Etrade, one of the leading online brokerage firms in the United States, announced in 2015 that it would no longer offer forex trading services to its clients. The decision was a surprise to many traders who had been using the platform for their foreign exchange transactions. In this article, we will explore the reasons behind Etrade’s decision to quit offering forex and what it means for the forex market.

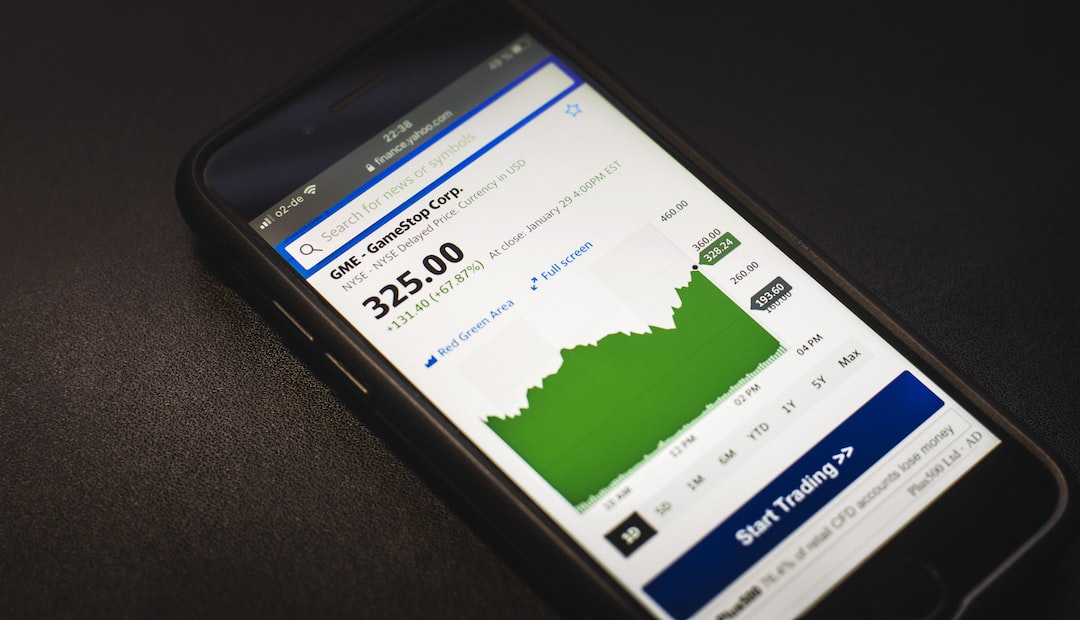

Forex, also known as foreign exchange or FX, is the largest financial market in the world, with an estimated daily trading volume of $6.6 trillion. It involves the buying and selling of currencies, with the aim of making a profit from the fluctuations in exchange rates. Forex trading has become increasingly popular in recent years, as more investors seek to diversify their portfolios and take advantage of the potential for high returns.

Etrade had been offering forex trading services since 2001, but in 2015, it decided to discontinue the service. The decision was met with mixed reactions from traders, some of whom were disappointed while others were not surprised. So, why did Etrade quit offering forex?

One of the main reasons for Etrade’s decision was the high level of risk associated with forex trading. Forex markets are highly volatile, and exchange rates can fluctuate rapidly due to a wide range of factors, including political events, economic data releases, and geopolitical tensions. This volatility can make it difficult for traders to predict market movements and can result in significant losses.

Etrade’s decision to quit offering forex was likely driven by a desire to reduce its exposure to risk. By discontinuing the service, Etrade was able to focus on its core business of stock and options trading, which are generally considered to be less risky than forex trading.

In addition to the high level of risk, forex trading is also highly regulated. Foreign exchange markets are subject to a complex web of regulations and rules, which can vary from country to country. This can make it difficult for brokers like Etrade to operate in multiple jurisdictions and comply with all the relevant regulations.

By discontinuing its forex trading services, Etrade was able to simplify its operations and reduce its regulatory burden. This allowed the company to focus on its core business and provide a better experience for its clients.

Finally, Etrade’s decision to quit offering forex may also have been influenced by the changing landscape of the forex market. In recent years, the market has become increasingly competitive, with a growing number of online brokers and trading platforms entering the market.

This increased competition has led to a race to the bottom in terms of pricing, with many brokers offering low-cost trading services in order to attract clients. This has put pressure on Etrade and other established brokers to keep up with the competition, which may have made it more difficult for them to make a profit from forex trading.

In conclusion, Etrade’s decision to quit offering forex was likely driven by a combination of factors, including the high level of risk associated with forex trading, the complex regulatory environment, and the changing landscape of the forex market. While some traders may have been disappointed by the decision, it was ultimately in the best interest of the company and its clients. Forex trading remains a popular and lucrative market, but it is important for traders to understand the risks involved and to choose a broker that is reputable and trustworthy.