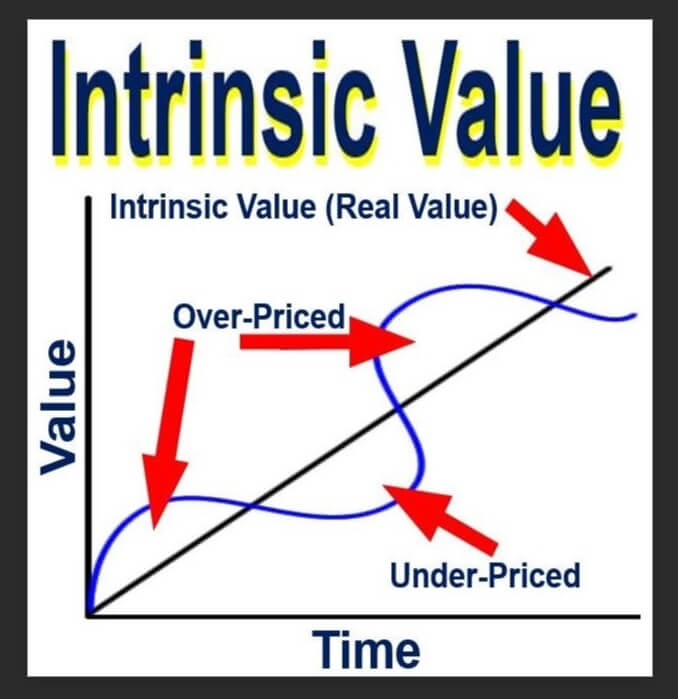

Intrinsic value is a noteworthy term in the forex world as it refers to the measurement of what an asset is worth. Rather than referring to the simple trading market price of the asset, intrinsic value is calculated using more factors, some of which can be difficult to measure accurately. This gives one an overall idea of how a company is performing, along with the underlying value of the company and how much cash is flowing through it. Traders can then determine if the asset is overbought or oversold.

When measuring intrinsic value, there are two types of measurements:

- Quantitative factors can be measured with hard numbers. This could include financial reports, profits, or any other statistics that can be accurately measured and represented with numbers.

- Qualitative factors are more interpretive. Traders look at the company’s business model, what sets the business apart, governance, target markets and seasons, the quality of the company’s leaders, and other data that gives one an idea of the company’s qualities and chances of success.

Most traders take both quantitative and qualitative factors into consideration when determining a company’s intrinsic value because both offer important details that give an overall idea of how successful the company is. Many financial analysts have broken this down into effective mathematical models so that these factors can be measured in the most accurate way possible. While this makes the process more accurate, determining a company’s value is still subjective. One trader might find a business model to be solid, while another might feel that it is lacking, for example. These details can lead to differences in opinion.

There are some popular calculation methods that are used by many traders, including the discounted cash flow (DCF) model, which looks at the company’s free cash flow and the weighted average cost of capital. The WACC accounts for the time value of money before then discounts future cash flow to the present. This system predicts the rate of return and future revenue streams for a company.

The goal of measuring the intrinsic value for a company is to decide if an asset is overbought or oversold. Investors then make decisions about whether to buy or sell, depending on whether the stock is expected to rise in price or decline.

Judging the intrinsic value of a company is subjective, but many traders have broken the process down to mathematical calculations that give good results. Most traders look at factors that can be measured with hard numbers, like financial reports, along with more interpretive data about a company’s target audience and other factors. Current events can also affect the intrinsic value of a company. For example, if a product launch fails or a major name in a company is arrested, the price is likely to fall. If you often invest in stocks, it is important to be aware of intrinsic value and how it can affect prices. Those that don’t want to keep up with this themselves should know that many successful financial investors publish their own intrinsic value calculations online for their followers.