Understanding the Basics of IQD Forex Trading

Forex trading has become increasingly popular among investors and traders around the world. With its potential for high returns and the ability to trade 24 hours a day, it has attracted individuals from various backgrounds. One of the currency pairs that traders often focus on is the Iraqi Dinar (IQD). In this article, we will delve into the basics of IQD Forex trading and provide insights into its unique characteristics.

The Iraqi Dinar, denoted by the currency code IQD, is the official currency of Iraq. Since the country went through a period of political instability and economic turmoil, the value of the Iraqi Dinar has fluctuated significantly over the years. This volatility has attracted many traders who seek to profit from these price movements.

One key factor to consider when trading the IQD is the country’s geopolitical situation and its impact on the currency. Iraq’s economy heavily relies on oil exports, making it vulnerable to fluctuations in global oil prices. Additionally, political instability and conflicts can have a profound effect on the value of the Iraqi Dinar. Traders need to stay informed about these factors and their potential impact on the currency’s value.

When trading the IQD, it is essential to understand the basics of Forex trading. Forex, short for foreign exchange, refers to the buying and selling of currencies. Traders aim to profit from the fluctuations in exchange rates between different currencies. In the case of IQD Forex trading, traders would be looking to profit from changes in the value of the Iraqi Dinar against other major currencies like the US Dollar (USD) or the Euro (EUR).

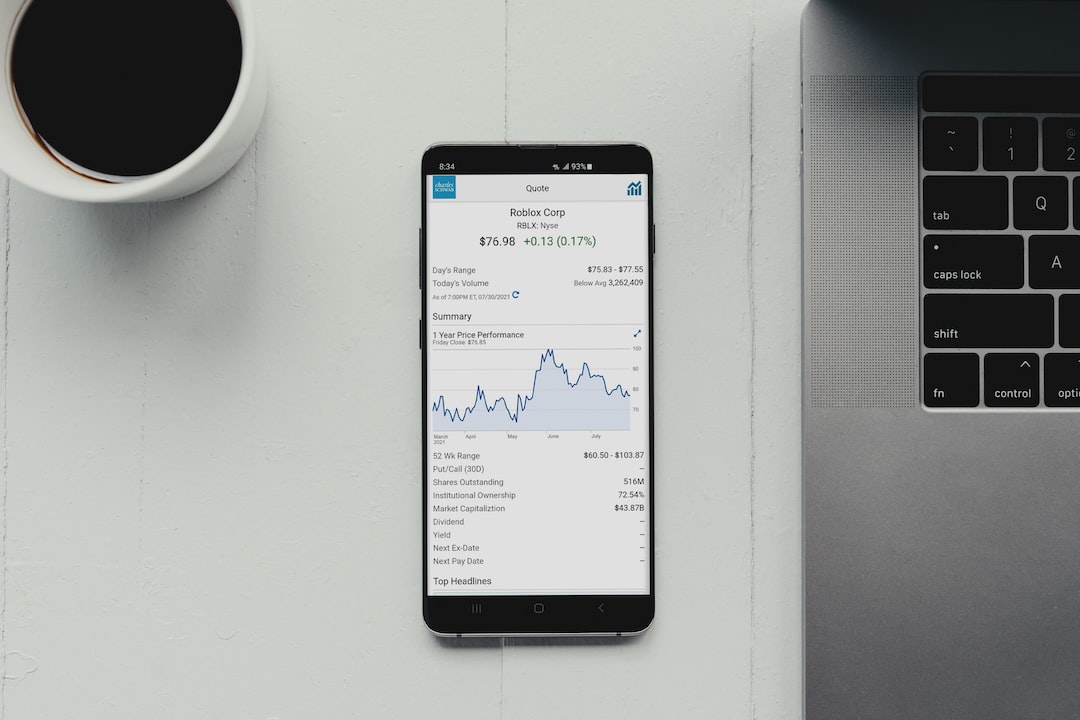

To trade IQD Forex, traders would typically use an online Forex broker. These brokers provide trading platforms that allow traders to execute trades, access real-time market data, and utilize various technical analysis tools. It is crucial to choose a reputable broker with competitive spreads, reliable customer support, and a user-friendly platform.

One common trading strategy used in Forex trading is technical analysis. This approach involves analyzing historical price data and using various technical indicators to identify potential trading opportunities. Traders can use indicators like moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) to assess market trends and make informed trading decisions.

Another essential aspect of IQD Forex trading is risk management. Forex trading can be highly volatile, and traders need to implement risk management strategies to protect their capital. This includes setting stop-loss orders to limit potential losses and using proper position sizing techniques. Traders should also consider diversifying their portfolios by incorporating other currency pairs or assets to mitigate risk.

It is also crucial for IQD Forex traders to stay updated with economic news and events that may impact the currency’s value. Economic indicators such as GDP (Gross Domestic Product), inflation rates, and interest rate decisions can significantly influence the Iraqi Dinar. Traders should have a reliable news source and use an economic calendar to stay informed about upcoming events that might affect their trades.

Furthermore, traders should be aware of the potential risks associated with IQD Forex trading. Due to the political and economic situation in Iraq, the market liquidity for the IQD might be lower compared to other major currency pairs. This can lead to wider spreads and increased volatility. Additionally, the IQD is considered an exotic currency, and liquidity may vary between different Forex brokers.

In conclusion, IQD Forex trading involves buying and selling the Iraqi Dinar against other major currencies. Traders need to understand the unique characteristics of the Iraqi Dinar, including its vulnerability to geopolitical events and its reliance on oil exports. By using proper risk management strategies, conducting technical analysis, and staying informed about economic news, traders can increase their chances of success in IQD Forex trading. However, traders should also be aware of the potential risks associated with trading exotic currencies and choose a reputable Forex broker to execute their trades.