Understanding Forex CFDs: A Beginner’s Guide to Trading

Forex trading has gained immense popularity in recent years, attracting individuals from all walks of life who are looking to capitalize on the fluctuations in currency exchange rates. One of the most popular ways to trade forex is through Contracts for Difference (CFDs). In this beginner’s guide, we will provide a comprehensive understanding of Forex CFDs and how to get started with trading.

What are Forex CFDs?

Forex CFDs are financial derivatives that allow traders to speculate on the price movements of different currency pairs without owning the underlying assets. CFDs are contracts between the trader and the broker, wherein the trader predicts whether the price of a currency pair will increase or decrease. If the trader’s prediction is correct, they make a profit, and if it is incorrect, they incur a loss.

How do Forex CFDs work?

When trading Forex CFDs, traders are essentially entering into an agreement with a broker to exchange the difference in the value of a currency pair between the time the contract is opened and closed. This means that traders can profit from both rising and falling markets.

Let’s say a trader believes that the value of the Euro will increase against the US Dollar. They open a long (buy) position on the EUR/USD currency pair. If the Euro strengthens as predicted, and the exchange rate rises, the trader will make a profit. Conversely, if the Euro weakens and the exchange rate falls, the trader will incur a loss.

Advantages of Forex CFDs

1. Leveraged Trading: Forex CFDs offer traders the opportunity to trade with leverage, which means they can control a larger position with a smaller amount of capital. This amplifies potential profits but also increases the risk of losses. It’s important for beginners to use leverage cautiously and understand the associated risks.

2. Access to Global Markets: Forex CFDs provide access to a wide range of currency pairs from various global markets. This allows traders to diversify their portfolios and take advantage of opportunities in different economies.

3. 24/5 Market: The forex market operates 24 hours a day, five days a week. This means that traders can enter and exit positions at any time, providing flexibility and the ability to react to market events in real-time.

4. Risk Management Tools: Forex CFD brokers offer risk management tools such as stop-loss orders and take-profit orders. These tools help traders set predefined levels at which their positions will be automatically closed, limiting potential losses and securing profits.

Getting Started with Forex CFDs

1. Educate Yourself: Before starting to trade Forex CFDs, it’s crucial to gain a solid understanding of the forex market, fundamental and technical analysis, and risk management strategies. There are numerous educational resources available online, including tutorials, webinars, and e-books, which can help beginners build a strong foundation.

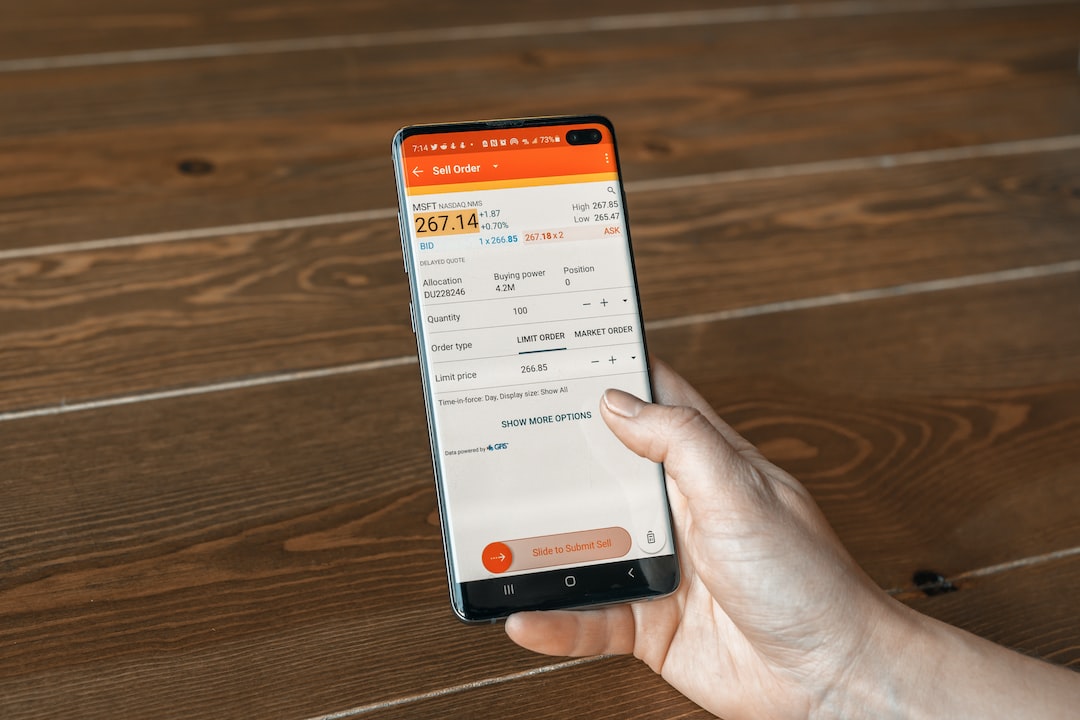

2. Choose a Reliable Broker: Selecting a reputable forex CFD broker is essential for a successful trading experience. Look for brokers that are regulated by recognized authorities and offer competitive spreads, user-friendly platforms, and a wide range of currency pairs.

3. Open a Demo Account: Most brokers provide demo accounts that allow beginners to practice trading in a risk-free environment. These accounts use virtual funds, providing an opportunity to familiarize yourself with the platform and test different trading strategies before risking real money.

4. Develop a Trading Plan: A trading plan outlines your trading goals, risk tolerance, and strategies. It serves as a roadmap to guide your trading decisions and helps you remain disciplined during volatile market conditions.

5. Start with Small Positions: It’s advisable for beginners to start with small positions and gradually increase their trading size as they gain experience and confidence. This approach helps manage risk and minimizes potential losses.

6. Continuous Learning: Forex trading is a dynamic and ever-changing market. It’s crucial to stay updated with market news, economic indicators, and geopolitical events that can impact currency prices. Continuously learning and adapting your trading strategies is key to long-term success.

Conclusion

Forex CFDs provide a unique opportunity for beginners to participate in the global forex market and potentially generate profits from currency price fluctuations. Understanding the basics of Forex CFDs, choosing a reliable broker, and developing a trading plan are crucial steps for success. However, it’s important to remember that forex trading involves risk, and beginners should approach it with caution, utilizing risk management tools and continuously educating themselves to mitigate potential losses.