The foreign exchange market, or Forex, is the largest financial market in the world, with a daily trading volume of over $5 trillion. It is a decentralized market where currencies are bought and sold, and it is affected by a wide variety of factors. Understanding these factors is essential for anyone looking to trade on the Forex market.

One of the most significant factors affecting the Forex market is global economic conditions. Economic indicators, such as GDP, inflation, and employment rates, can have a significant impact on currency values. For example, if a country’s GDP grows faster than expected, its currency is likely to appreciate against other currencies.

Another factor that affects the Forex market is political events. Political instability, elections, and government policies can all have a significant impact on currency values. For example, if a country is experiencing political turmoil or uncertainty, investors may be hesitant to invest in that country, causing the value of its currency to decline.

Central bank policies also play a crucial role in the Forex market. Central banks have the power to influence interest rates, which can have a significant impact on currency values. When a central bank raises interest rates, it can attract foreign investors, increasing demand for the currency and causing its value to appreciate.

In addition to these macroeconomic factors, market sentiment and technical analysis also play a role in the Forex market. Market sentiment refers to the overall attitude of investors towards a particular currency or market. Positive sentiment can lead to increased demand for a currency, while negative sentiment can cause its value to decline.

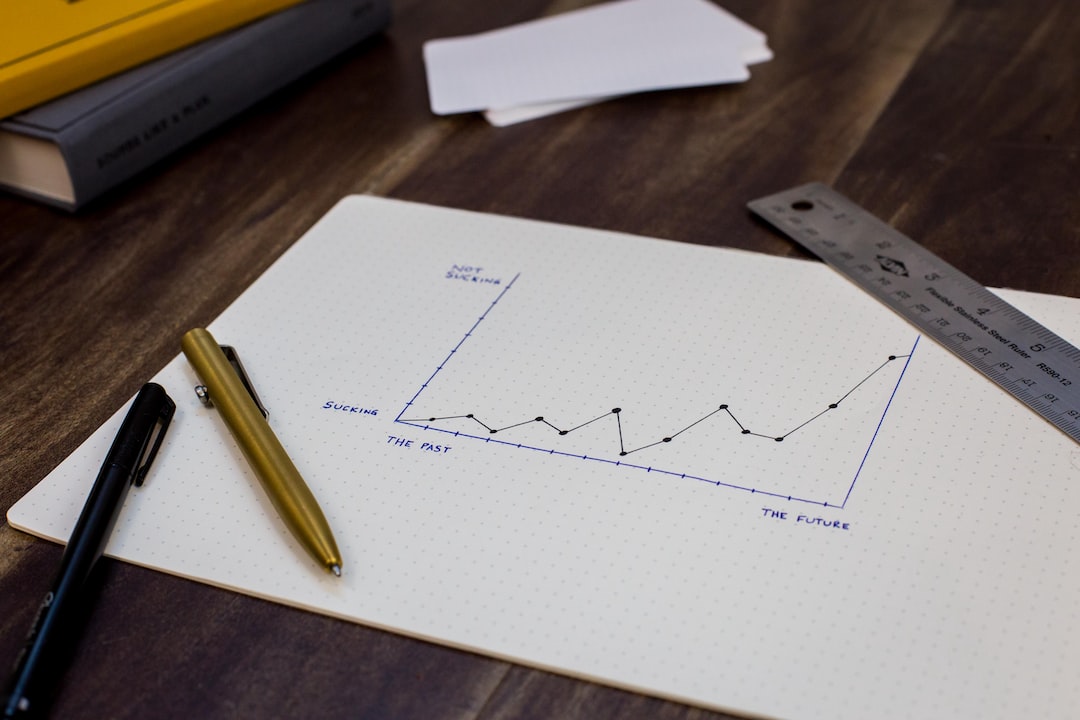

Technical analysis involves the use of charts and other technical indicators to identify trends and patterns in the market. Traders use technical analysis to identify potential buying and selling opportunities, and to make informed trading decisions.

Finally, global events such as natural disasters, terrorist attacks, and pandemics can also affect the Forex market. These events can lead to increased volatility and uncertainty, causing traders to adjust their strategies and positions.

In conclusion, the Forex market is affected by a wide variety of factors, including economic conditions, political events, central bank policies, market sentiment, technical analysis, and global events. Understanding these factors is essential for anyone looking to trade on the Forex market, as it can help them make informed trading decisions and minimize their risk.