more than ever) as a theoretically infallible remedy to exit the crisis. We will see in the future how the experiment ends.

With the current price of the future of gold over $1,720, a significant volume of open positions on call 2,500 this December, but also on call 3,000, and even on call 4,000. In addition, there is still a very strong interest for the call 3.500 and call 4.000 of June 2021. Therefore, and although we know that options positions are often part of a more complete portfolio, combined with futures or with options spreads, we conclude that there is a very strong bullish bet on gold by the market.