Forex and stocks are two of the most popular financial instruments for trading. Both of them offer unique opportunities for investors to make profits. However, the question that often arises is, which one is easier to trade? In this article, we will take a closer look at both forex and stocks and evaluate their differences to determine which one is easier to trade.

Forex Trading

Forex, also known as foreign exchange, is the largest financial market globally, with a daily turnover of over $6 trillion. The forex market involves the buying and selling of currencies from different countries. The primary goal of forex trading is to make a profit by speculating on the movement of currency exchange rates.

Forex trading is primarily done through a forex broker, who acts as the intermediary between the trader and the market. The trader can access the market through the broker’s trading platform, which provides access to real-time price quotes, charts, and other trading tools.

One of the significant advantages of forex trading is the high liquidity of the market. This makes it easier for traders to enter and exit trades quickly, without worrying about liquidity issues. Another advantage of forex trading is the availability of leverage, which enables the trader to open larger positions with a smaller initial investment.

However, forex trading also comes with its own set of challenges. The forex market is highly volatile, which means that currency exchange rates can fluctuate rapidly, making it difficult to predict market movements accurately. Additionally, the forex market is open 24 hours a day, five days a week, which can be challenging for traders to keep up with.

Stocks Trading

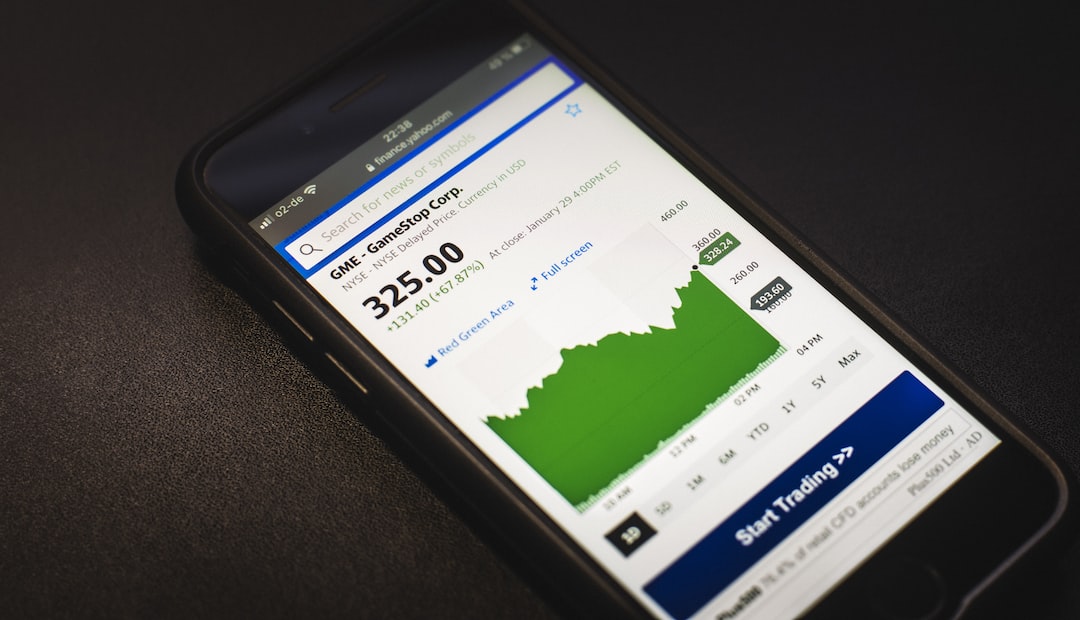

Stocks, also known as equities, represent ownership in a company. When an investor buys a stock, they are buying a share of the company’s ownership. The primary goal of stocks trading is to make a profit by buying low and selling high.

Stocks trading can be done through a stockbroker or an online trading platform. The trader can access the market through the broker’s trading platform, which provides access to real-time price quotes, charts, and other trading tools.

One of the significant advantages of stocks trading is the availability of a wide range of investment options. There are thousands of publicly traded companies to choose from, providing investors with a diverse portfolio. Additionally, stocks trading is less volatile than forex trading, making it easier to predict market movements accurately.

However, stocks trading also comes with its own set of challenges. The stock market can be affected by various factors, such as economic conditions, political events, and company-specific news. This makes it difficult for traders to accurately predict market movements. Additionally, stocks trading is less liquid than forex trading, which can make it difficult to enter and exit trades quickly.

Which One is Easier to Trade?

When it comes to deciding which one is easier to trade, it ultimately depends on the trader’s individual preferences and experience. Both forex and stocks trading have their own set of advantages and challenges, and traders need to evaluate them based on their goals and risk tolerance.

Forex trading is ideal for traders who prefer a more dynamic and fast-paced trading environment. The high liquidity and availability of leverage make it easier for traders to enter and exit trades quickly. However, the high volatility of the market can make it challenging for traders to accurately predict the market movements.

On the other hand, stocks trading is ideal for traders who prefer a more stable and predictable trading environment. The wide range of investment options and less volatile market make it easier for traders to make informed decisions. However, the less liquidity of the market can make it difficult for traders to enter and exit trades quickly.

In conclusion, both forex and stocks trading offer unique opportunities for traders to make profits. However, the decision of which one is easier to trade ultimately depends on the trader’s individual preferences and experience. Traders need to evaluate the advantages and challenges of both markets to determine which one is the best fit for their trading style.