Quantum Swing Index QSI is an indicator created in September 2015 by developer Dzhafer Medzhakhed. The developer claims to have analysed many of the indicators available on the market and has concluded that there is no appropriate instrument to judge whether the price of an asset is overbought or over-priced. He has spent several years researching and analyzing the market until he has created a new mathematical model called the Quantum Swing Index (QSI) which shows much more accurately the areas where the market is overbought.

Overview

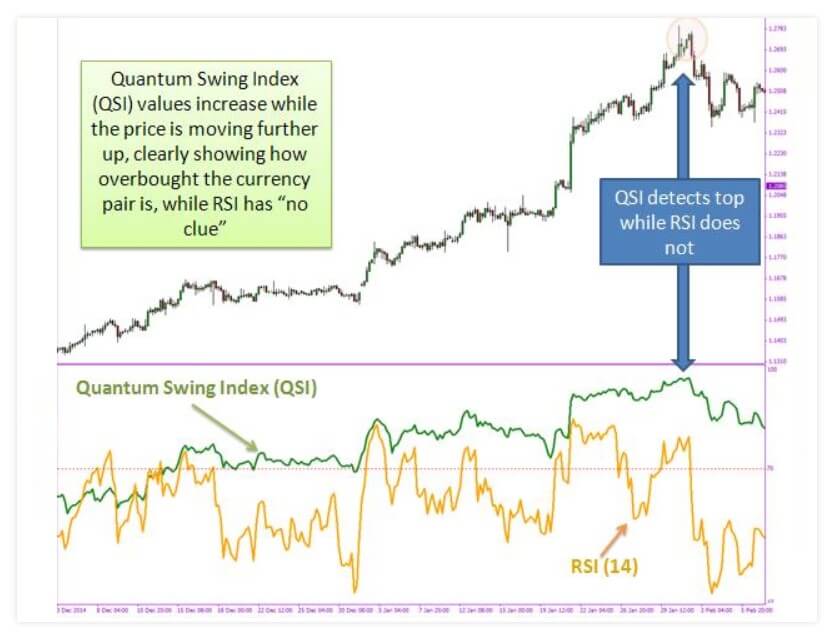

QSI is an oversold purchase indicator designed for the foreign exchange market. One of the most commonly used indicators for assessing whether the market is overbought is the RSI (Relative Strength Index). The RSI was not really designed by its author as an indicator of oversold purchases, but it is used by many merchants to help in this matter. The RSI gives some indication of the oversold or oversold state of the market but has no memory of where the market is, which causes the RSI to lose real tops. When compared to stochastic, which is also used by many to try to detect caps and bottoms, QSI gives a much better idea of an oversold or oversold state.

QSI is undoubtedly one of the most accurate indicators that detect overbought market conditions. On top of that, we see that the QSI shows very precisely where the trend changes and helps swing operators recognize areas to enter (end of correction points). This makes QSI a very powerful universal indicator.

Strategy:

- It applies to the most common trade approaches, trend monitoring, and fluctuating trade.

- Time frames: Any time frame is possible to use. In our opinion, the best results are given in H1, H4, D1, W1.

- Symbols: Any symbol. Works with all major EURUSD, GBPUSD, AUDUSD, USDJPY, USDCAD, etc.

- Not repainted: this indicator does not repaint or redraw.

- Email alerts: Yes Yes

- Sound alerts: Yes No

Main parameters of the indicator:

-Email alerts: If it equals “true” it allows email alerts depending on the criteria chosen. Sound alerts: if it is equal to “true” allows sound alert depending on the criteria chosen (see other parameters below).

-Scalp alert up: if it equals true when QSI goes above the “Scalp up threshold” value, you will receive an alert based on Email/ Sound Alert settings.

-Scalp up threshold: threshold QSI above which an alert is generated.

-Scalp alert down: if it equals true when QSI goes below the “Scalp down threshold” value, you will receive an alert based on Email/ Sound Alert settings.

-Scalp down threshold: QSI threshold below which an alert is generated.

-Trend alert down: if it equals true when QSI goes from less than 50 to more than 50 (buy signal), you will receive an alert based on Email/ Sound Alert settings.

-Trend alert up: if it is equal to true when QSI goes from over 50 to less than 50 (sales signal), you will receive an alert based on Email/ Sound Alert settings.

Service Cost

The selling price of this indicator is 39 USD and you can find it in the MQL market. You will notice that a free demo is available, which is excellent. While $39 is certainly not a fortune, testing for free is always the best idea before committing to purchase.

Conclusion

In short, we are talking about a simple indicator, suitable for all types of traders. This is an indicator that seeks to be more accurate than the RSI and the stochastic to look for over-buying and oversold points. The few comments that exist about this indicator are positive, but few reviews. Therefore we advise you to try the demo version and see if this indicator can be accommodated to our trading.