Investors will always try to diversify their investments in order to reduce their risk. Specifically seek the investments of safe haven that have a better when the rest of the market drops. Of these safe investments – treasury bills, Swiss francs, and others, investors think gold is the best. For this reason, you will see that investors often include gold in their portfolios. Now with COVID19, gold is the order of the day and has a lot of attention from investors

Gold as Merchandise

Like any other asset, the price of gold is determined by demand and supply. Most of the world’s gold comes from hard rock mining, but it can also be produced by alluvial mining methods or as a by-product of copper mining. China, Australia, and Russia are the largest gold producers in the world. Regarding demand, the main use of gold is jewelry production. It is also used in aerospace, medicine, dentistry, and electronics. Governments and central banks are gold buyers.

At present, the United States is the largest holder of gold, while Germany is second and the International Monetary Fund ( IMF) third. Private investors like you are also interested in buying gold and treat the purchase of gold as an investment. For this reason we have thought to make this guide.

Why are private investors investing in gold? Instead of keeping money in cash, investors can buy gold when they expect a recession, geopolitical uncertainty, inflation, or currency depreciation. Sometimes they keep it as insurance against the market crash. You can’t always predict unwanted events, so it makes sense to keep assets that do well as protection against a market crash.

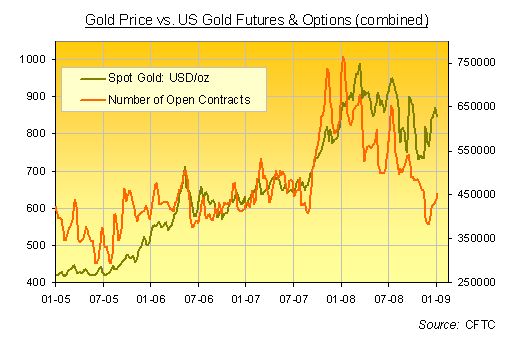

Over the past 40 years, gold has recorded significant gains from 1979 to 1980 and from 2000 to 2011. It fought during the 1990s and after 2011. Fears of inflation and recession led to gold peaking in 1980, while several events caused gold to be traded higher after 1999. The 9/11 attacks and the war in Iraq kept the price high until 2003. The insurance purchase was behind the gold surge in the 2007 recession. It continued its upward trend as the market traded downwards, with economic uncertainty as to the main issue.

Problems in Europe, the weakening of the US dollar, and concerns about economic recovery kept the price of gold high until 2011. Do not think that gold behaves itself or always well. It has had difficulties during the 1990s due to GDP growth in the US, interest rate increases in 1995, and a strict fiscal policy. After 2011, the strength of the U.S. dollar and the U.S. economy damaged gold. The stock market broke a downward trend and became an upward trend and investors were not as interested in owning gold as insurance. So, now you know a little more about gold and why people can invest in it, let’s see how you can invest in gold

Investing in Physical Gold

If you want to expose yourself to gold, one way is to buy gold jewelry, gold coins, or gold bullion. Gold bullion is traded very close to the price of gold and may refer to gold bars or gold bullion coins.

Gold bars have no artistic value, which differentiates them from jewellery or coin. To buy gold bullion you must pay a premium on the price of gold that can be in a range of 3 to 10 percent. You will also need to use a vault or bank deposit box to store it. You can buy physical gold online, at a jewelry store, or at another gold store.

Before buying, make sure that the price is right, the gold is real and proven, and that you’re not paying a higher premium for collector coins if you’re just looking for pure gold. Be willing to move away if these rules are not possible to comply with, in particular, if it is an online store or a shop window of dubious repute.

A trusted online store with a 4.9 rating in the google store is Silver Gold Bull, which not only allows you to buy gold, but will also store it, and buy it back if you decide to sell it for a profit. When you buy gold, you need to store it properly. It is possible to store it at home, but security problems could arise in this case. If you prefer to do so buy and keep it at home, make sure you have a proper safe, and take steps to protect your property.

Buying Gold Futures

Futures contracts are standard contracts traded on organised exchanges. Allow an investor to sell or buy an underlying in a given time in the future and at the price of the futures contract. First, you need to open an account with a broker. My recommendation is to use Interactive brokers as it is the broker I use 20 years ago and has never been a problem.

The gold futures contract at the Chicago Mercantile Exchange covers 100 troy ounces (ZG), although there is also a future smaller Mini that has no physical delivery (QG). To operate it, it is necessary to deposit an initial margin, which is a minimum amount necessary to open a position. Every day your position will be marked to the market. This means that if the value goes in your direction, you will get a profit, but if it goes against you, you will lose money.

If your account falls below the maintenance margin, you will need to transfer money to your account to meet the securities required by the broker. Futures contracts are leveraged instruments. You only need the balance of your account to be equal to the initial margin, which is less than the value of the entire contract. A 100-ounce contract is currently worth about $170,000, and you only need an amount less than $10,000 to open a position.

Some brokers do not have the delivery option, so the contract is settled in cash when it expires. Maturity is also a standardized feature of the gold futures contract and investors can choose their time horizon based on standard maturity. The prices of subsequent maturity contracts may be higher than the spot price and early maturity futures. When this is the situation, we usually say that the financial market is in a quagmire.

In another situation, when the spot price or the price of early-maturity contracts is higher than the price of late-maturity futures contracts, we are behind schedule. If you find yourself buying gold at the time the market is in contango, you additionally will have to pay a premium for contracts later due.

Invest in Gold ETFs

If you’re not a fan of investing in gold futures, you can try gold ETFs. Instead of having a futures contract and paying attention to the maintenance margin, you can buy shares in ETFs and get gold exposure.

If this is the first time you’ve been able to invest in ETF before and want to start, you must understand its operation well. Once you choose a broker, just open an account and choose your preferred gold ETF. The most popular gold ETF is SPDR Gold Shares (NYSE: GLD) and costs 0.40 percent per year to own it. ETF follows the price of gold bullion.

Investing in Gold Mining Companies

An investment in gold mining companies offers gold exposure, but exposure is sometimes limited. These companies carry operational risks, which can break the correlation with the price of gold. Gold miners are at risk of default and their shares may be quoted lower in case of an operational problem with the company, regardless of the price of gold.

ETFs seem to be the best way to invest in gold. If you don’t like to own futures and control initial and maintenance margins, you can buy shares in an ETF and follow the price of gold bullion. GLD is a liquid instrument and does not have high transaction costs. Futures are sometimes difficult to handle, so ETFs can be the right move.

Invest in Gold CFDs

If you don’t want to open a futures account or don’t have that much capital, you can buy gold CFDs at a regulated broker. In these cases, the investment can be from about 1000 euros in a regulated broker. The fundamental aspect that you have to pay attention to is in the Swap, which is the daily cost that the broker will charge you for keeping a CFD from one day to the next.